Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. The following selected transactions occurred at Mountain Hats, Inc. during the month of September (its first month of operations). Mountain Hats currently sells only

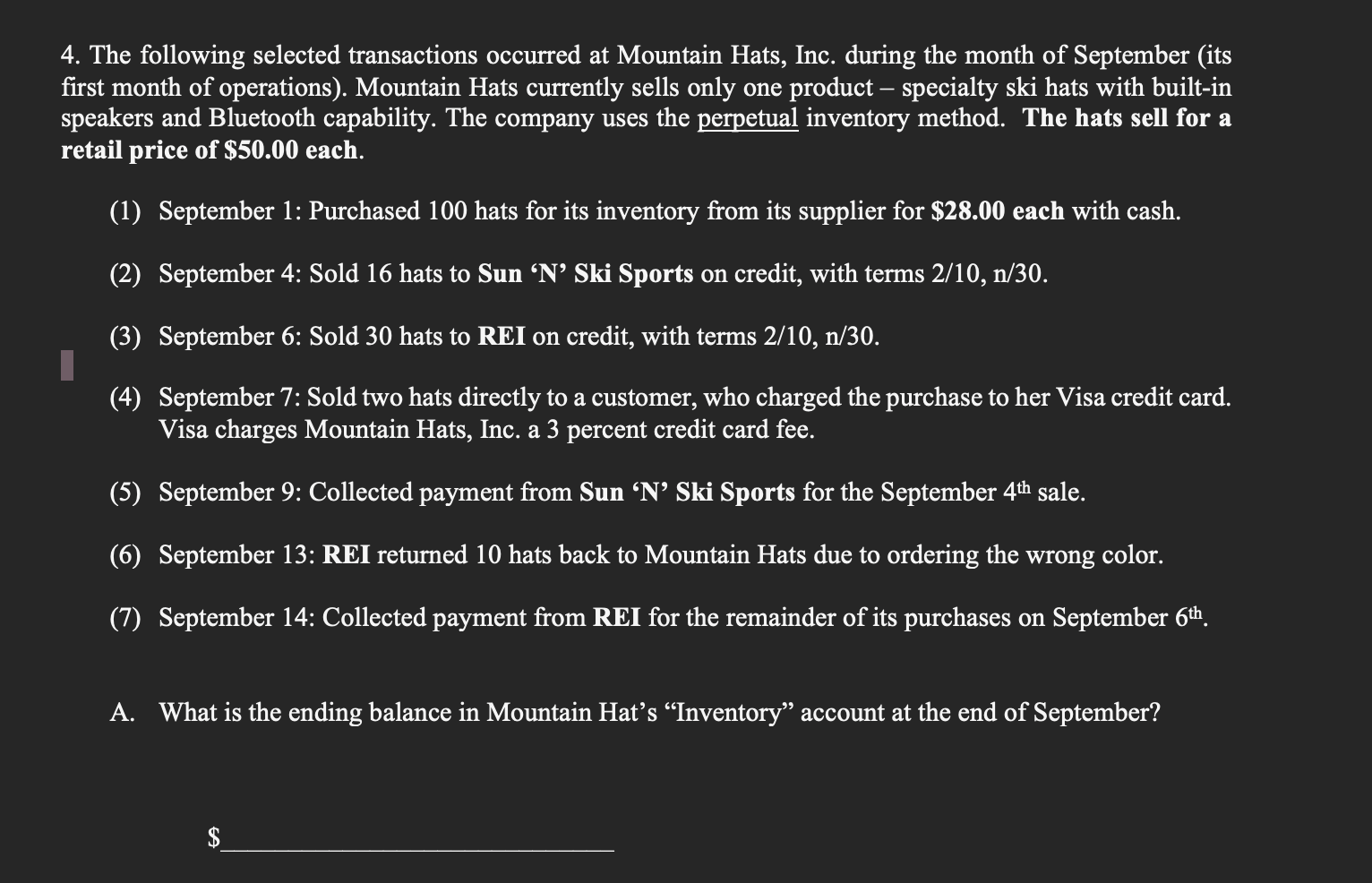

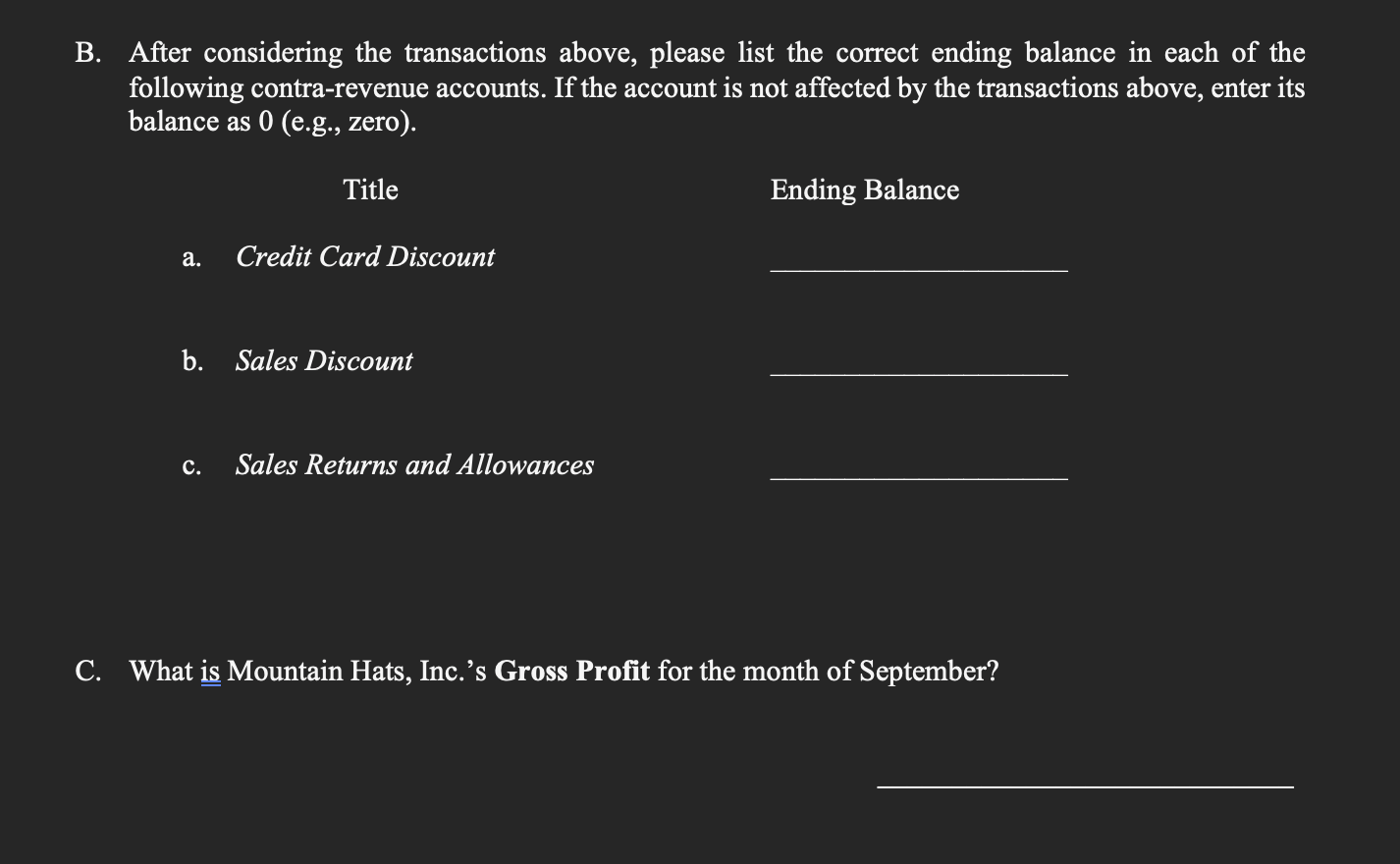

4. The following selected transactions occurred at Mountain Hats, Inc. during the month of September (its first month of operations). Mountain Hats currently sells only one product - specialty ski hats with built-in speakers and Bluetooth capability. The company uses the perpetual inventory method. The hats sell for a retail price of $50.00 each. (1) September 1: Purchased 100 hats for its inventory from its supplier for $28.00 each with cash. (2) September 4: Sold 16 hats to Sun 'N' Ski Sports on credit, with terms 2/10, n/30. (3) September 6: Sold 30 hats to REI on credit, with terms 2/10, n/30. (4) September 7: Sold two hats directly to a customer, who charged the purchase to her Visa credit card. Visa charges Mountain Hats, Inc. a 3 percent credit card fee. (5) September 9: Collected payment from Sun 'N' Ski Sports for the September 4th sale. (6) September 13: REI returned 10 hats back to Mountain Hats due to ordering the wrong color. (7) September 14: Collected payment from REI for the remainder of its purchases on September 6th. A. What is the ending balance in Mountain Hat's "Inventory" account at the end of September? 3. After considering the transactions above, please list the correct ending balance in each of the following contra-revenue accounts. If the account is not affected by the transactions above, enter its balance as 0 (e.g., zero). Title a. Credit Card Discount b. Sales Discount c. Sales Returns and Allowances Ending Balance 10 C. What is Mountain Hats, Inc.'s Gross Profit for the month of September

