Question

3a) Explain the payoffs to the borrower in the case where the borrower repays the loan and the case where the borrower doesnt repay the

3a) Explain the payoffs to the borrower in the case where the borrower repays the loan and the case where the borrower doesnt repay the loan. (Describe what the algebraic statements are saying why they arent some other random assortment of letters.) Explain what the algebraic statement labeled Condition set by bank means. [(2+2) + 2 = 6 pts.]

3b) Based on the credit constraint, what happens to k (it increases, decreases, or no change) as w decreases? You may explain what is happening mathematically in words (or use calculus). [1+2=3 pts.]

3c) Based on the credit constraint, what happens to k (it increases, decreases, or no change) as h increases? You may explain what is happening mathematically in words (or use calculus). [1+2=3 pts.]

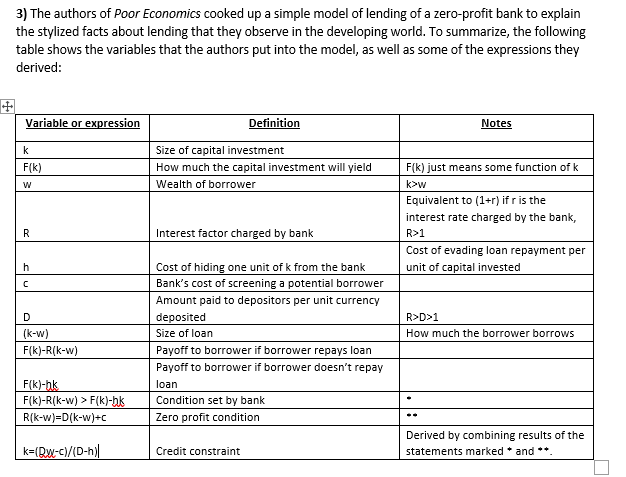

3) The authors of Poor Economics cooked up a simple model of lending of a zero-profit bank to explain the stylized facts about lending that they observe in the developing world. To summarize, the following table shows the variables that the authors put into the model, as well as some of the expressions they derived: Variable or expression Definition Notes k F[k) Size of capital investment How much the capital investment will yield Wealth of borrower W F(k) just means some function of k k>w Equivalent to (1+r) if r is the interest rate charged by the bank, R>1 Cost of evading loan repayment per unit of capital invested R Interest factor charged by bank h C D (k-w) F(k)-R(k-w) R>D>1 How much the borrower borrows Cost of hiding one unit of k from the bank Bank's cost of screening a potential borrower Amount paid to depositors per unit currency deposited Size of loan Payoff to borrower if borrower repays loan Payoff to borrower if borrower doesn't repay loan Condition set by bank Zero profit condition Fk)-hk F(k)-R(k-w) > F(k)-bk R(k-w)=D(k-w)+c Derived by combining results of the statements marked * and ** k=CDw-c)/(D-nil Credit constraint 3) The authors of Poor Economics cooked up a simple model of lending of a zero-profit bank to explain the stylized facts about lending that they observe in the developing world. To summarize, the following table shows the variables that the authors put into the model, as well as some of the expressions they derived: Variable or expression Definition Notes k F[k) Size of capital investment How much the capital investment will yield Wealth of borrower W F(k) just means some function of k k>w Equivalent to (1+r) if r is the interest rate charged by the bank, R>1 Cost of evading loan repayment per unit of capital invested R Interest factor charged by bank h C D (k-w) F(k)-R(k-w) R>D>1 How much the borrower borrows Cost of hiding one unit of k from the bank Bank's cost of screening a potential borrower Amount paid to depositors per unit currency deposited Size of loan Payoff to borrower if borrower repays loan Payoff to borrower if borrower doesn't repay loan Condition set by bank Zero profit condition Fk)-hk F(k)-R(k-w) > F(k)-bk R(k-w)=D(k-w)+c Derived by combining results of the statements marked * and ** k=CDw-c)/(D-nil Credit constraintStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started