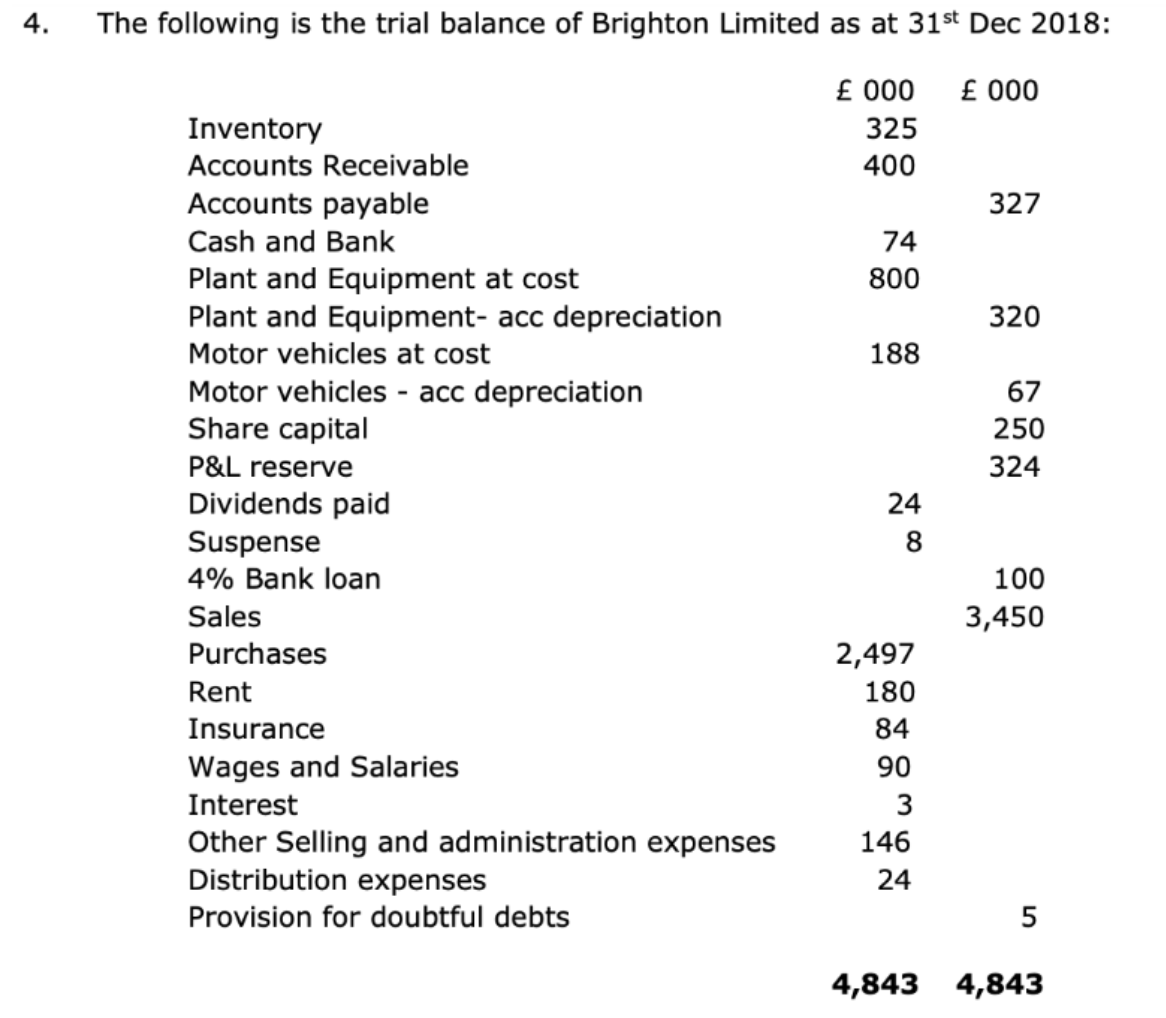

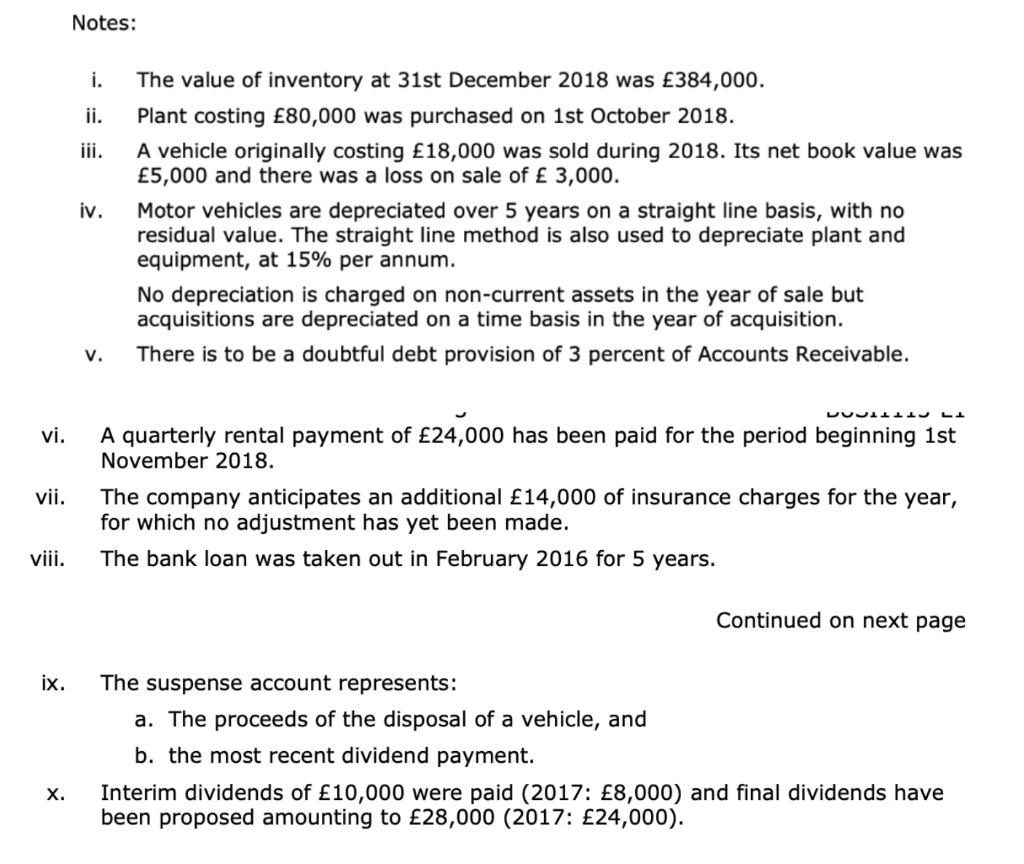

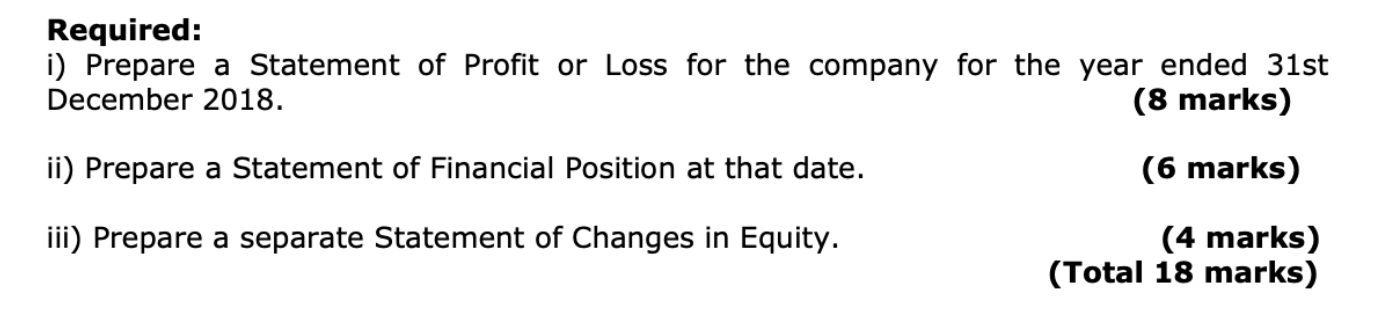

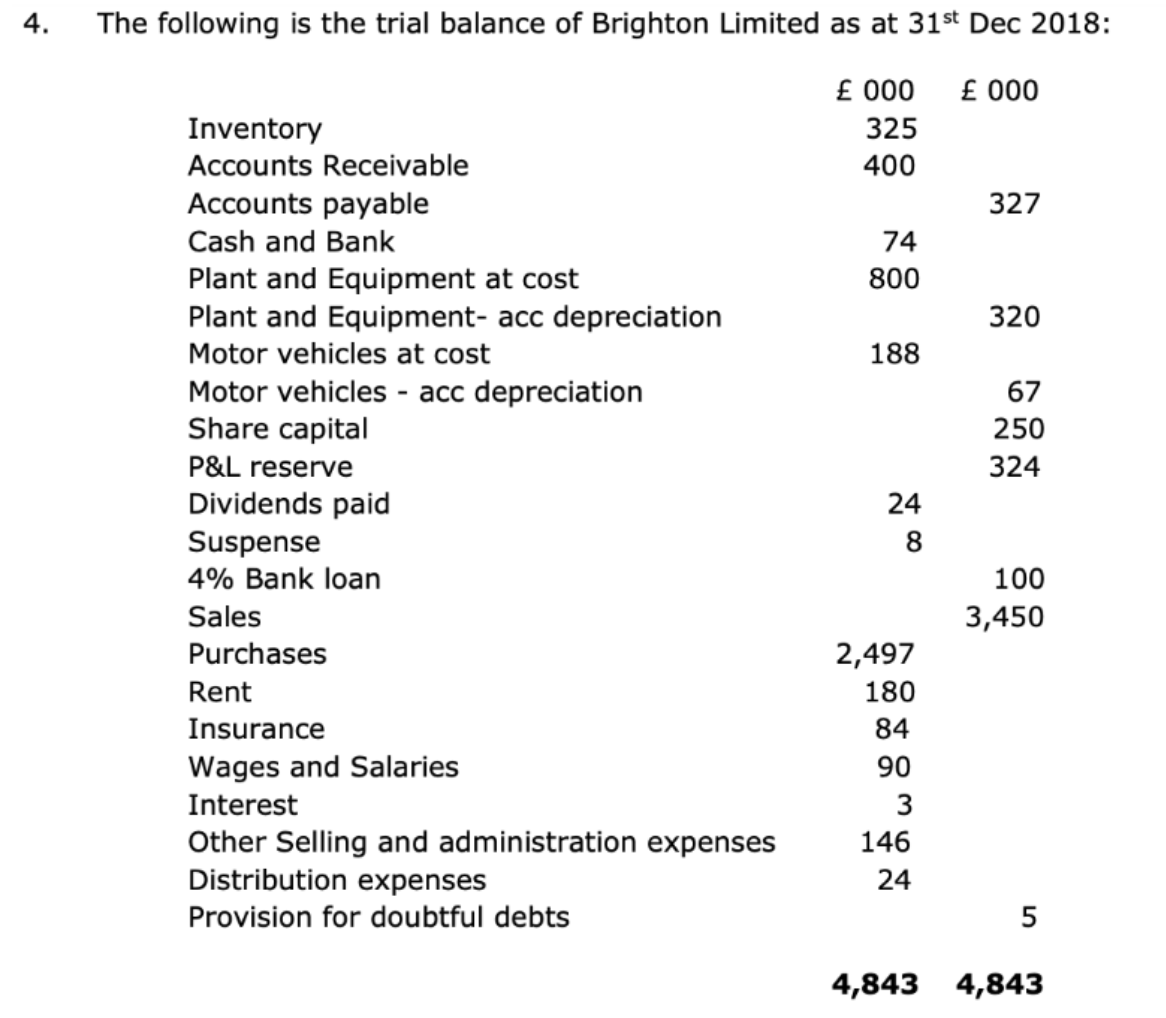

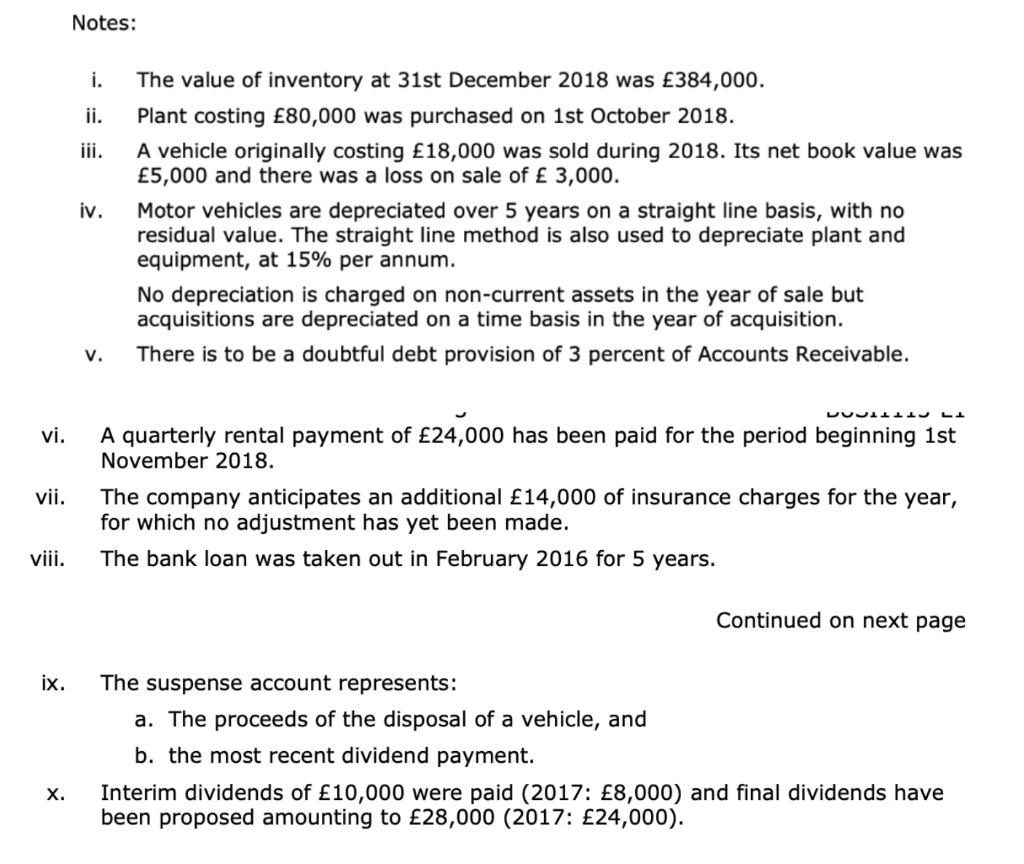

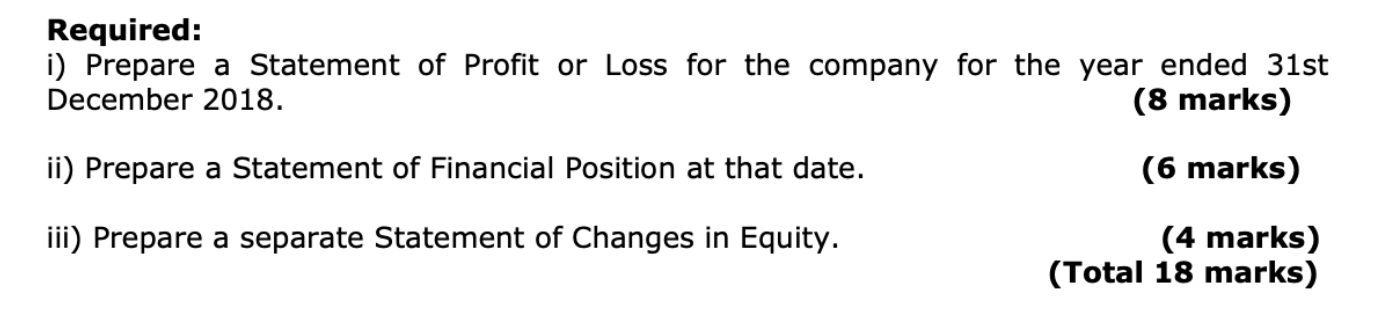

4. The following is the trial balance of Brighton Limited as at 31st Dec 2018: 000 000 325 400 327 74 800 320 188 67 250 324 Inventory Accounts Receivable Accounts payable Cash and Bank Plant and Equipment at cost Plant and Equipment- acc depreciation Motor vehicles at cost Motor vehicles - acc depreciation Share capital P&L reserve