Answered step by step

Verified Expert Solution

Question

1 Approved Answer

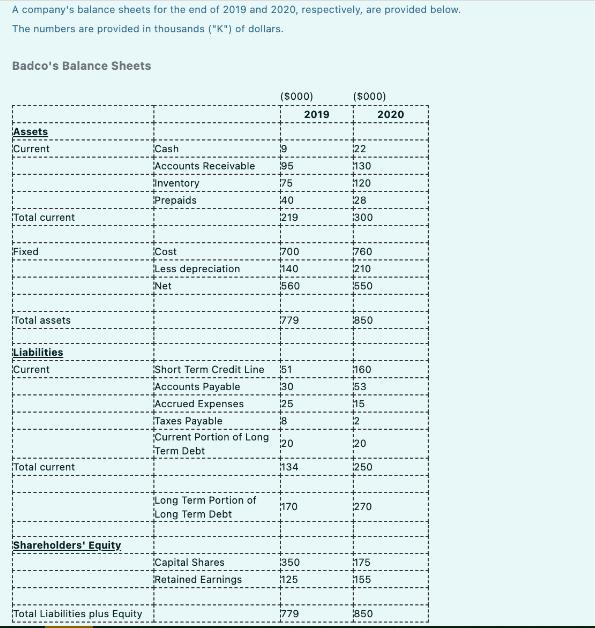

A company's balance sheets for the end of 2019 and 2020, respectively, are provided below. The numbers are provided in thousands (K) of dollars.

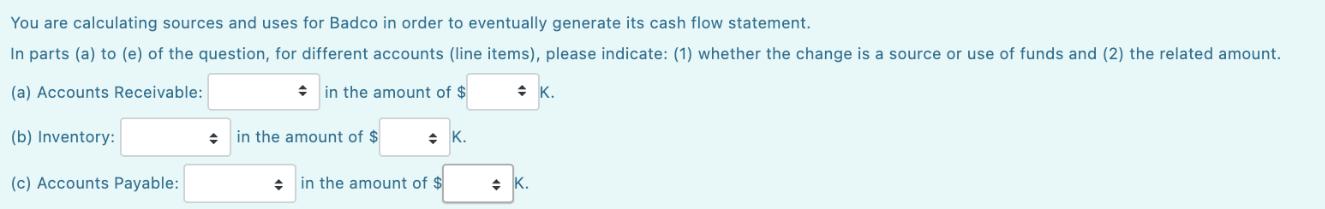

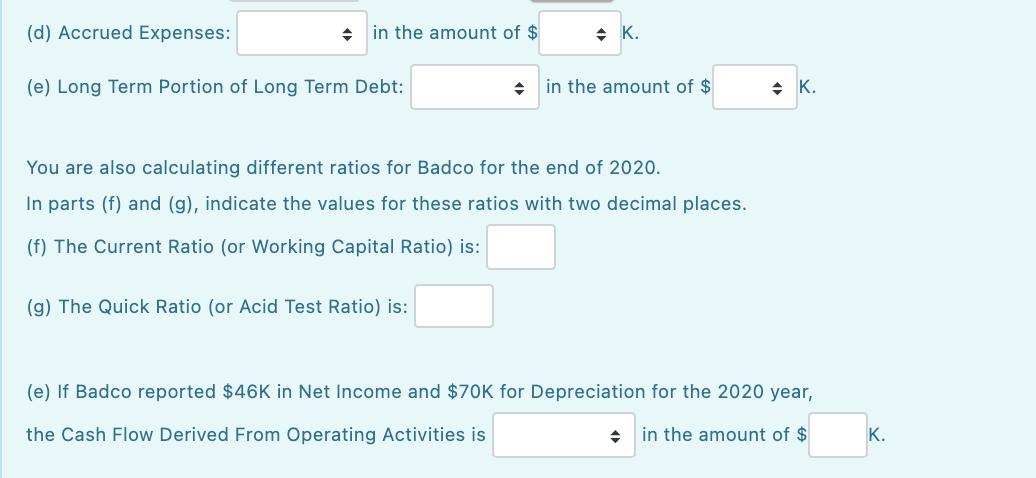

A company's balance sheets for the end of 2019 and 2020, respectively, are provided below. The numbers are provided in thousands ("K") of dollars. Badco's Balance Sheets Assets Current Total current Fixed Total assets Liabilities Current Total current Shareholders' Equity Total Liabilities plus Equity L===== Cash Accounts Receivable Inventory Prepaids Cost Less depreciation Net Short Term Credit Line Accounts Payable Accrued Expenses Taxes Payable Current Portion of Long Term Debt Long Term Portion of Long Term Debt Capital Shares Retained Earnings ($000) 19 195 175 140 1219 700 1140 560 1779 151 30 125 8 20 134 170 1350 125 779 2019 ($000) 22 1130 120 128 1300 760 1210 550 850 160 153 15 12 20 1250 1270 1175 155 850 2020 You are calculating sources and uses for Badco in order to eventually generate its cash flow statement. In parts (a) to (e) of the question, for different accounts (line items), please indicate: (1) whether the change is a source or use of funds and (2) the related amount. (a) Accounts Receivable: in the amount of $ (b) Inventory: (c) Accounts Payable: in the amount of $ K. + in the amount of $ K. K. (d) Accrued Expenses: in the amount of $ (e) Long Term Portion of Long Term Debt: K. (g) The Quick Ratio (or Acid Test Ratio) is: in the amount of $ You are also calculating different ratios for Badco for the end of 2020. In parts (f) and (g), indicate the values for these ratios with two decimal places. (f) The Current Ratio (or Working Capital Ratio) is: K. (e) If Badco reported $46K in Net Income and $70K for Depreciation for the 2020 year, the Cash Flow Derived From Operating Activities is in the amount of $ + K.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started