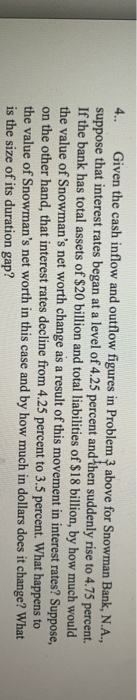

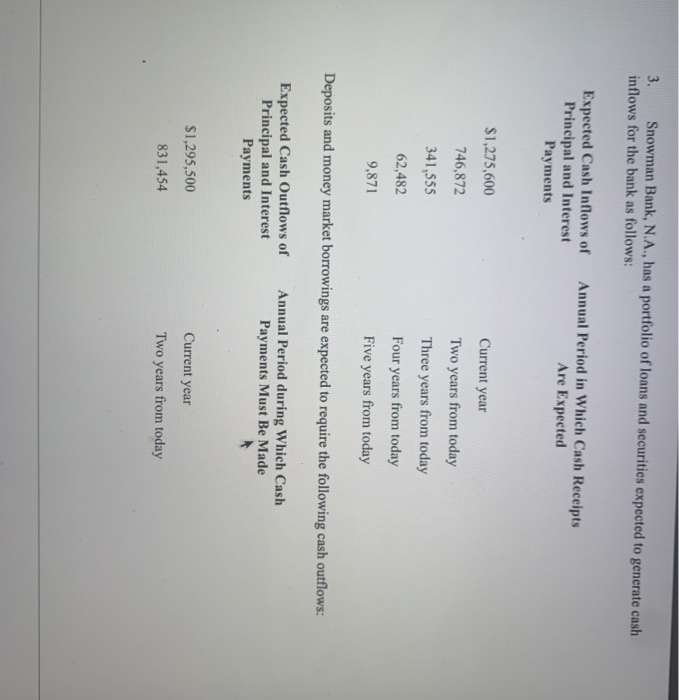

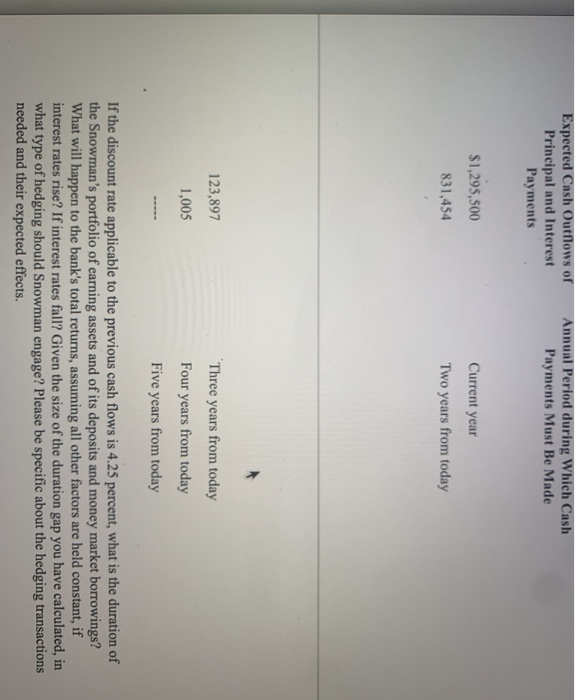

4. Given the cash inflow and outflow figures in Problem 3 above for Snowman Bank, N.A., suppose that interest rates began at a level of 4.25 percent and then suddenly rise to 4.75 percent. If the bank has total assets of $20 billion and total liabilities of $18 billion, by how much would the value of Snowman's net worth change as a result of this movement in interest rates? Suppose, on the other hand, that interest rates decline from 4.25 percent to 3.5 percent. What happens to the value of Snowman's net worth in this case and by how much in dollars does it change? What is the size of its duration gap? 3. Snowman Bank, N.A., has a portfolio of loans and securities expected to generate cash inflows for the bank as follows: Expected Cash Inflows of Principal and Interest Payments Annual Period in Which Cash Receipts Are Expected $1,275,600 Current year 746,872 341,555 Two years from today Three years from today Four years from today 62,482 9,871 Five years from today Deposits and money market borrowings are expected to require the following cash outflows: Principal and Interest Payments Payments Must Be Made $1,295,500 Current year Two years from today 831,454 Expected Cash Outflows of Principal and Interest Payments Annual Period during Which Cash Payments Must Be Made $1,295,500 831,454 Current year Two years from today 123,897 1,005 Three years from today Four years from today Five years from today If the discount rate applicable to the previous cash flows is 4.25 percent, what is the duration of the Snowman's portfolio of earning assets and of its deposits and money market borrowings? What will happen to the bank's total returns, assuming all other factors are held constant, if interest rates rise? If interest rates fall? Given the size of the duration gap you have calculated, in what type of hedging should Snowman engage? Please be specific about the hedging transactions needed and their expected effects. 4. Given the cash inflow and outflow figures in Problem 3 above for Snowman Bank, N.A., suppose that interest rates began at a level of 4.25 percent and then suddenly rise to 4.75 percent. If the bank has total assets of $20 billion and total liabilities of $18 billion, by how much would the value of Snowman's net worth change as a result of this movement in interest rates? Suppose, on the other hand, that interest rates decline from 4.25 percent to 3.5 percent. What happens to the value of Snowman's net worth in this case and by how much in dollars does it change? What is the size of its duration gap? 3. Snowman Bank, N.A., has a portfolio of loans and securities expected to generate cash inflows for the bank as follows: Expected Cash Inflows of Principal and Interest Payments Annual Period in Which Cash Receipts Are Expected $1,275,600 Current year 746,872 341,555 Two years from today Three years from today Four years from today 62,482 9,871 Five years from today Deposits and money market borrowings are expected to require the following cash outflows: Principal and Interest Payments Payments Must Be Made $1,295,500 Current year Two years from today 831,454 Expected Cash Outflows of Principal and Interest Payments Annual Period during Which Cash Payments Must Be Made $1,295,500 831,454 Current year Two years from today 123,897 1,005 Three years from today Four years from today Five years from today If the discount rate applicable to the previous cash flows is 4.25 percent, what is the duration of the Snowman's portfolio of earning assets and of its deposits and money market borrowings? What will happen to the bank's total returns, assuming all other factors are held constant, if interest rates rise? If interest rates fall? Given the size of the duration gap you have calculated, in what type of hedging should Snowman engage? Please be specific about the hedging transactions needed and their expected effects