4. The following selected transactions occurred at Mountain Hats, Inc. during the month of September (its first month of operations). Mountain Hats currently sells only one product - specialty ski hats with built-in speakers and Bluetooth capability. The company uses the perpetual inventory method. The hats sell for a retail price of $50.00 each. (1) September 1: Purchased 100 hats for its inventory from its supplier for $28.00 each with cash. (2) September 4: Sold 16 hats to Sun 'N' Ski Sports on credit, with terms 2/10, n/30. (3) September 6: Sold 30 hats to REI on credit, with terms 2/10, n/30. (4) September 7: Sold two hats directly to a customer, who charged the purchase to her Visa credit card. Visa charges Mountain Hats, Inc. a 3 percent credit card fee. (5) September 9: Collected payment from Sun 'N' Ski Sports for the September 4th sale. (6) September 13: REI returned 10 hats back to Mountain Hats due to ordering the wrong color. (7) September 14: Collected payment from REI for the remainder of its purchases on September 6th. A. What is the ending balance in Mountain Hat's "Inventory" account at the end of September? 3. After considering the transactions above, please list the correct ending balance in each of the following contra-revenue accounts. If the account is not affected by the transactions above, enter its balance as 0 (e.g., zero). Title a. Credit Card Discount b. Sales Discount c. Sales Returns and Allowances Ending Balance 10 C. What is Mountain Hats, Inc.'s Gross Profit for the month of September Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started