Dividends paid Suspense 4% Bank loan Sales Purchases Rent Insurance Wages and Salaries Interest Other Selling and administration expenses Distribution expenses Provision for doubtful debts 24 8 100 3,450 2,497 180 84 90 146 24 5 4,843 4,843 Notes: i. ii. iii. iv. The value of inventory at 31st December 2018 was 384,000. Plant costing 80,000 was purchased on 1st October 2018. A vehicle originally costing 18,000 was sold during 2018. Its net book value was 5,000 and there was a loss on sale of 3,000. Motor vehicles are depreciated over 5 years on a straight line basis, with no residual value. The straight line method is also used to depreciate plant and equipment, at 15% per annum. No depreciation is charged on non-current assets in the year of sale but acquisitions are depreciated on a time basis in the year of acquisition. There is to be a doubtful debt provision of 3 percent of Accounts Receivable. V. VUJIIiiu LI vi. vii. A quarterly rental payment of 24,000 has been paid for the period beginning 1st November 2018. The company anticipates an additional 14,000 of insurance charges for the year, for which no adjustment has yet been made. The bank loan was taken out in February 2016 for 5 years. viii. Continued on next page ix. The suspense account represents: a. The proceeds of the disposal of a vehicle, and b. the most recent dividend payment. Interim dividends of 10,000 were paid (2017: 8,000) and final dividends have been proposed amounting to 28,000 (2017: 24,000). X. Required: i) Prepare a Statement of Profit or Loss for the company for the year ended 31st December 2018. (8 marks) ii) Prepare a Statement of Financial Position at that date. (6 marks) iii) Prepare a separate Statement of Changes in Equity. (4 marks) (Total 18 marks)