Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 JUST ANSWER C. THIS IS MY SECOND TIME POSTING BECAUSE THE PREVIOUS GOT IT WRONG 5 Suppose you purchase the May 2017 put option

5 JUST ANSWER C. THIS IS MY SECOND TIME POSTING BECAUSE THE PREVIOUS GOT IT WRONG

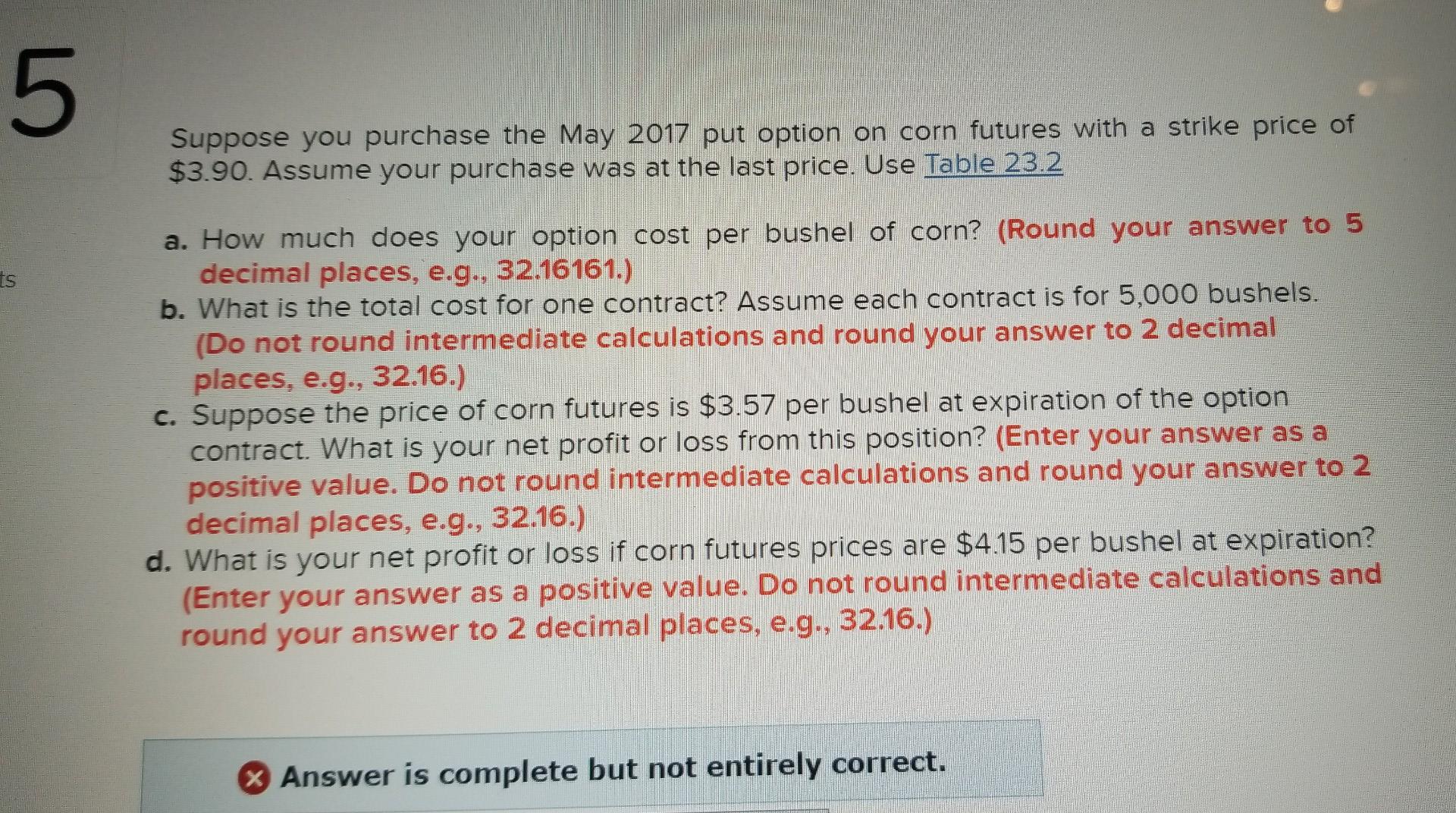

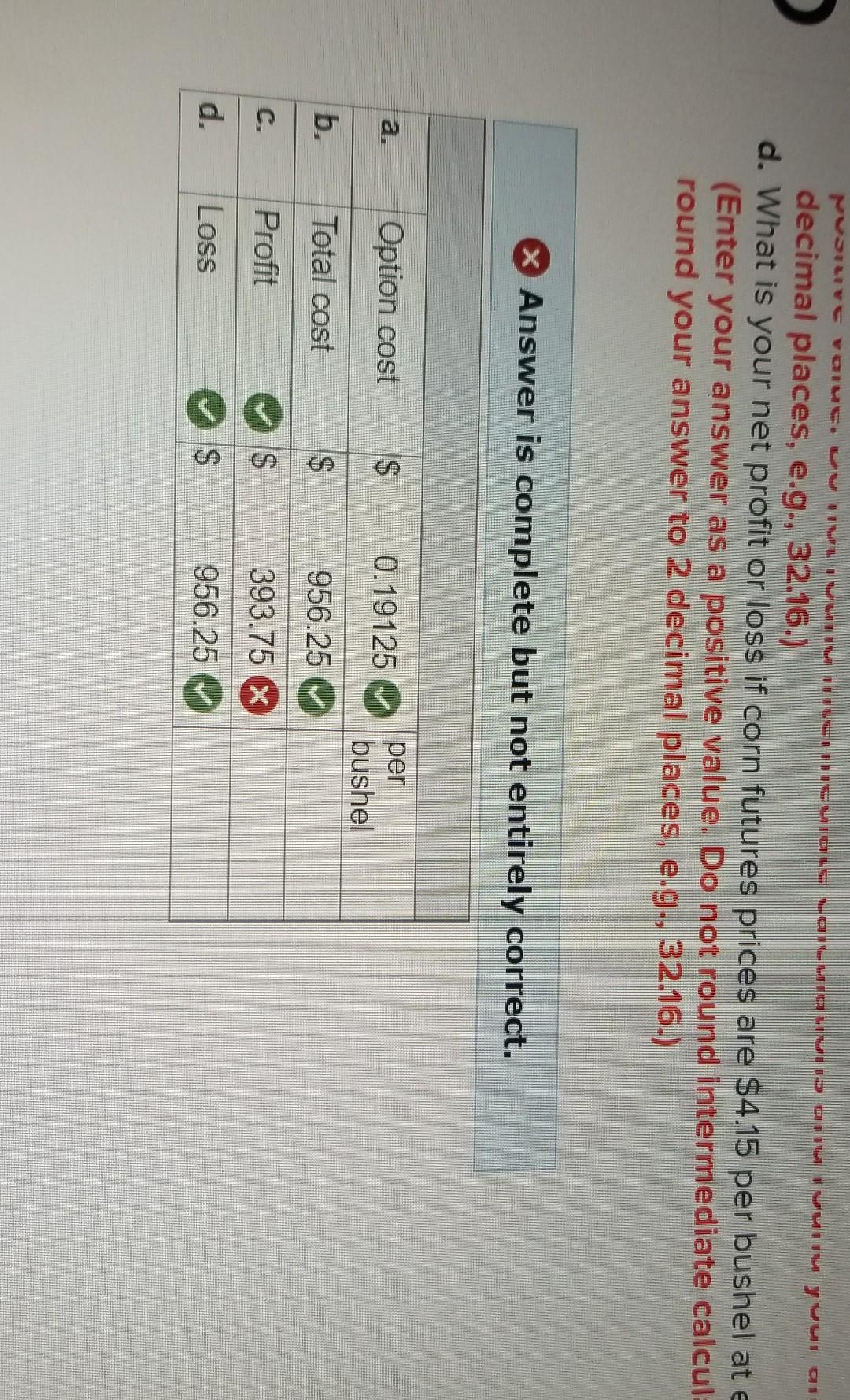

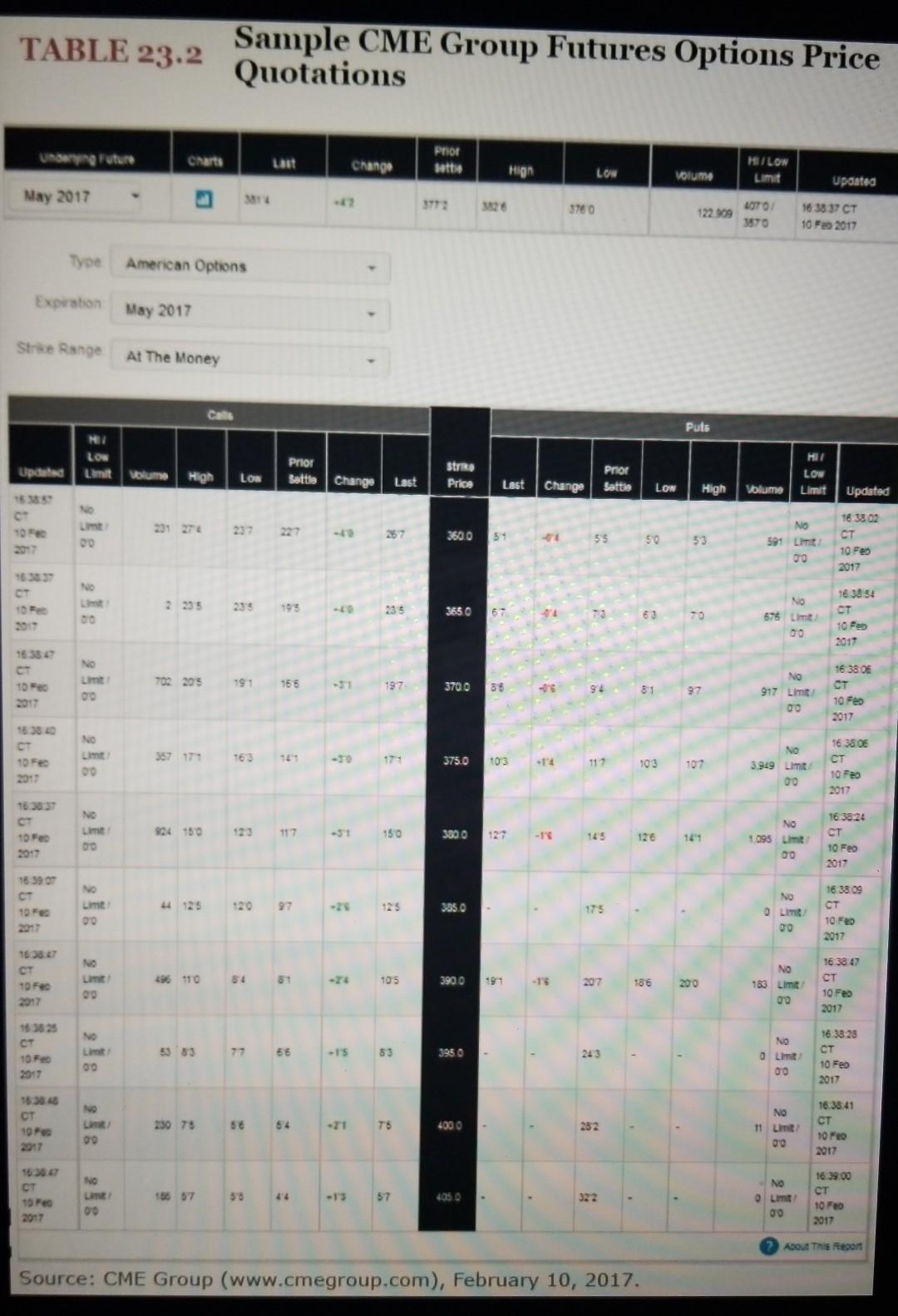

5 Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.90. Assume your purchase was at the last price. Use Table 23.2 ts a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.57 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $4.15 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) % Answer is complete but not entirely correct. Maruv varuc. Luvun deuaugue acurauis an unu yuu au decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $4.15 