Answered step by step

Verified Expert Solution

Question

1 Approved Answer

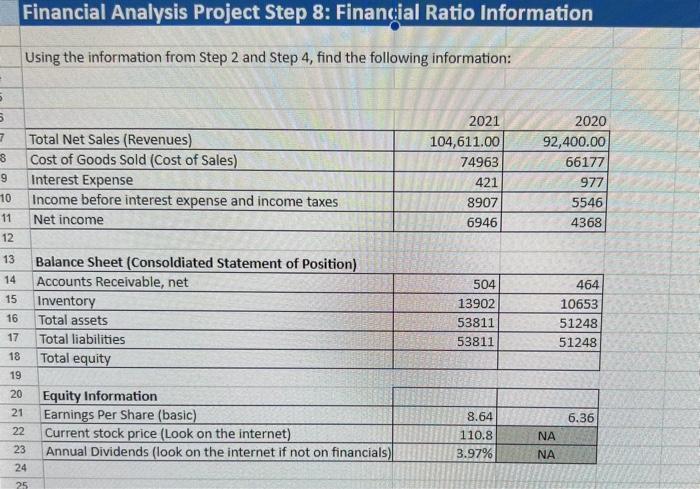

5 5 7 8 9 10 11 12 Financial Analysis Project Step 8: Financial Ratio Information Using the information from Step 2 and Step

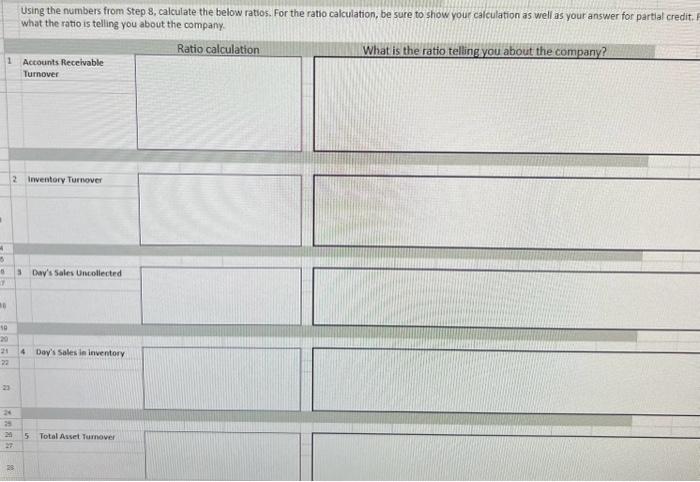

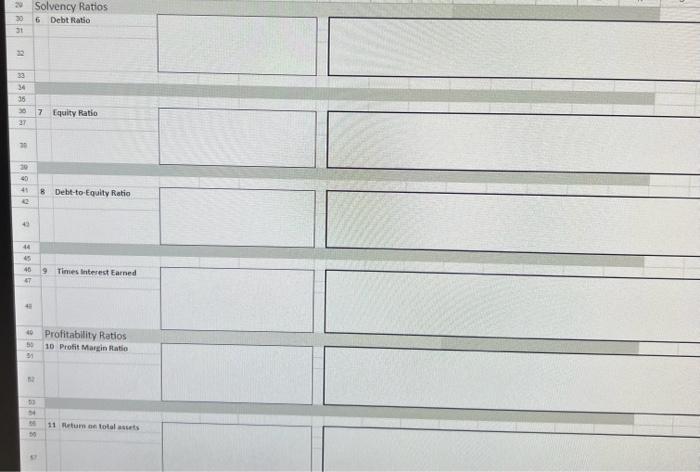

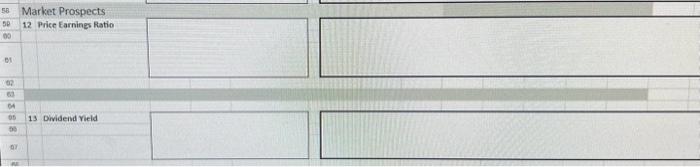

5 5 7 8 9 10 11 12 Financial Analysis Project Step 8: Financial Ratio Information Using the information from Step 2 and Step 4, find the following information: 13 14 15 16 17 18 19 20 21 22 23 24 25 Total Net Sales (Revenues) Cost of Goods Sold (Cost of Sales) Interest Expense Income before interest expense and income taxes Net income Balance Sheet (Consoldiated Statement of Position) Accounts Receivable, net Inventory Total assets Total liabilities Total equity Equity Information Earnings Per Share (basic) Current stock price (Look on the internet) Annual Dividends (look on the internet if not on financials) 2021 104,611.00 74963 421 8907 6946 504 13902 53811 53811 8.64 110.8 3.97% 2020 92,400.00 66177 977 5546 4368 464 10653 51248 51248 6.36 1 4 15 6 f 16 10 21 22 23 24 25 20 Using the numbers from Step 8, calculate the below ratios. For the ratio calculation, be sure to show your calculation as well as your answer for partial credit. F what the ratio is telling you about the company. Ratio calculation What is the ratio telling you about the company? 27 Accounts Receivable Turnover 2 Inventory Turnover 3 Day's Sales Uncollected 4 Day's Sales in inventory 5 Total Asset Turnover 29 Solvency Ratios 30 6 Debt Ratio 31 32 33 34 35 37 RSV 41 44 1 45 46 9 Times Interest Earned 47 12 7 Equity Ratio Profitability Ratios 50 10 Profit Margin Ratio 2228 8 Debt-to-Equity Ratio 13 11 Return on total assets 58 Market Prospects 50 12 Price Earnings Ratio 00 01 88388 a 02 63 04 13 Dividend Yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the financial ratios asked for youll need to follow specific formulas and use the provided financial information from the images Lets cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started