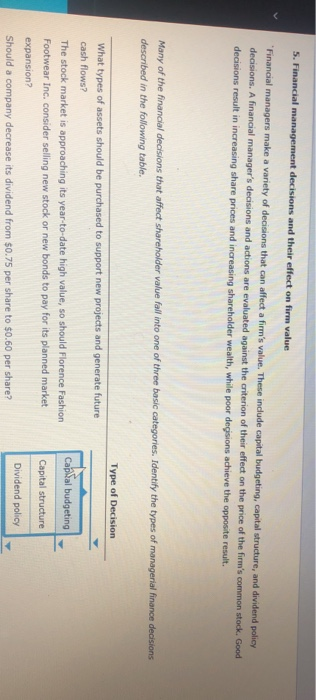

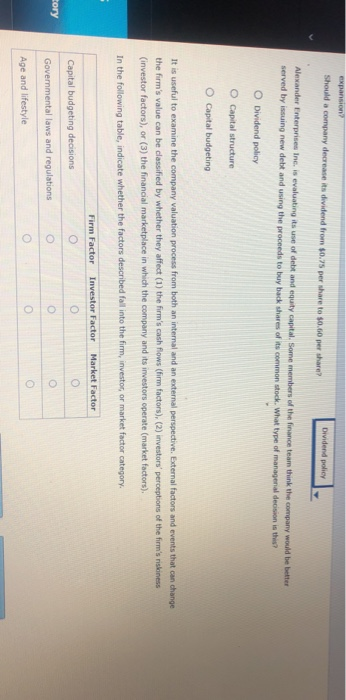

5. Financial management decisions and their effect on firm value Financial managers make a variety of decisions that can affect a firm's value. These include capital budgeting, capital structure, and dividend policy decisions. A financial manager's decisions and actions are evaluated against the criterion of their effect on the price of the firm's common stock. Good decisions result in increasing share prices and increasing shareholder wealth, while poor decisions achieve the opposite result. Many of the financial decisions that affect shareholder value fall into one of three basic categories. Identify the types of managerial finance decisions described in the following table. Type of Decision What types of assets should be purchased to support new projects and generate future cash flows? Cap al budgeting Capital structure The stock market is approaching its year-to-date high value, so should Florence Fashion Footwear Inc, consider selling new stock or new bonds to pay for its planned market expansion? Should a company decrease its dividend from $0.75 per share to $0.60 per share? Dividend policy expansion Should a company decrease its dividend from $0.75 per share to $0.60 per share? Dividend policy Alexander Enterprises Inc. is evaluating its use of debt and equity capital. Some members of the finance team think the company would be better served by issuing new debt and using the proceeds to buy back shares of its common stock. What type of managenal decision is this? O Dividend policy O Capital structure O Capital budgeting It is useful to examine the company valuation process from both an internal and an external perspective. External factors and events that can change the firm's value can be classified by whether they affect (1) the firm's cash flows (firm factors), (2) investors' perceptions of the firm's riskiness investor factors), or (3) the financial marketplace in which the company and its investors operate (market factors). In the following table, indicate whether the factors described fall into the firm, investos or market factor category. Firm Factor Investor Factor Market Factor Capital budgeting decisions cory Governmental laws and regulations O O O Age and lifestyle