Answered step by step

Verified Expert Solution

Question

1 Approved Answer

35. Harry and Ruth are married but file separate returns. Each of them holds stocks in their own individual account. Near the end of the

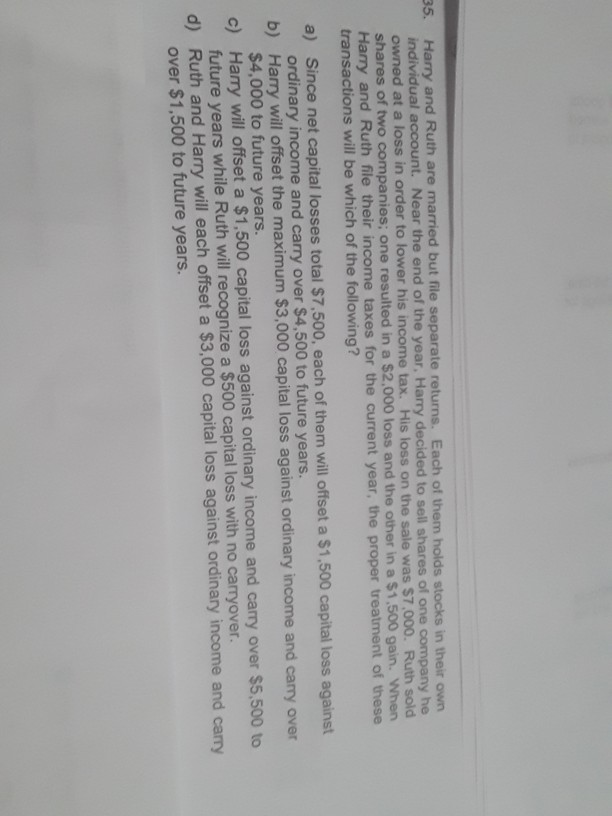

35. Harry and Ruth are married but file separate returns. Each of them holds stocks in their own individual account. Near the end of the year, Harry decided to sell shares of one company he owned at a loss in order to lower his income tax. His loss on the sale was $7.000. Ruth sold shares of two companies; one resulted in a $2,000 loss and the other in a $1.500 gain. When Harry and Ruth file their income taxes for the current year, the proper treatment of these transactions will be which of the following? a) Since net capital losses total $7,500, each of them will offset a $1.500 capital loss against ordinary income and carry over $4,500 to future years. b) Harry will offset the maximum $3,000 capital loss against ordinary income and carry over $4,000 to future years. c) Harry will offset a $1,500 capital loss against ordinary income and carry over $5,500 to future years while Ruth will recognize a $500 capital loss with no carryover. d) Ruth and Harry will each offset a $3,000 capital loss against ordinary income and carry over $1,500 to future years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started