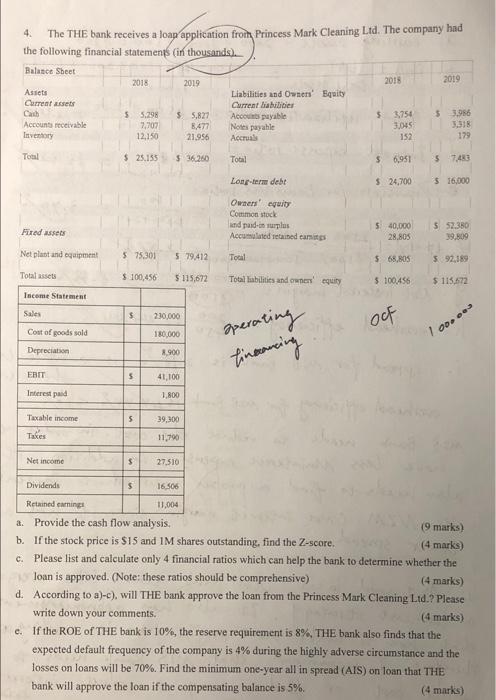

4. The THE bank receives a loap application from Princess Mark Cleaning Ltd. The company had the following financial statements (in thousands). Balance Sheet 2018 2019 2018 2019 Assets Liabilities and Owners' Equity Current set Current liabilities Cat 59 $5,827 Accounts payable 3.754 $ 3.986 Accounts receivable 7,707 8,477 Notes payable 3.045 3.518 Inventory 12.150 Accrual 152 179 Total $ 25.133 $36.260 Total $ 6,951 7.40 5 21.955 Long-term debt $ 24,700 $16.000 Owners' equity Common stock and puden plus Accumulated retained earts Fred users 540,000 28.805 5 52.380 19.809 Net plant and equipment $ 75,301 579.412 Tool $ 68,805 592,189 Total assets $ 100,456 $ 115,672 Total abilities and won' equity $ 100,456 $ 115.672 Income Statement Sales $ 230,000 oct Cost of goods sold OD 180,000 Depreciation sperating finsancing 8.900 ERIT 5 41,100 Interest and 1.800 5 39,300 Table income Taxes 11.790 Net income $ 27.510 5 16.506 c. Dividends Retained earning 11,004 2. Provide the cash flow analysis, (9 marks) b. If the stock price is $15 and 1M shares outstanding, find the Z-score. (4 marks) Please list and calculate only 4 financial ratios which can help the bank to determine whether the loan is approved. (Note: these ratios should be comprehensive) (4 marks) d. According to a)-c), will THE bank approve the loan from the Princess Mark Cleaning Ltd.? Please write down your comments. (4 marks) e. If the ROE of THE bank is 10%, the reserve requirement is 8%, THE bank also finds that the expected default frequency of the company is 4% during the highly adverse circumstance and the losses on loans will be 70%. Find the minimum one-year all in spread (AIS) on loan that THE bank will approve the loan if the compensating balance is 5%. (4 marks) 4. The THE bank receives a loap application from Princess Mark Cleaning Ltd. The company had the following financial statements (in thousands). Balance Sheet 2018 2019 2018 2019 Assets Liabilities and Owners' Equity Current set Current liabilities Cat 59 $5,827 Accounts payable 3.754 $ 3.986 Accounts receivable 7,707 8,477 Notes payable 3.045 3.518 Inventory 12.150 Accrual 152 179 Total $ 25.133 $36.260 Total $ 6,951 7.40 5 21.955 Long-term debt $ 24,700 $16.000 Owners' equity Common stock and puden plus Accumulated retained earts Fred users 540,000 28.805 5 52.380 19.809 Net plant and equipment $ 75,301 579.412 Tool $ 68,805 592,189 Total assets $ 100,456 $ 115,672 Total abilities and won' equity $ 100,456 $ 115.672 Income Statement Sales $ 230,000 oct Cost of goods sold OD 180,000 Depreciation sperating finsancing 8.900 ERIT 5 41,100 Interest and 1.800 5 39,300 Table income Taxes 11.790 Net income $ 27.510 5 16.506 c. Dividends Retained earning 11,004 2. Provide the cash flow analysis, (9 marks) b. If the stock price is $15 and 1M shares outstanding, find the Z-score. (4 marks) Please list and calculate only 4 financial ratios which can help the bank to determine whether the loan is approved. (Note: these ratios should be comprehensive) (4 marks) d. According to a)-c), will THE bank approve the loan from the Princess Mark Cleaning Ltd.? Please write down your comments. (4 marks) e. If the ROE of THE bank is 10%, the reserve requirement is 8%, THE bank also finds that the expected default frequency of the company is 4% during the highly adverse circumstance and the losses on loans will be 70%. Find the minimum one-year all in spread (AIS) on loan that THE bank will approve the loan if the compensating balance is 5%. (4 marks)