Answered step by step

Verified Expert Solution

Question

1 Approved Answer

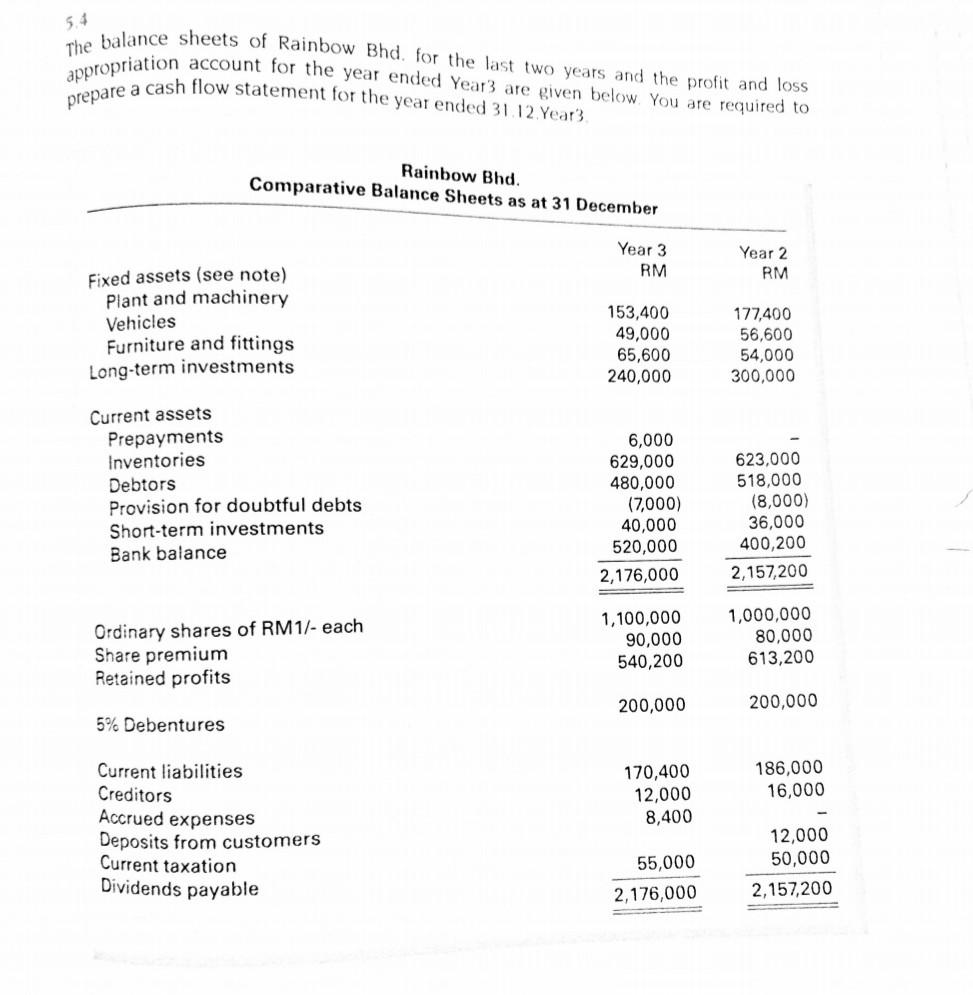

5.4 The balance sheets of Rainbow Bhd. for the last two years and the profit and loss appropriation account for the year ended Year3 are

