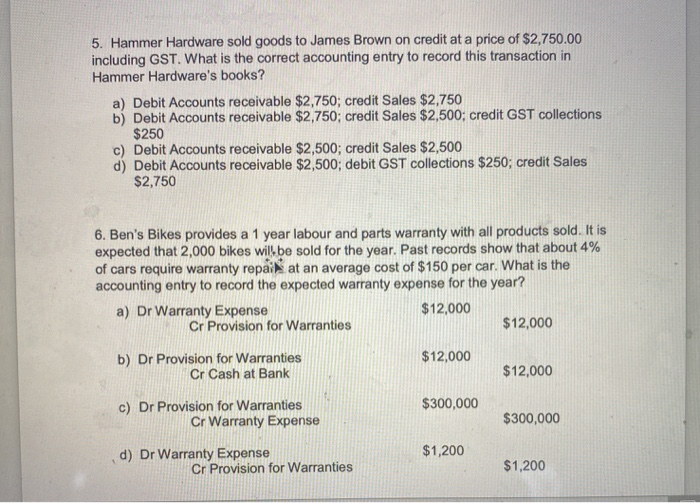

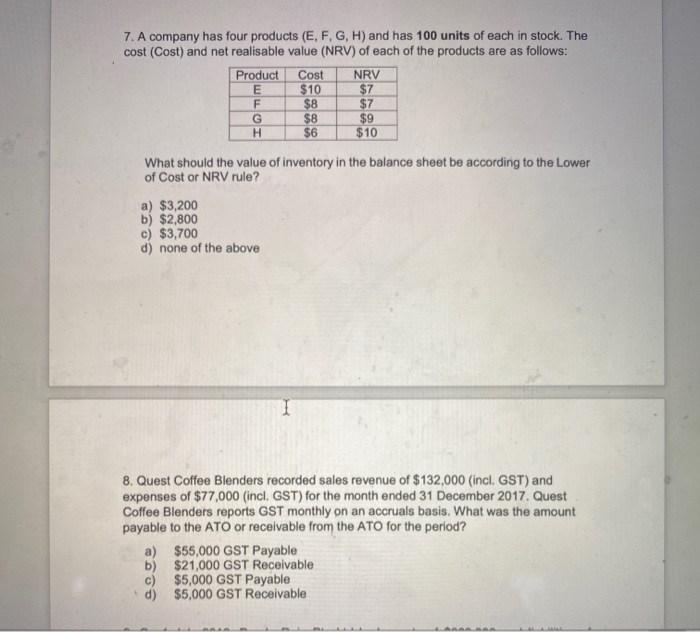

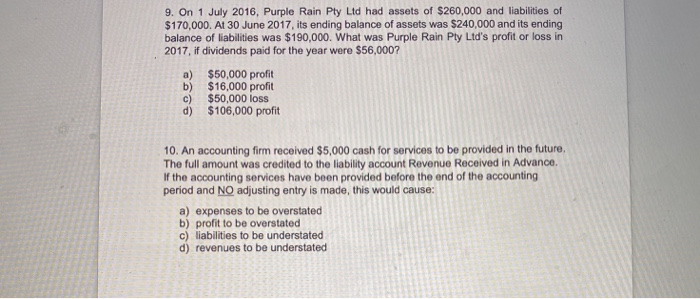

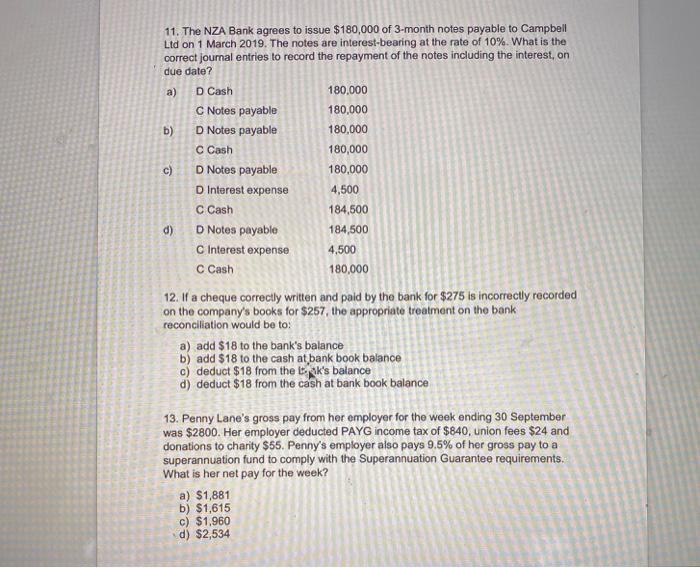

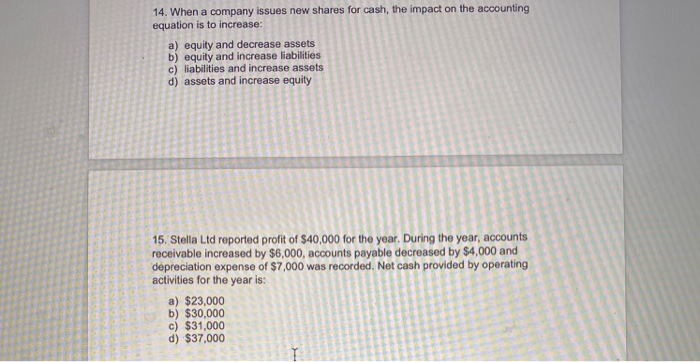

5. Hammer Hardware sold goods to James Brown on credit at a price of $2,750.00 including GST. What is the correct accounting entry to record this transaction in Hammer Hardware's books? a) Debit Accounts receivable $2,750; credit Sales $2,750 b) Debit Accounts receivable $2,750; credit Sales $2,500; credit GST collections $250 c) Debit Accounts receivable $2,500; credit Sales $2,500 d) Debit Accounts receivable $2,500; debit GST collections $250; credit Sales $2,750 6. Ben's Bikes provides a 1 year labour and parts warranty with all products sold. It is expected that 2,000 bikes will be sold for the year. Past records show that about 4% of cars require warranty repaikat an average cost of $150 per car. What is the accounting entry to record the expected warranty expense for the year? a) Dr Warranty Expense $12,000 Cr Provision for Warranties $12,000 b) Dr Provision for Warranties $12,000 Cr Cash at Bank $12,000 $300,000 c) Dr Provision for Warranties Cr Warranty Expense $300,000 $1,200 d) Dr Warranty Expense Cr Provision for Warranties $1,200 7. A company has four products (E,F,G,H) and has 100 units of each in stock. The cost (Cost) and net realisable value (NRV) of each of the products are as follows: Product Cost NRV E $10 $7 F $8 $7 G $8 $9 H $6 $10 What should the value of inventory in the balance sheet be according to the Lower of Cost or NRV rule? a) $3,200 b) $2,800 c) $3,700 d) none of the above 8. Quest Coffee Blenders recorded sales revenue of $132,000 (incl. GST) and expenses of $77,000 (incl. GST) for the month ended 31 December 2017. Quest Coffee Blenders reports GST monthly on an accruals basis. What was the amount payable to the ATO or receivable from the ATO for the period? a) $55,000 GST Payable b) $21,000 GST Receivable c) $5,000 GST Payable d) $5,000 GST Receivable 9. On 1 July 2016, Purple Rain Pty Ltd had assets of $260,000 and liabilities of $170,000. At 30 June 2017, its ending balance of assets was $240,000 and its ending balance of liabilities was $190,000. What was Purple Rain Pty Ltd's profit or loss in 2017, if