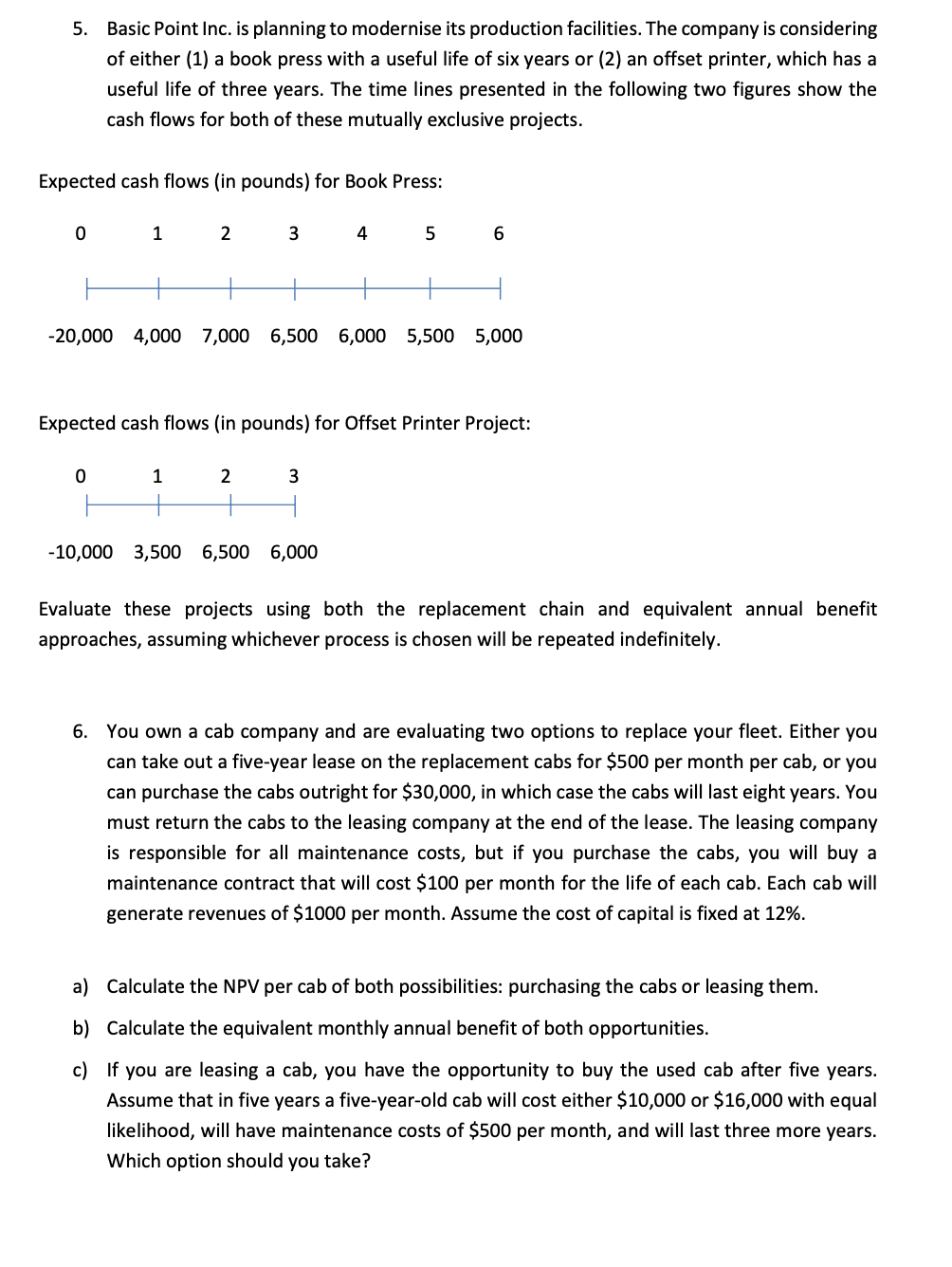

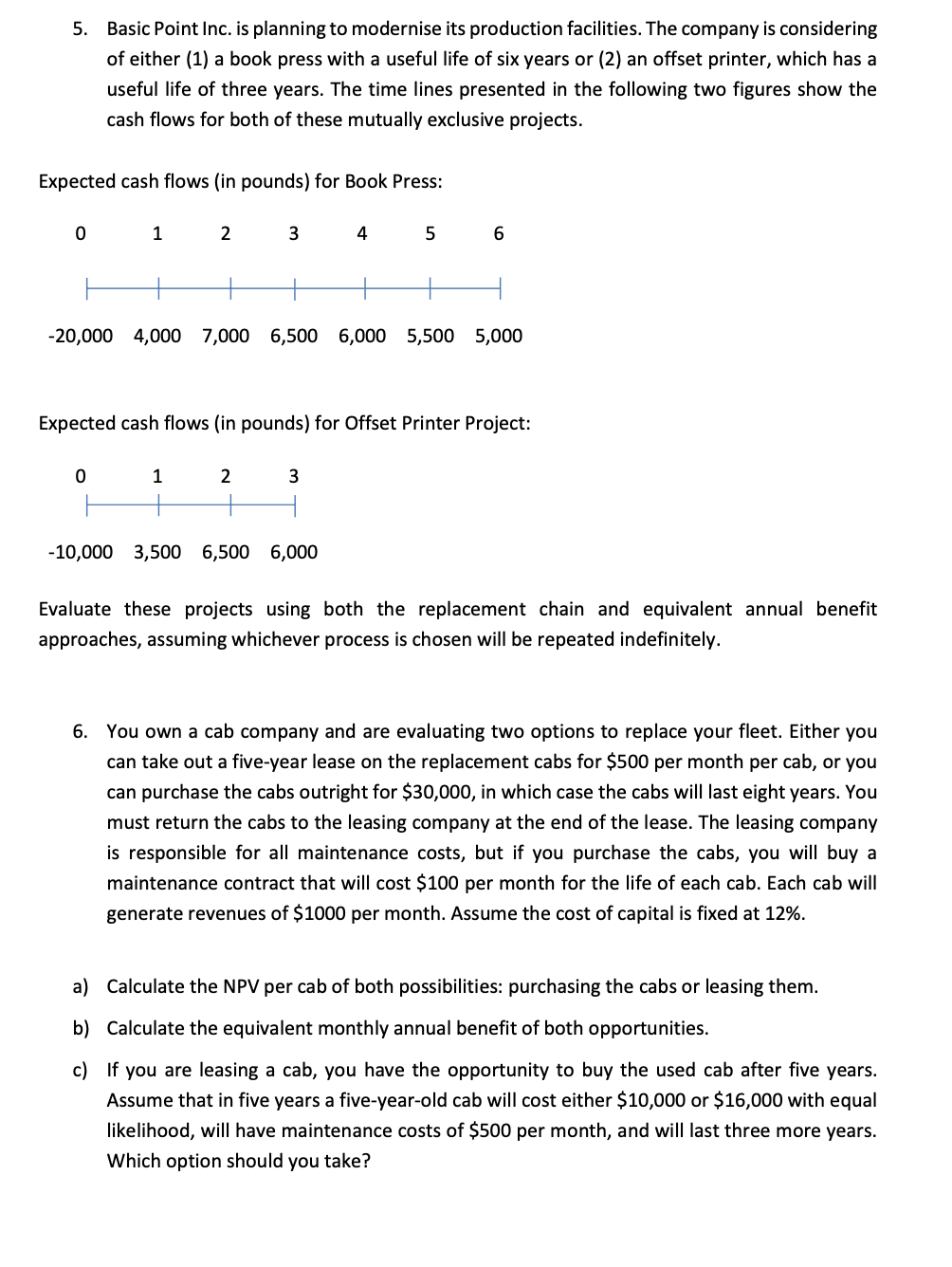

5. Basic Point Inc. is planning to modernise its production facilities. The company is considering of either (1) a book press with a useful life of six years or (2) an offset printer, which has a useful life of three years. The time lines presented in the following two figures show the cash flows for both of these mutually exclusive projects. Expected cash flows (in pounds) for Book Press: Expected cash flows (in pounds) for Offset Printer Project: Evaluate these projects using both the replacement chain and equivalent annual benefit approaches, assuming whichever process is chosen will be repeated indefinitely. 6. You own a cab company and are evaluating two options to replace your fleet. Either you can take out a five-year lease on the replacement cabs for $500 per month per cab, or you can purchase the cabs outright for $30,000, in which case the cabs will last eight years. You must return the cabs to the leasing company at the end of the lease. The leasing company is responsible for all maintenance costs, but if you purchase the cabs, you will buy a maintenance contract that will cost $100 per month for the life of each cab. Each cab will generate revenues of $1000 per month. Assume the cost of capital is fixed at 12%. a) Calculate the NPV per cab of both possibilities: purchasing the cabs or leasing them. b) Calculate the equivalent monthly annual benefit of both opportunities. c) If you are leasing a cab, you have the opportunity to buy the used cab after five years. Assume that in five years a five-year-old cab will cost either $10,000 or $16,000 with equal likelihood, will have maintenance costs of $500 per month, and will last three