per bushel at e (Enter your answer as a positive value. Do not round intermediate calcul round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. Option cost 0.19125 per bushel b. Total cost $ 956.25 C. Profit $ 393.75 X d. Loss $ 956.25 TABLE 23.2 Sample CME Group Futures Options Price Quotations Unangruturo Charts Last Change Pro sotto Hign LOW Volume HILON Limit Updated May 2017 3760 122.909 LOTO 3670 16 38 37 CT 10 Feo 2017 Type American Options Expation May 2017 Strice Range At The Money Cats Puts NE Low Limit Updated Volume Prior Battle Prior High Low Stre Price Change ME LOW Limit Last Last Change Satte LON High Volume Updated 237 25 TO 2017 3600 54 00 55 50 53 NO 591 Limit 00 16 3802 10 Feb 2017 193 235 3650 67 00 63 70 NO 675 Limit 00 sis mg CT 10 Feb 2017 16.330 NO 10 Fec 702205 165 197 3700 58 15 94 16 380 OT 10 Feb 51 No 917 Limit 92 2017 No 16.380 CT 10 Fe 2017 357 171 *63 172 3750 103 117 103 107 NO 3.949 Limit 00 16 380 CT 10 Feb 2017 16.30.37 Fee 2017 924 150 123 117 150 3800 127 145 126 141 NO 1095 Lim 00 16 3824 CT 10 Feo 2017 16390 CT to Fes NO Lit 4 125 97 335.0 175 NO Limit 00 16 3809 CT 10 FD 2017 16.387 CT 10 Fee Lim 496 110 84 105 3900 -18 207 186 200 NO 183 Limit 00 16 38 47 10 Feb 2017 165025 CT 10 Fec 2017 53 83 66 -15 53 3950 243 21: 1: 21: Limit 16 38 28 CT 10 Feb 2017 16.30.48 CT 10 2017 230 75 56 54 -71 75 4000 252 11 Limit 00 16 38 41 CT 10 Feo 2017 NO 33 4'4 10 Fe 2017 57 4050 322 NO 0 Limit 00 16.39.00 CT 10 Feo 2017 About The Repon Source: CME Group (www.cmegroup.com), February 10, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started