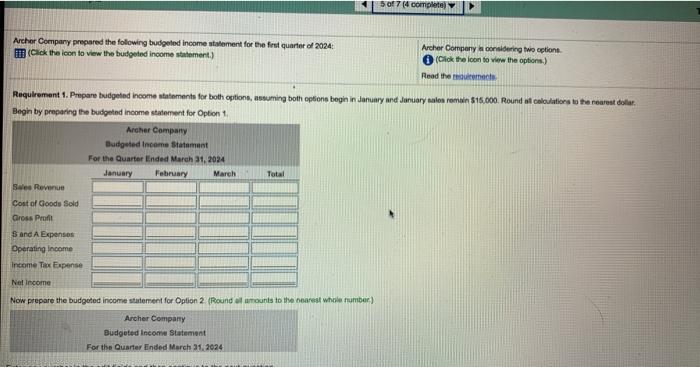

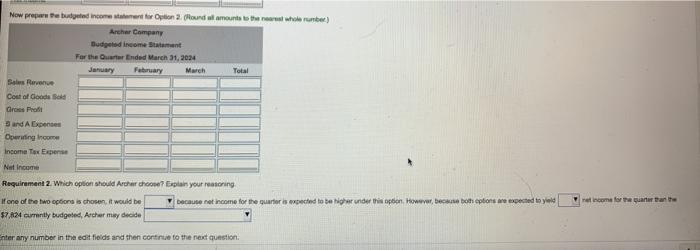

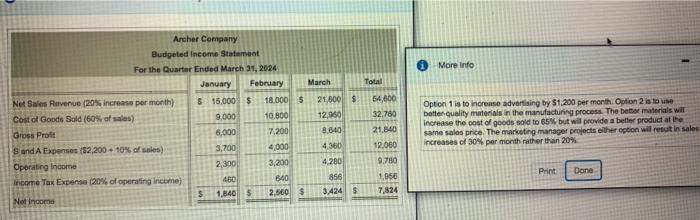

5 of 7 (4 complete Archer Company prepared the following budgeted Income statement for the first quarter of 2024 (Click the icon to view the budgeted income statement.) Archer Company considering two options (Click the loon to view the options) Read the reci Requirement 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $15.000. Round of clolations to the nearest dollar Begin by preparing the budgeted income statement for Option 1 Archer Company Budgeted Income Statement For the Quarter Ended March 31, 2024 January February March Total Se Revenue Cost of Good Sold Gross Profit S and A Expenses Operating Income Income Tax Expense Net Income Now prepare the budgeted income statement for Option 2 (Round amounts to the rest whole number) Archer Company Budgeted Income Statement For the Quarter Ended March 31, 2024 New prepare the butted Income statement for Option 2. Round at amounts the real whole rumber) Archer Company Budgeted income Statement For the Quarter Ended March 31, 2024 January February March Total Sol Revenue Cost of Goods Groe Prot Band A Operating in Income Tax Expense Not Income Requirement 2. Which option should Archer choose? Explain your restoring If one of the two option is chosen, it would be because not income for the quarter is expected to be higher under this poon. However, because both options are expected to yield $7.21 currently budgeted, Archer may decide net income for an anth nter any number in the edit fields and then continue to the next question More info March Tota Archer Company Budgeted Income Statement For the Quarter Ended March 31, 2024 January February Net Sales Revenue (20% Increase per month) $15.000 $ 18.000 $ Cost of Goods Sold (60% of sales) 9,000 10.800 Gross Prot 6,000 7,200 Sand A Expenses (52,200 - 10% of sales) 3,700 4,000 Operating Income 2,300 3,200 Income Tax Expos (20% of operating income) 460 840 $ 1.840 5 Net Income 2.500 5 54,600 32,769 21,600 $ 12,950 8.640 Option is to increase advertising by $1.200 per month Option 2 is to use better quality materials in the manufacturing process. The bebor materials will increase the cost of goods sold to 65% but will provide a better product at the same sales price. The marketing manager projects either option will retutin sales increases of 30% per month rather than 20% 21.14 4.360 12.000 4.280 Print Done 9.780 1,956 7.824 856 3424