more years. Which option should you take? 5. Basic Point Inc. is planning to modernise its production facilities. The company is considering of either (1) a book press with a useful life of six years or (2) an offset printer, which has a useful life of three years. The time lines presented in the following two figures show the cash flows for both of these mutually exclusive projects. Expected cash flows (in pounds) for Book Press: Expected cash flows (in pounds) for Offset Printer Project: Evaluate these projects using both the replacement chain and equivalent annual benefit approaches, assuming whichever process is chosen will be repeated indefinitely. 6. You own a cab company and are evaluating two options to replace your fleet. Either you can take out a five-year lease on the replacement cabs for $500 per month per cab, or you can purchase the cabs outright for $30,000, in which case the cabs will last eight years. You must return the cabs to the leasing company at the end of the lease. The leasing company is responsible for all maintenance costs, but if you purchase the cabs, you will buy a maintenance contract that will cost $100 per month for the life of each cab. Each cab will generate revenues of $1000 per month. Assume the cost of capital is fixed at 12%. a) Calculate the NPV per cab of both possibilities: purchasing the cabs or leasing them. b) Calculate the equivalent monthly annual benefit of both opportunities. c) If you are leasing a cab, you have the opportunity to buy the used cab after five years. Assume that in five years a five-year-old cab will cost either $10,000 or $16,000 with equal likelihood, will have maintenance costs of $500 per month, and will last three more years. Which option should you take