Answered step by step

Verified Expert Solution

Question

1 Approved Answer

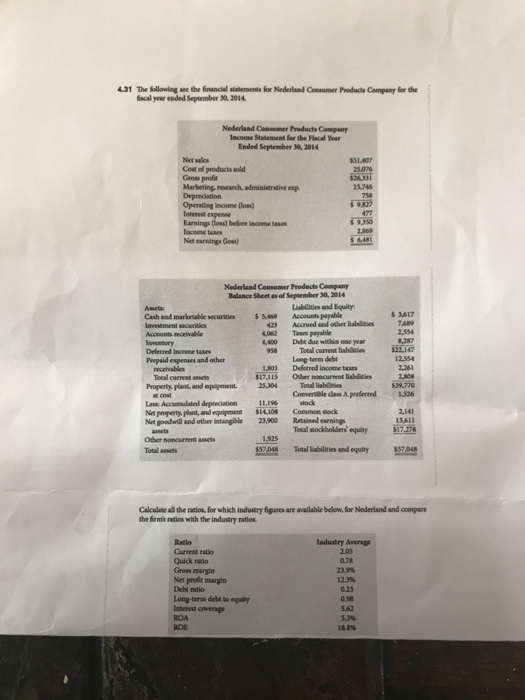

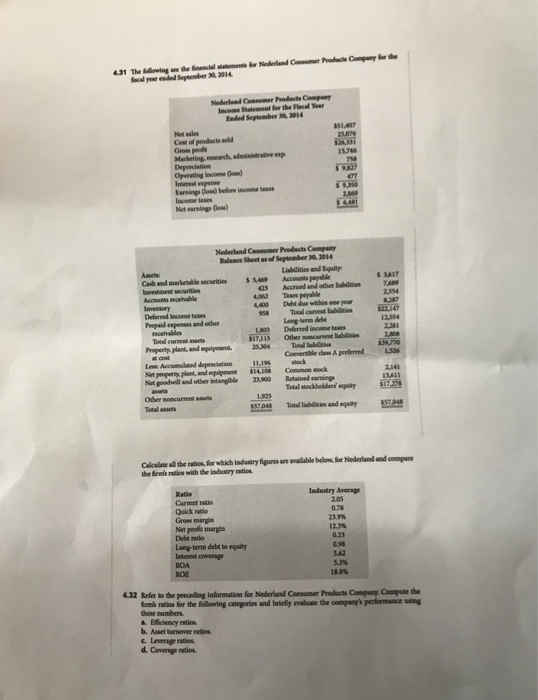

4.32 is the question to be answered 431 The following ane the financial statements for Nederland Consumer Products Company for the iscal year ended September

4.32 is the question to be answered

431 The following ane the financial statements for Nederland Consumer Products Company for the iscal year ended September 30 2014 Nederland Consemer Products Company lncome Statement for the Flscal Year Ended September 30,2014 51 407 Cost of products sold Gros proft 15.746 Operating Income los) Interest expense Earnings Dloss) betfore income taxes Income tase Net earnings loss Nederland Cousumer Prodects Company Balance Sheet as of September 30, 2014 Liabilities and Equity Accounts payable Cash and marketable securides $ Investment securities Accounts receivable 423 ccrued and other liabilizies 402 4,400 3617 ,554 958 Toal curent liabaces $22,147 Tases payable Debt due withis one year Delerred income tases Prepaid expenses and other Long term deb 1715 Ober noncurrent liabilities 1803 Defeered income tase 2.261 Total current assets Converable dass A preferred 1,526 Less Accumulated depreciation Net pmoperty, plant, and equipment $14I0S Common sock Net goodwill and other intangible 23,900 Retained earnings 2141 13,611 $17-27 Tetal sockholders equity Oher noncurrent assets Total assets $37D48 Total liablities and equity $57048 Calculase all the ratios, for which industry figures are available below, for Nederland and compare the firmis rnatios with the industry ratios Industry Average Cureent ratio Quick natio Groas margin Net profie margin Debt ratio Long-term drbe to equity loterest covernge ROA ROE 078 12.3% 0.23 0.98 5.62 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started