Answered step by step

Verified Expert Solution

Question

1 Approved Answer

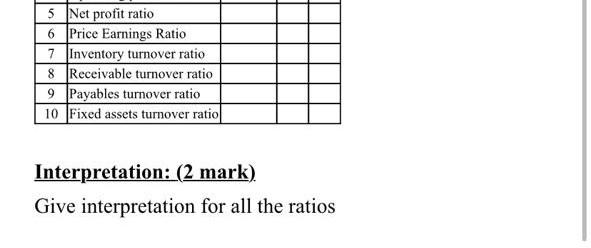

5 Net profit ratio 6 Price Earnings Ratio 7 Inventory turnover ratio 8 Receivable turnover ratio 9 Payables turnover ratio 10 Fixed assets turnover ratio

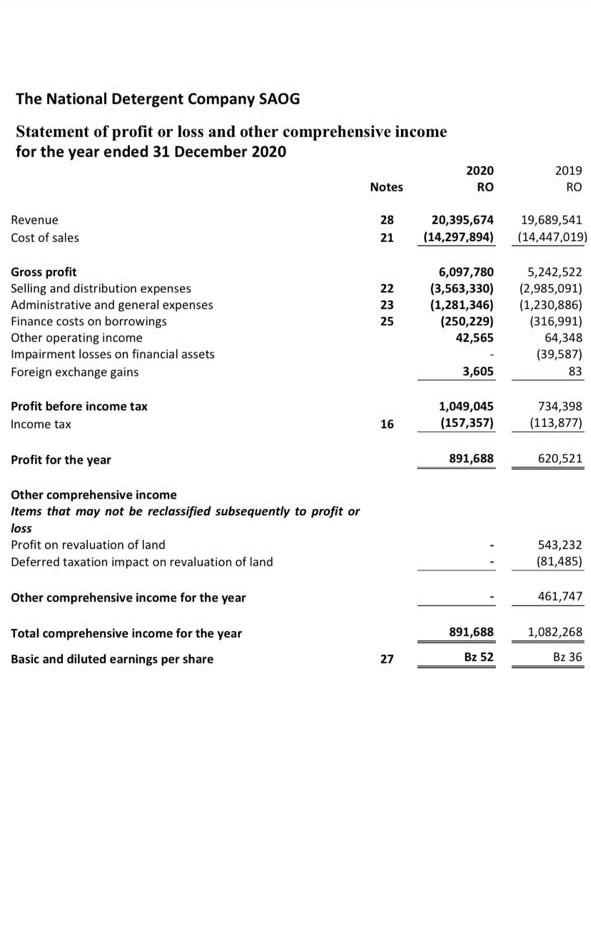

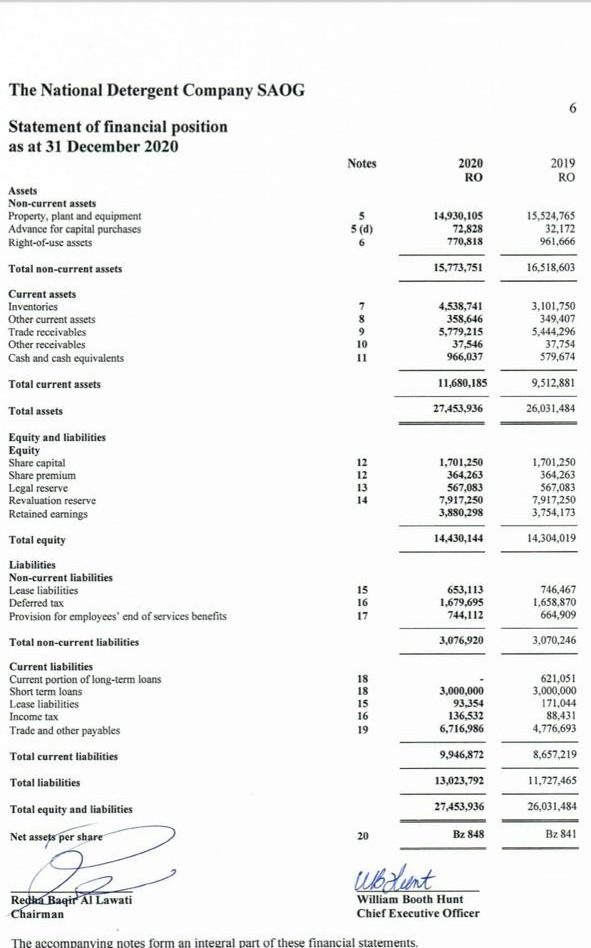

5 Net profit ratio 6 Price Earnings Ratio 7 Inventory turnover ratio 8 Receivable turnover ratio 9 Payables turnover ratio 10 Fixed assets turnover ratio Interpretation: (2 mark) Give interpretation for all the ratios The National Detergent Company SAOG Statement of profit or loss and other comprehensive income for the year ended 31 December 2020 2020 RO 2019 RO Notes Revenue Cost of sales 28 21 20,395,674 (14,297,894) 19,689,541 (14,447,019) Gross profit Selling and distribution expenses Administrative and general expenses Finance costs on borrowings Other operating income Impairment losses on financial assets Foreign exchange gains 22 23 25 6,097,780 (3,563,330) (1,281,346) (250,229) 42,565 5,242,522 (2,985,091) (1,230,886) (316,991) 64,348 (39,587) 83 3,605 Profit before income tax Income tax 1,049,045 (157,357) 734,398 (113,877) 16 Profit for the year 891,688 620,521 Other comprehensive income Items that may not be reclassified subsequently to profit or loss Profit on revaluation of land Deferred taxation impact on revaluation of land 543,232 (81,485) Other comprehensive income for the year 461,747 891,688 1,082,268 Total comprehensive income for the year Basic and diluted earnings per share 27 Bz 52 Bz 36 The National Detergent Company SAOG Statement of financial position as at 31 December 2020 Notes 2020 RO 2019 RO 5(d) 14,930,105 72,828 770,818 15,524,765 32,172 961,666 15,773,751 16,518,603 4,538,741 358,646 5,779,215 37,546 966,037 3,101,750 349,407 5,444,296 37.754 579,674 10 11 11,680,185 9,512,881 27,453.936 26,031.484 12 12 13 14 Assets Non-current assets Property, plant and equipment Advance for capital purchases Right-of-use assets Total non-current assets Current assets Inventories Other current assets Trade receivables Other receivables Cash and cash equivalents Total current assets Total assets Equity and liabilities Equity Share capital Share premium Legal reserve Revaluation reserve Retained earnings Total equity Liabilities Non-current liabilities Lease liabilities Deferred tax Provision for employees' end of services benefits Total non-current liabilities Current liabilities Current portion of long-term loans Short term loans Lease liabilities Income tax Trade and other payables Total current liabilities Total liabilities Total equity and liabilities Net assets per share 1,701,250 364.263 567,083 7,917.250 3,880,298 1,701,250 364,263 567,083 7,917.250 3,754,173 14,430,144 14,304,019 15 16 17 653,113 1.679,695 744,112 746,467 1.658,870 664,909 3,076,920 3,070,246 18 18 15 16 19 3,000,000 93.354 136,532 6,716,986 621,051 3,000,000 171,044 88,431 4,776,693 9,946,872 8,657,219 13,023,792 11,727,465 27,453,936 26,031,484 20 Bz 848 Bz 841 wbalent Redka Baqir Al Lawati Chairman William Booth Hunt Chief Executive Officer The accompanying notes form an integral part of these financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started