Answered step by step

Verified Expert Solution

Question

1 Approved Answer

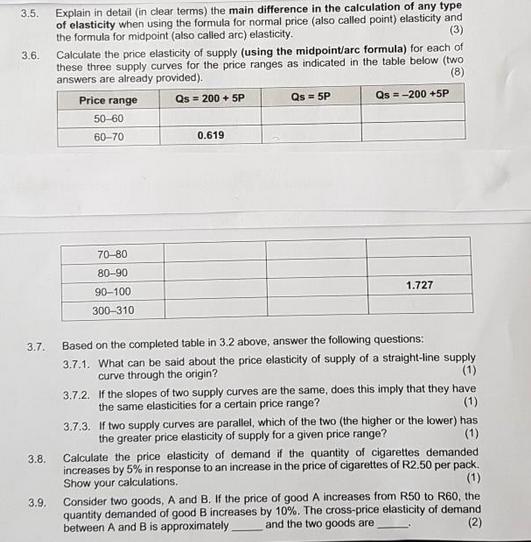

3.5. 3.6. Explain in detail (in clear terms) the main difference in the calculation of any type of elasticity when using the formula for

3.5. 3.6. Explain in detail (in clear terms) the main difference in the calculation of any type of elasticity when using the formula for normal price (also called point) elasticity and the formula for midpoint (also called arc) elasticity. (3) Calculate the price elasticity of supply (using the midpoint/arc formula) for each of these three supply curves for the price ranges as indicated in the table below (two answers are already provided). Price range 50-60 60-70 (8) Qs = 200 + 5P Qs = 5P Qs -200+5P 0.619 70-80 80-90 90-100 300-310 1.727 3.7. Based on the completed table in 3.2 above, answer the following questions: 3.7.1. What can be said about the price elasticity of supply of a straight-line supply (1) curve through the origin? 3.7.2. If the slopes of two supply curves are the same, does this imply that they have the same elasticities for a certain price range? (1) 3.7.3. If two supply curves are parallel, which of the two (the higher or the lower) has (1) the greater price elasticity of supply for a given price range? Calculate the price elasticity of demand if the quantity of cigarettes demanded increases by 5% in response to an increase in the price of cigarettes of R2.50 per pack. Show your calculations. 3.8. 3.9. (1) Consider two goods, A and B. If the price of good A increases from R50 to R60, the quantity demanded of good B increases by 10%. The cross-price elasticity of demand between A and B is approximately. and the two goods are (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started