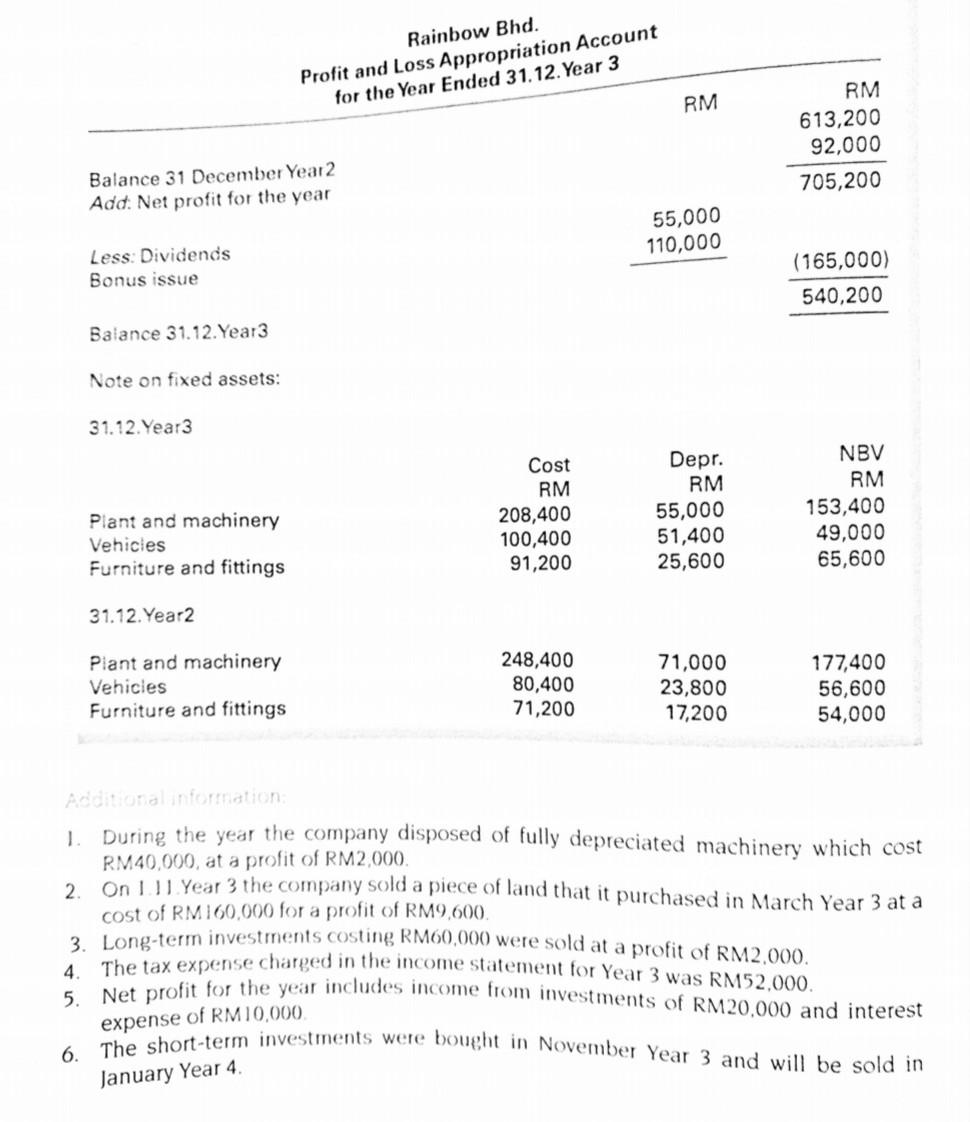

5.4 The balance sheets of Rainbow Bhd. for the last two years and the profit and loss appropriation account for the year ended Year3 are given below. You are required to prepare a cash flow statement for the year ended 31.12 Year3 Rainbow Bhd. Comparative Balance Sheets as at 31 December Year 2 Year 3 RM RM Fixed assets (see note) Plant and machinery Vehicles Furniture and fittings Long-term investments 153,400 49,000 65,600 240,000 177,400 56,600 54,000 300,000 Current assets Prepayments Inventories Debtors Provision for doubtful debts Short-term investments Bank balance 6,000 629,000 480,000 (7,000) 40,000 520,000 623,000 518,000 (8,000) 36,000 400,200 2,176,000 2,157,200 Ordinary shares of RM1/- each Share premium Retained profits 1,100,000 90,000 540,200 1,000,000 80,000 613,200 200,000 200,000 5% Debentures 170,400 12,000 8,400 186,000 16,000 Current liabilities Creditors Accrued expenses Deposits from customers Current taxation Dividends payable 12,000 50,000 55,000 2,176,000 2,157,200 Rainbow Bhd. Profit and Loss Appropriation Account for the Year Ended 31. 12. Year 3 RM RM 613,200 92,000 705,200 Balance 31 December Year 2 Add: Net profit for the year 55,000 110,000 Less: Dividends Bonus issue (165,000) 540,200 Balance 31.12.Year3 Note on fixed assets: 31.12. Year3 Cost RM 208,400 100,400 91,200 Depr. RM 55,000 51,400 25,600 NBV RM 153,400 49,000 65,600 Plant and machinery Vehicles Furniture and fittings 31.12.Year2 Plant and machinery Vehicles Furniture and fittings 248,400 80,400 71,200 71,000 23,800 17,200 177,400 56,600 54,000 2. Additional information 1. During the year the company disposed of fully depreciated machinery which cost RM40,000, at a profit of RM2,000, On 11 Year 3 the company sold a piece of land that it purchased in March Year 3 at a cost of RM160,000 for a profit of RM9,600, 3. Long-term investments costing RM60,000 were sold at a profit of RM2,000. 4. The tax expense charged in the income statement for Year 3 was RM52,000. Net profit for the year includes income from investments of RM20,000 and interest 5. expense of RM10,000, The short-term investments were bought in November Year 3 and will be sold in 6. January Year 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started