Answered step by step

Verified Expert Solution

Question

1 Approved Answer

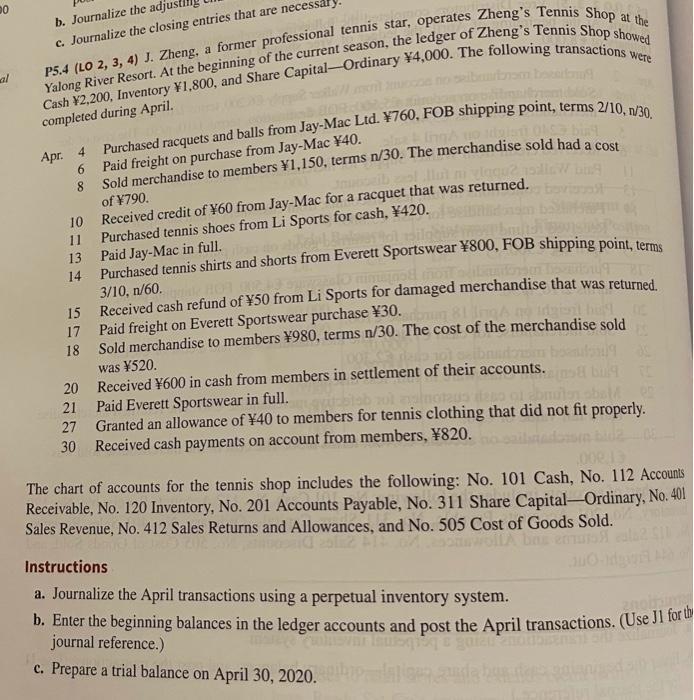

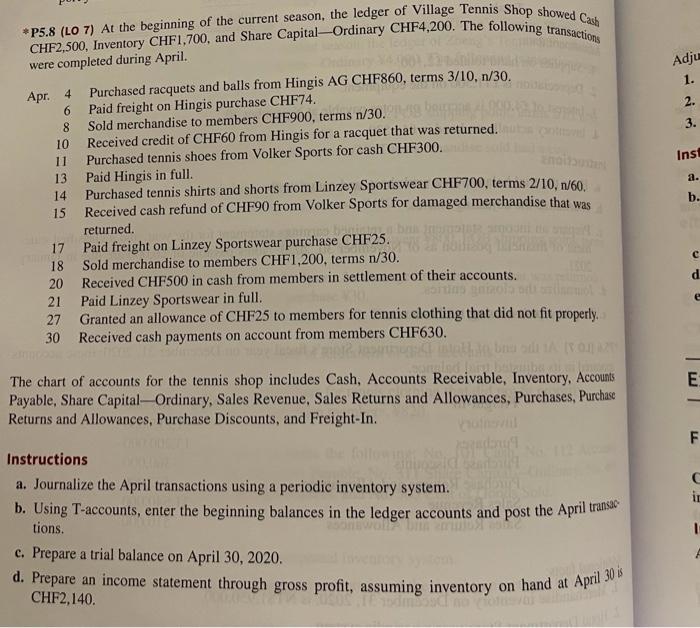

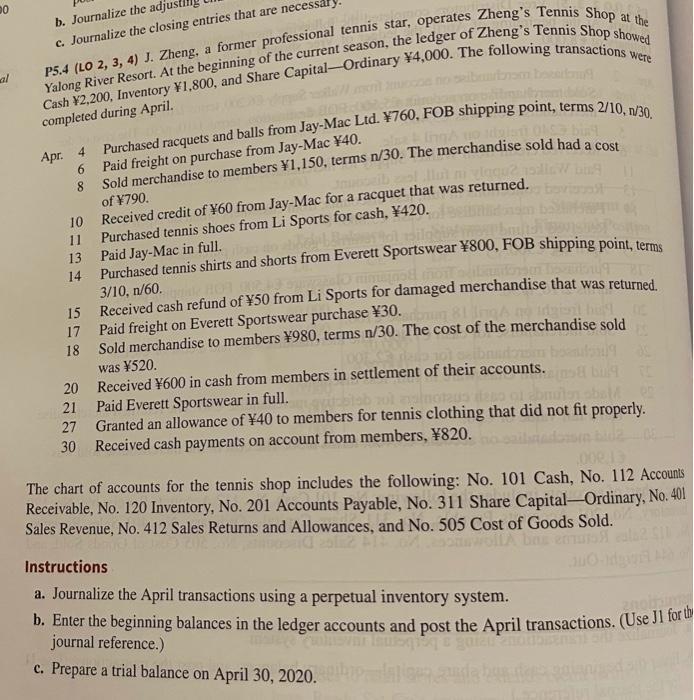

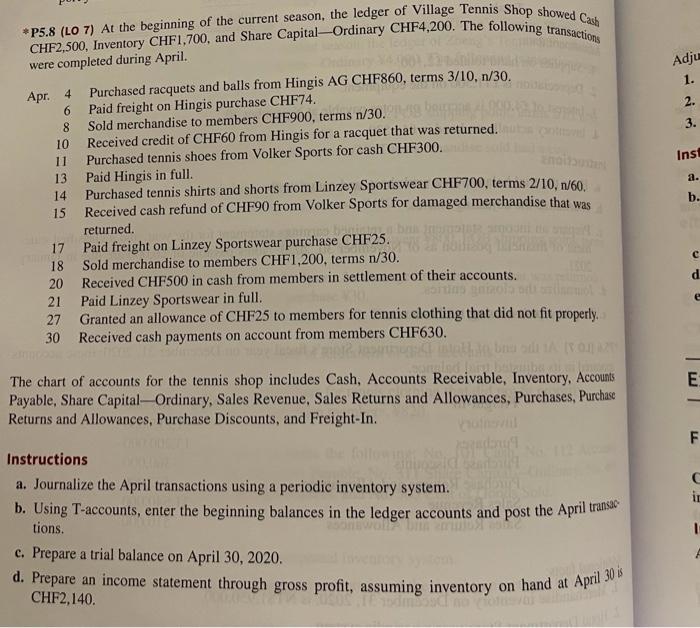

5.4 and 5.8 DO b. Journalize the adju c. Journalize the closing entries that are necessary. were al P5.4 (LO 2, 3, 4) J. Zheng,

5.4 and 5.8

DO b. Journalize the adju c. Journalize the closing entries that are necessary. were al P5.4 (LO 2, 3, 4) J. Zheng, a former professional tennis star, operates Zheng's Tennis Shop at the Yalong River Resort. At the beginning of the current season, the ledger of Zheng's Tennis Shop showed Cash 2,200, Inventory 1,800, and Share Capital - Ordinary 4,000. The following transactions completed during April. Purchased racquets and balls from Jay-Mac Ltd. 760, FOB shipping point, terms 2/10, 1/30. bus Apr. 4 6 8 Paid freight on purchase from Jay-Mac 40. Sold merchandise to members 1,150, terms /30. The merchandise sold had a cost of 790. mm 10 Received credit of 60 from Jay-Mac for a racquet that was returned. 11 Purchased tennis shoes from Li Sports for cash, 420. 13 Paid Jay-Mac in full. 14 Purchased tennis shirts and shorts from Everett Sportswear #800, FOB shipping point, terms 3/10, n/60. 15 Received cash refund of 50 from Li Sports for damaged merchandise that was returned. 17 Paid freight on Everett Sportswear purchase X30. 18 Sold merchandise to members 980, terms n/30. The cost of the merchandise sold Those was 520. 20 Received Y600 in cash from members in settlement of their accounts. 21 Paid Everett Sportswear in full. 27 Granted an allowance of 40 to members for tennis clothing that did not fit properly. 30 Received cash payments on account from members, 820. 000 The chart of accounts for the tennis shop includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, No. 311 Share Capital-Ordinary, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, and No. 505 Cost of Goods Sold. Instructions a. Journalize the April transactions using a perpetual inventory system. b. Enter the beginning balances in the ledger accounts and post the April transactions. (Use Ji forth journal reference.) c. Prepare a trial balance on April 30, 2020. Adju 1. 