Answered step by step

Verified Expert Solution

Question

1 Approved Answer

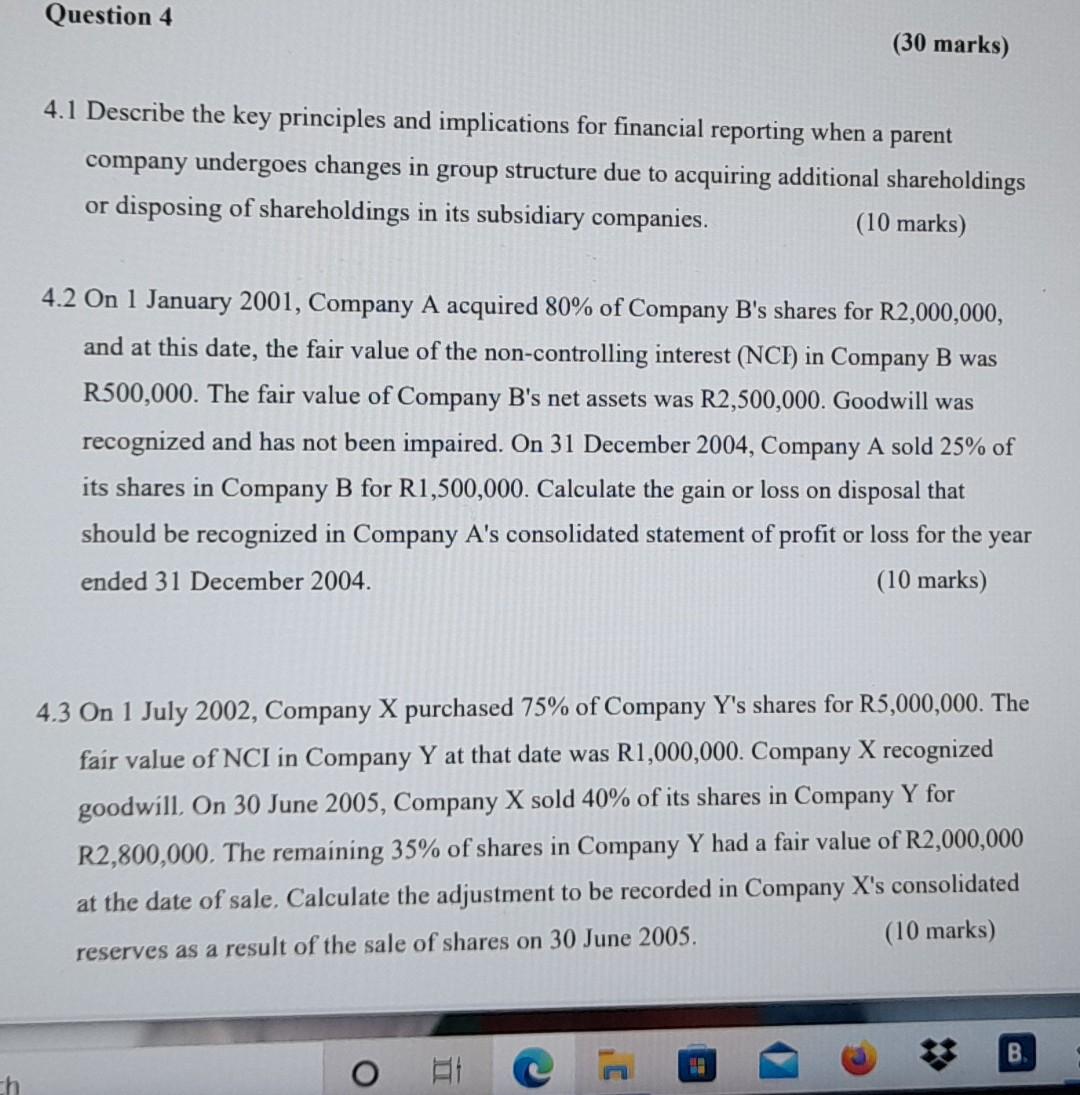

4.1 Describe the key principles and implications for financial reporting when a parent company undergoes changes in group structure due to acquiring additional shareholdings or

4.1 Describe the key principles and implications for financial reporting when a parent company undergoes changes in group structure due to acquiring additional shareholdings or disposing of shareholdings in its subsidiary companies. (10 marks) 4.2 On 1 January 2001, Company A acquired 80% of Company B's shares for R2,000,000, and at this date, the fair value of the non-controlling interest (NCI) in Company B was R500,000. The fair value of Company B's net assets was R2,500,000. Goodwill was recognized and has not been impaired. On 31 December 2004, Company A sold 25\% of its shares in Company B for R1,500,000. Calculate the gain or loss on disposal that should be recognized in Company A's consolidated statement of profit or loss for the year ended 31 December 2004. (10 marks) 4.3 On 1 July 2002, Company X purchased 75\% of Company Y's shares for R5,000,000. The fair value of NCI in Company Y at that date was R1,000,000. Company X recognized goodwill. On 30 June 2005, Company X sold 40% of its shares in Company Y for R2,800,000. The remaining 35% of shares in Company Y had a fair value of R2,000,000 at the date of sale. Calculate the adjustment to be recorded in Company X's consolidated reserves as a result of the sale of shares on 30 June 2005 . (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started