dividends paid for the year were $56,000? a) $50,000 profit b) $16,000 profit c) $50,000 loss d) $106,000 profit 10. An accounting firm received $5,000 cash for services to be provided in the future, The full amount was credited to the liability account Revenue Received in Advance. If the accounting services have been provided before the end of the accounting period and NO adjusting entry is made, this would cause: a) expenses to be overstated b) profit to be overstated c) liabilities to be understated d) revenues to be understated 11. The NZA Bank agrees to issue $180,000 of 3-month notes payable to Campbell Ltd on 1 March 2019. The notes are interest-bearing at the rate of 10%. What is the correct journal entries to record the repayment of the notes including the interest, on due date? a) D Cash 180.000 C Notes payable 180,000 b) D Notes payable 180,000 C Cash 180,000 c) Notes payable 180,000 D Interest expense 4,500 C Cash 184,500 d) D Notes payable 184,500 C Interest expense 4,500 C Cash 180,000 12. If a cheque correctly written and paid by the bank for $275 is incorrectly recorded on the company's books for $257, the appropriate treatment on the bank reconciliation would be to: a) add $18 to the bank's balance b) add $18 to the cash at bank book balance c) deduct $18 from the lak's balance d) deduct $18 from the cash at bank book balance 13. Penny Lane's gross pay from her employer for the week ending 30 September was $2800. Her employer deducted PAYG income tax of $840, union fees $24 and donations to charity $55. Penny's employer also pays 9.5% of her gross pay to a superannuation fund to comply with the Superannuation Guarantee requirements. What is her net pay for the week? a) $1,881 b) $1,615 c) $1,960 d) $2,534 14. When a company issues new shares for cash, the impact on the accounting equation is to increase: a) equity and decrease assets b) equity and increase liabilities c) liabilities and increase assets d) assets and increase equity 15. Stella Ltd reported profit of $40,000 for the year. During the year, accounts receivable increased by $6,000, accounts payable decreased by $4,000 and depreciation expense of $7,000 was recorded. Net cash provided by operating activities for the year is: a) $23,000 b) $30,000 c) $31,000 d) $37.000