Answered step by step

Verified Expert Solution

Question

1 Approved Answer

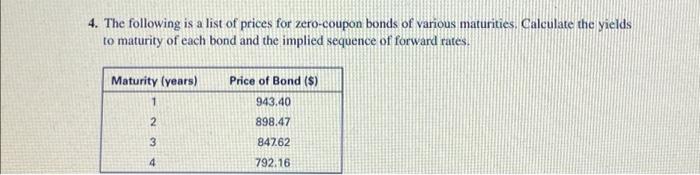

4. The following is a list of prices for zero-coupon bonds of various maturities. Calculate the yields to maturity of each bond and the implied

4. The following is a list of prices for zero-coupon bonds of various maturities. Calculate the yields to maturity of each bond and the implied sequence of forward rates. Maturity (years) 1 2 3 4 Price of Bond ($) 943.40 898.47 847.62 792.16

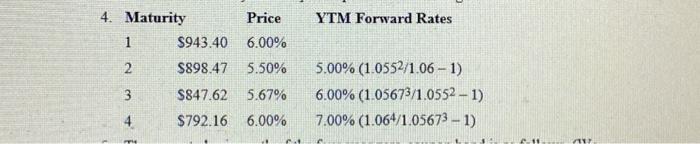

Second image is the answer but idk how they came to those numbers. can you break down the formulas and how the yield was derived. also where is the forward rates?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started