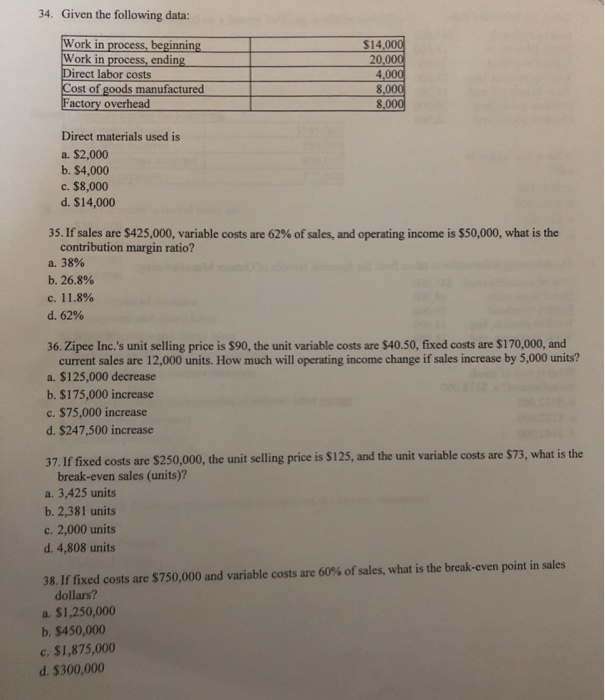

34. Given the following data: Work in process, beginning Work in process, ending Direct labor costs Cost of goods manufactured Factory overhead S14,000 20,000 4,000 8,000 8.000 Direct materials used is a. $2,000 b. $4,000 c. $8,000 d. $14,000 35. If sales are $425,000, variable costs are 62% of sales, and operating income is $50,000, what is the contribution margin ratio? a. 38% b. 26.8% c. 11.8% d. 62% 36. Zipee Inc.'s unit selling price is $90, the unit variable costs are $40.50, fixed costs are $170,000, and current sales are 12,000 units. How much will operating income change if sales increase by 5,000 units? a. $125,000 decrease b. $175,000 increase c. $75,000 increase d. $247,500 increase 37. If fixed costs are $250,000, the unit selling price is $125, and the unit variable costs are $73, what is the break-even sales (units)? a. 3,425 units b. 2,381 units c. 2,000 units d. 4,808 units 38. If fixed costs are $750,000 and variable costs are 60% of sales, what is the break-even point in sales dollars? a. S1,250,000 b. $450,000 c. $1,875,000 d. $300,000 34. Given the following data: Work in process, beginning Work in process, ending Direct labor costs Cost of goods manufactured Factory overhead S14,000 20,000 4,000 8,000 8.000 Direct materials used is a. $2,000 b. $4,000 c. $8,000 d. $14,000 35. If sales are $425,000, variable costs are 62% of sales, and operating income is $50,000, what is the contribution margin ratio? a. 38% b. 26.8% c. 11.8% d. 62% 36. Zipee Inc.'s unit selling price is $90, the unit variable costs are $40.50, fixed costs are $170,000, and current sales are 12,000 units. How much will operating income change if sales increase by 5,000 units? a. $125,000 decrease b. $175,000 increase c. $75,000 increase d. $247,500 increase 37. If fixed costs are $250,000, the unit selling price is $125, and the unit variable costs are $73, what is the break-even sales (units)? a. 3,425 units b. 2,381 units c. 2,000 units d. 4,808 units 38. If fixed costs are $750,000 and variable costs are 60% of sales, what is the break-even point in sales dollars? a. S1,250,000 b. $450,000 c. $1,875,000 d. $300,000