Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Before 2017, Nadeau accounted for its income from long-term construction contracts on the completed- contract basis because it was unable to reliably measure the

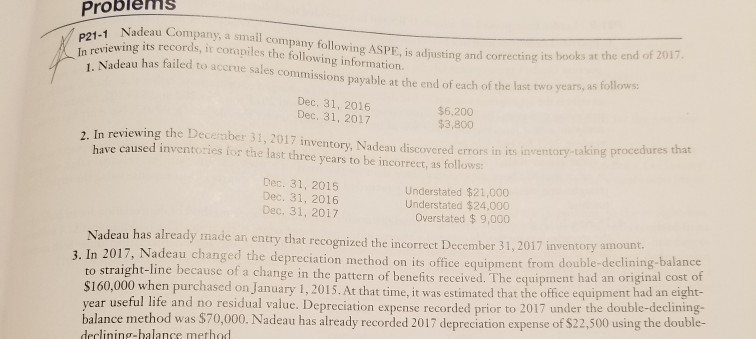

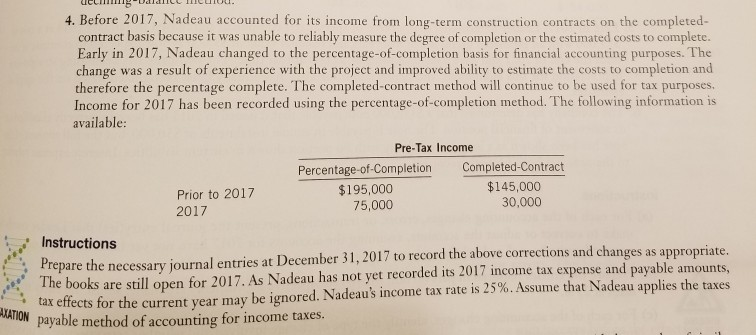

4. Before 2017, Nadeau accounted for its income from long-term construction contracts on the completed- contract basis because it was unable to reliably measure the degree of completion or the estimated costs to complete. Early in 2017, Nadeau changed to the percentage-of-completion basis for financial accounting purposes. The change was a result of experience with the project and improved ability to estimate the costs to completion and therefore the percentage complete. The completed-contract method will continue to be used for tax purposes. Income for 2017 has been recorded using the percentage-of-completion method. The following information is available Pre-Tax Income Percentage of Completion $195,000 75,000 Completed.-Contract $145,000 Prior to 2017 2017 30,000 Instructions Prepare the necesary journal entries at December 31, 2017 to record the above corrections and changes as appropriate. tax e ects or the current year may be ignored. Nadeaus income tax rate is 25%. Assume that Nadeau applies the taxes payable method of accounting for income taxes. The books are still open for 2017. As Nadeau has not yet recorded its 2017 income tax expense and payable amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started