Answered step by step

Verified Expert Solution

Question

1 Approved Answer

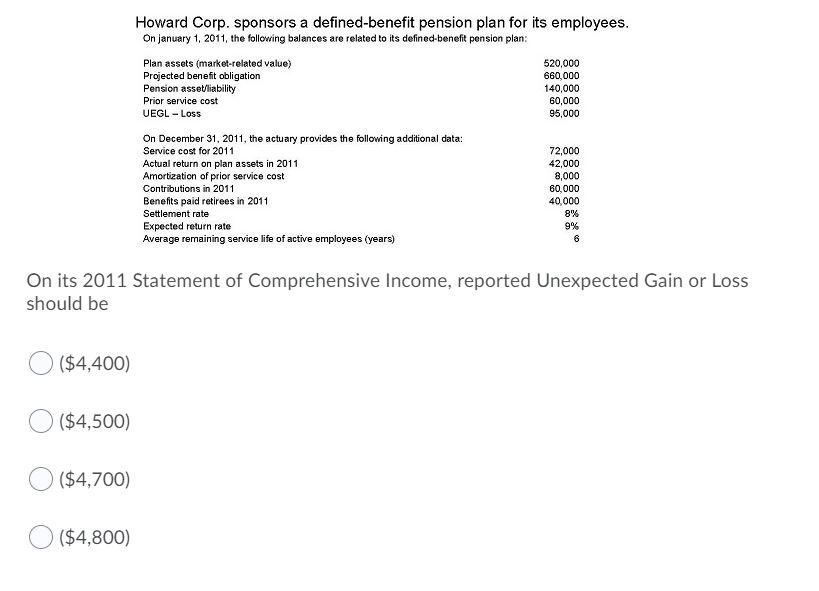

($4,400) ($4,500) ($4,700) Howard Corp. sponsors a defined-benefit pension plan for its employees. On january 1, 2011, the following balances are related to its

($4,400) ($4,500) ($4,700) Howard Corp. sponsors a defined-benefit pension plan for its employees. On january 1, 2011, the following balances are related to its defined-benefit pension plan: ($4,800) Plan assets (market-related value) Projected benefit obligation Pension asset/liability Prior service cost UEGL - Loss On December 31, 2011, the actuary provides the following additional data: Service cost for 2011 Actual return on plan assets in 2011 Amortization of prior service cost Contributions in 2011 Benefits paid retirees in 2011 Settlement rate Expected return rate Average remaining service life of active employees (years) 520,000 660,000 140,000 On its 2011 Statement of Comprehensive Income, reported Unexpected Gain or Loss should be 60,000 95,000 72,000 42,000 8,000 60,000 40,000 8% 9% 6

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

solution 4833 explanation Unexpected gains or losses on the pension plan may be due to sudden change...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started