2. 3. 8 Insi a. b. CHF2,500, Inventory CHF1,700, and Share Capital-Ordinary CHF4,200. The following transactions P5.8 (LO 7) At the beginning of the current season, the ledger of Village Tennis Shop showed Cash were completed during April. Apr. 4 Purchased racquets and balls from Hingis AG CHF860, terms 3/10,n/30. 6 Paid freight on Hingis purchase CHF74. Sold merchandise to members CHF900, terms n/30. 10 Received credit of CHF60 from Hingis for a racquet that was returned. 11 Purchased tennis shoes from Volker Sports for cash CHF300. 13 Paid Hingis in full 14 Purchased tennis shirts and shorts from Linzey Sportswear CHF700, terms 2/10, 1/60. 15 Received cash refund of CHF90 from Volker Sports for damaged merchandise that was returned. 17 Paid freight on Linzey Sportswear purchase CHF25. 18 Sold merchandise to members CHF1,200, terms n/30. 20 Received CHF500 in cash from members in settlement of their accounts. 21 Paid Linzey Sportswear in full. 27 Granted an allowance of CHF25 to members for tennis clothing that did not fit properly. 30 Received cash payments on account from members CHF630. novo The chart of accounts for the tennis shop includes Cash, Accounts Receivable, Inventory, Accounts Payable, Share Capital - Ordinary, Sales Revenue, Sales Returns and Allowances, Purchases, Purchase Returns and Allowances, Purchase Discounts, and Freight-In. E E F in Instructions a. Journalize the April transactions using a periodic inventory system. b. Using T-accounts, enter the beginning balances in the ledger accounts and post the April transea tions. c. Prepare a trial balance on April 30, 2020. d. Prepare an income statement through gross profit, assuming inventory on hand at April 30 is CHF2,140 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part B Journalize the Adjusting Entries Adjusting entries ensure that the revenue recognition and matching principles are followed For Zhengs Tennis S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started