Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Makeover Inc. believes that at its current stock price of $16.00 the firm is undervalued in the market. Makeover plans to repurchase 2.4 million

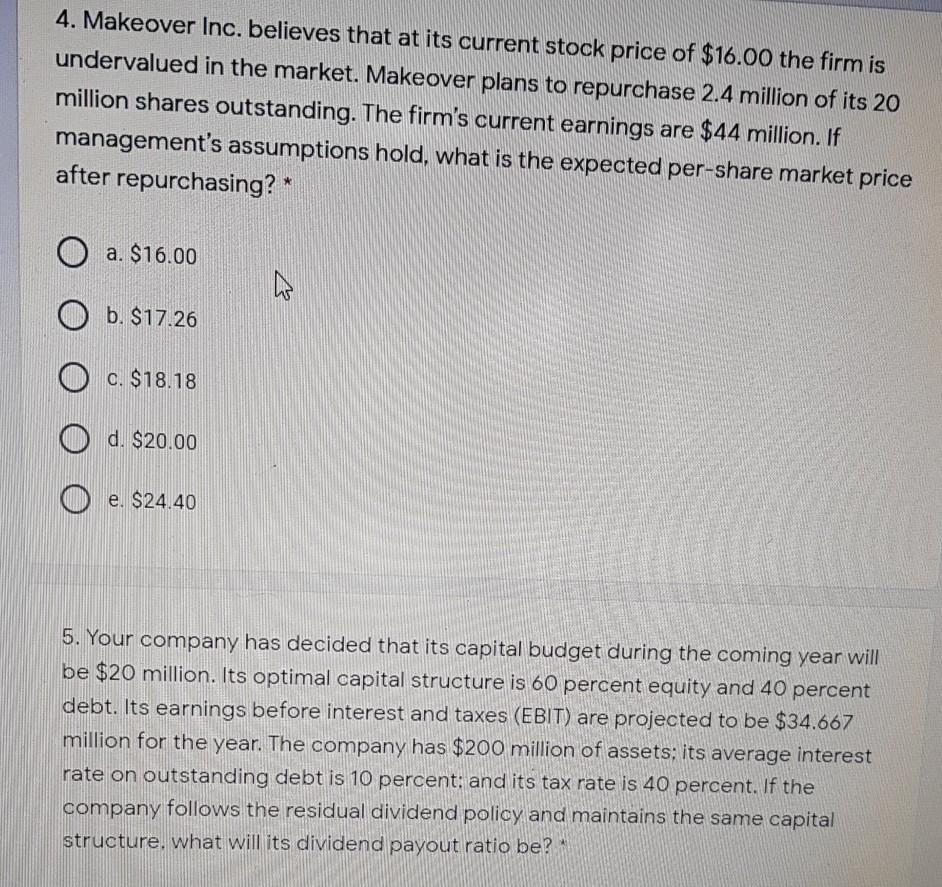

4. Makeover Inc. believes that at its current stock price of $16.00 the firm is undervalued in the market. Makeover plans to repurchase 2.4 million of its 20 million shares outstanding. The firm's current earnings are $44 million. If management's assumptions hold, what is the expected per-share market price after repurchasing? * a. $16.00 W b. $17.26 O c. $18.18 O d. $20.00 O e. $24.40 5. Your company has decided that its capital budget during the coming year will be $20 million. Its optimal capital structure is 60 percent equity and 40 percent debt. Its earnings before interest and taxes (EBIT) are projected to be $34.667 million for the year. The company has $200 million of assets; its average interest rate on outstanding debt is 10 percent: and its tax rate is 40 percent. If the company follows the residual dividend policy and maintains the same capital structure. what will its dividend payout ratio be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started