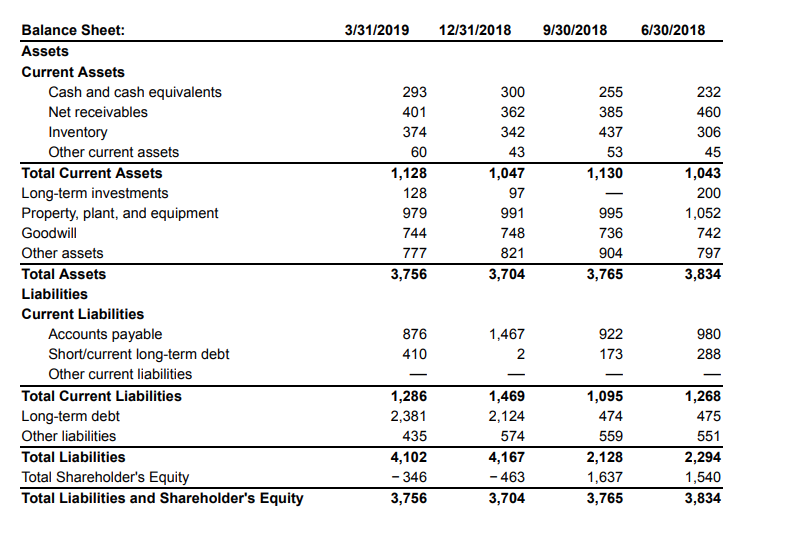

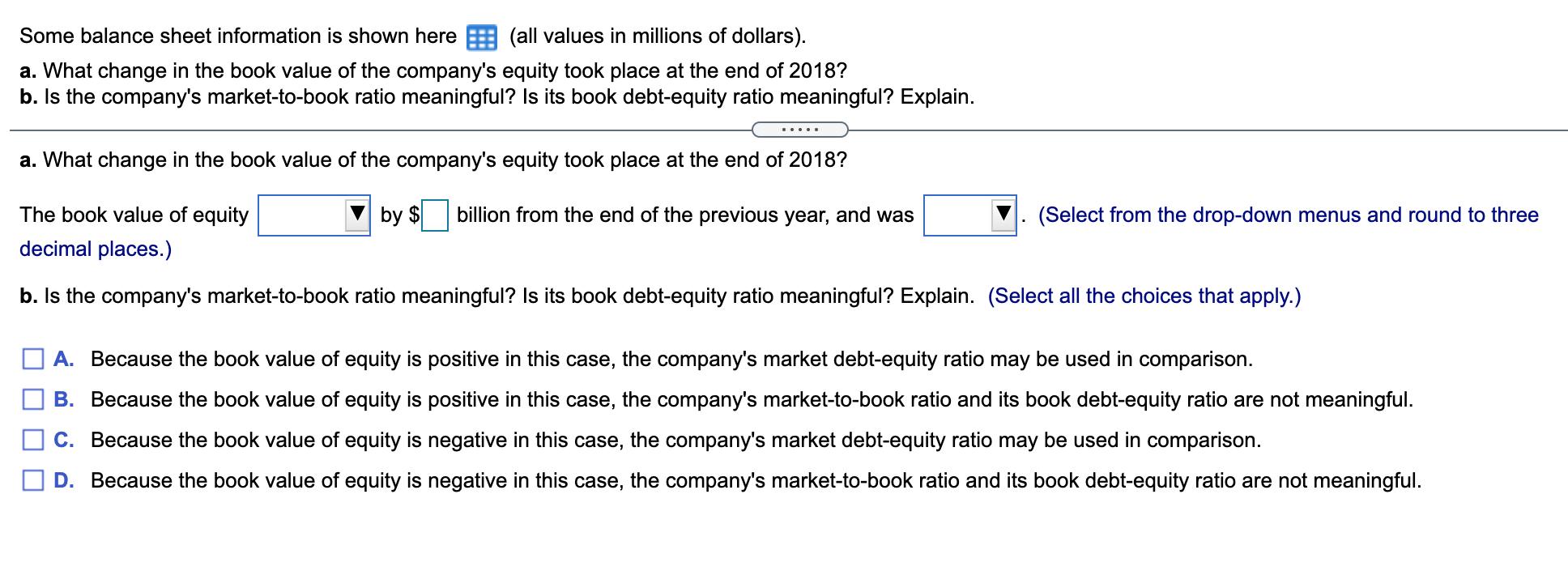

3/31/2019 12/31/2018 9/30/2018 6/30/2018 293 401 374 60 1,128 255 385 437 232 460 306 53 45 1,130 300 362 342 43 1,047 97 991 748 821 3,704 1,043 200 Balance Sheet: Assets Current Assets Cash and cash equivalents Net receivables Inventory Other current assets Total Current Assets Long-term investments Property, plant, and equipment Goodwill Other assets Total Assets Liabilities Current Liabilities Accounts payable Short/current long-term debt Other current liabilities Total Current Liabilities Long-term debt Other liabilities Total Liabilities Total Shareholder's Equity Total Liabilities and Shareholder's Equity 128 979 744 777 3,756 995 736 904 3,765 1,052 742 797 3,834 876 410 1,467 2 922 173 980 288 1,286 2,381 435 4,102 - 346 3,756 1,469 2,124 574 4,167 -463 3,704 1,095 474 559 2,128 1,637 3,765 1,268 475 551 2,294 1,540 3,834 Some balance sheet information is shown here (all values in millions of dollars). a. What change in the book value of the company's equity took place at the end of 2018? b. Is the company's market-to-book ratio meaningful? Is its book debt-equity ratio meaningful? Explain. a. What change in the book value of the company's equity took place at the end of 2018? by $ billion from the end of the previous year, and was (Select from the drop-down menus and round to three The book value of equity decimal places.) b. Is the company's market-to-book ratio meaningful? Is its book debt-equity ratio meaningful? Explain. (Select all the choices that apply.) A. Because the book value of equity is positive in this case, the company's market debt-equity ratio may be used in comparison. B. Because the book value of equity is positive in this case, the company's market-to-book ratio and its book debt-equity ratio are not meaningful. C. Because the book value of equity is negative in this case, the company's market debt-equity ratio may be used in comparison. D. Because the book value of equity is negative in this case, the company's market-to-book ratio and its book debt-equity ratio are not meaningful