Answered step by step

Verified Expert Solution

Question

1 Approved Answer

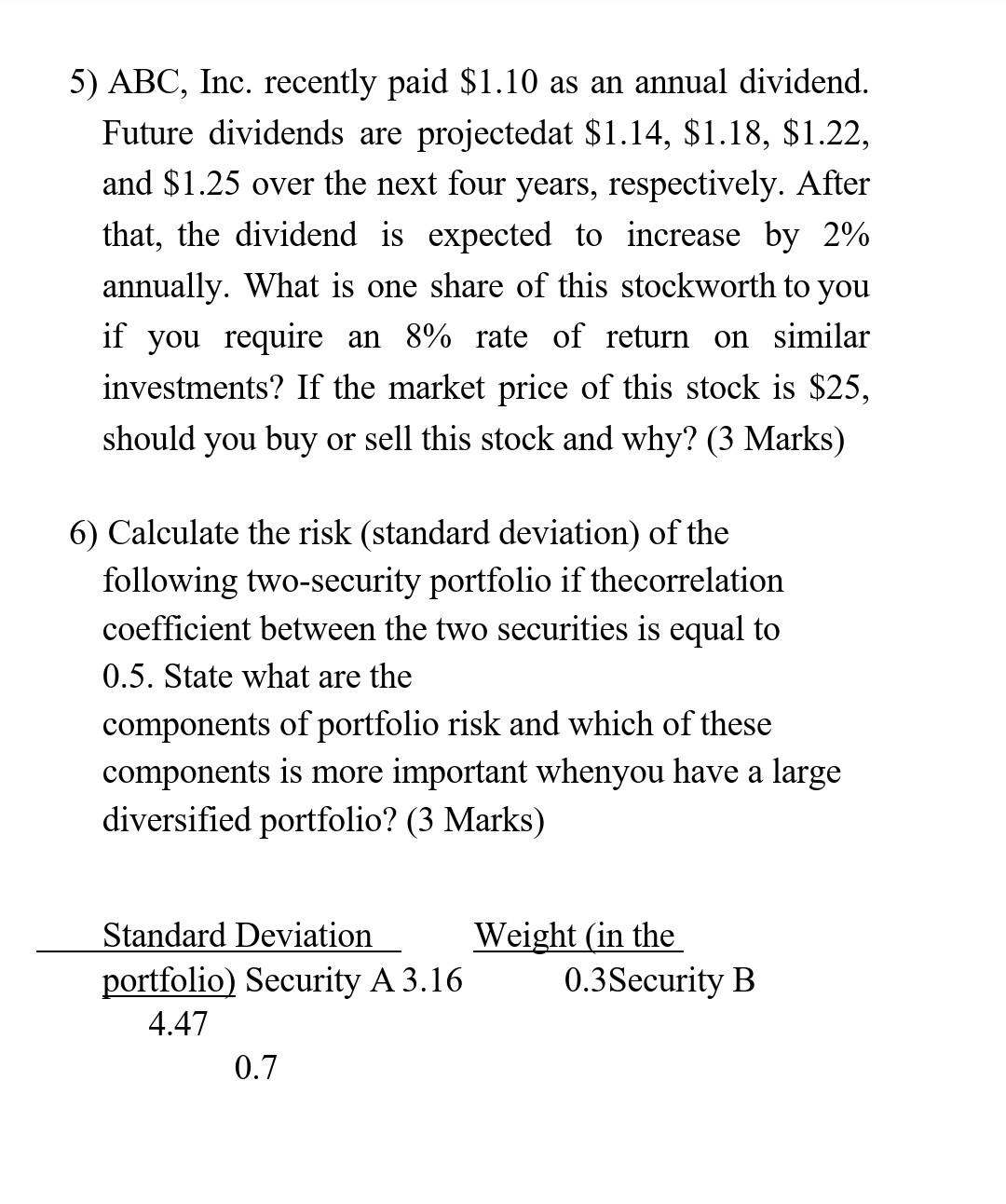

5) ABC, Inc. recently paid $1.10 as an annual dividend. Future dividends are projectedat $1.14, $1.18, $1.22, and $1.25 over the next four years, respectively.

5) ABC, Inc. recently paid $1.10 as an annual dividend. Future dividends are projectedat $1.14, $1.18, $1.22, and $1.25 over the next four years, respectively. After that, the dividend is expected to increase by 2% annually. What is one share of this stockworth to you if you require an 8% rate of return on similar investments? If the market price of this stock is $25, should you buy or sell this stock and why? (3 Marks) 6) Calculate the risk (standard deviation) of the following two-security portfolio if thecorrelation coefficient between the two securities is equal to 0.5. State what are the components of portfolio risk and which of these components is more important whenyou have a large diversified portfolio? (3 Marks) Standard Deviation Weight (in the portfolio, Security A 3.16 0.3Security B 4.47 0.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started