Answered step by step

Verified Expert Solution

Question

1 Approved Answer

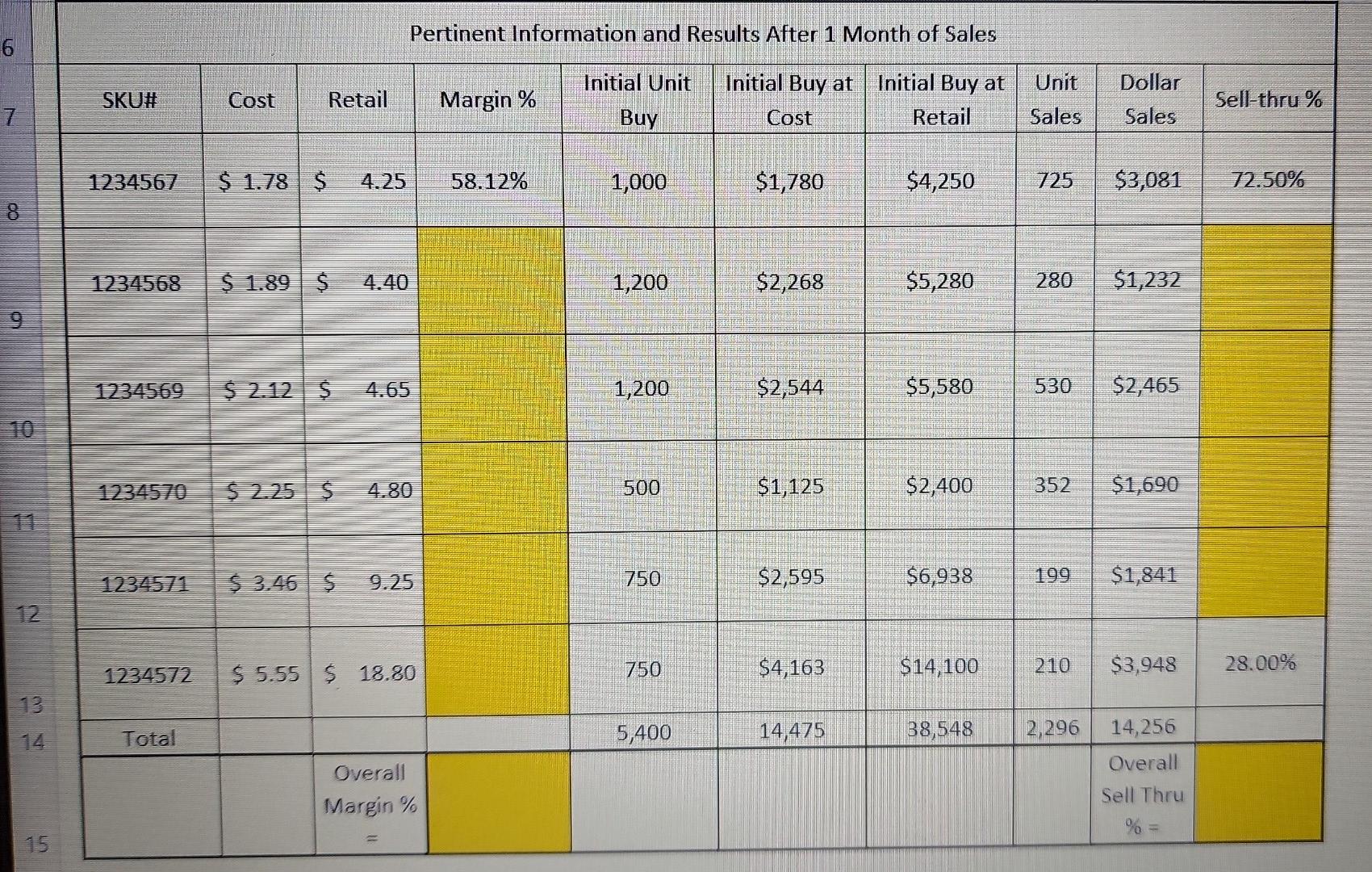

6 7 10 2 15 SKU# 1234567 1234568 1234569 1234570 1234571 1234572 Total Pertinent Information and Results After 1 Month of Sales Initial Buy at

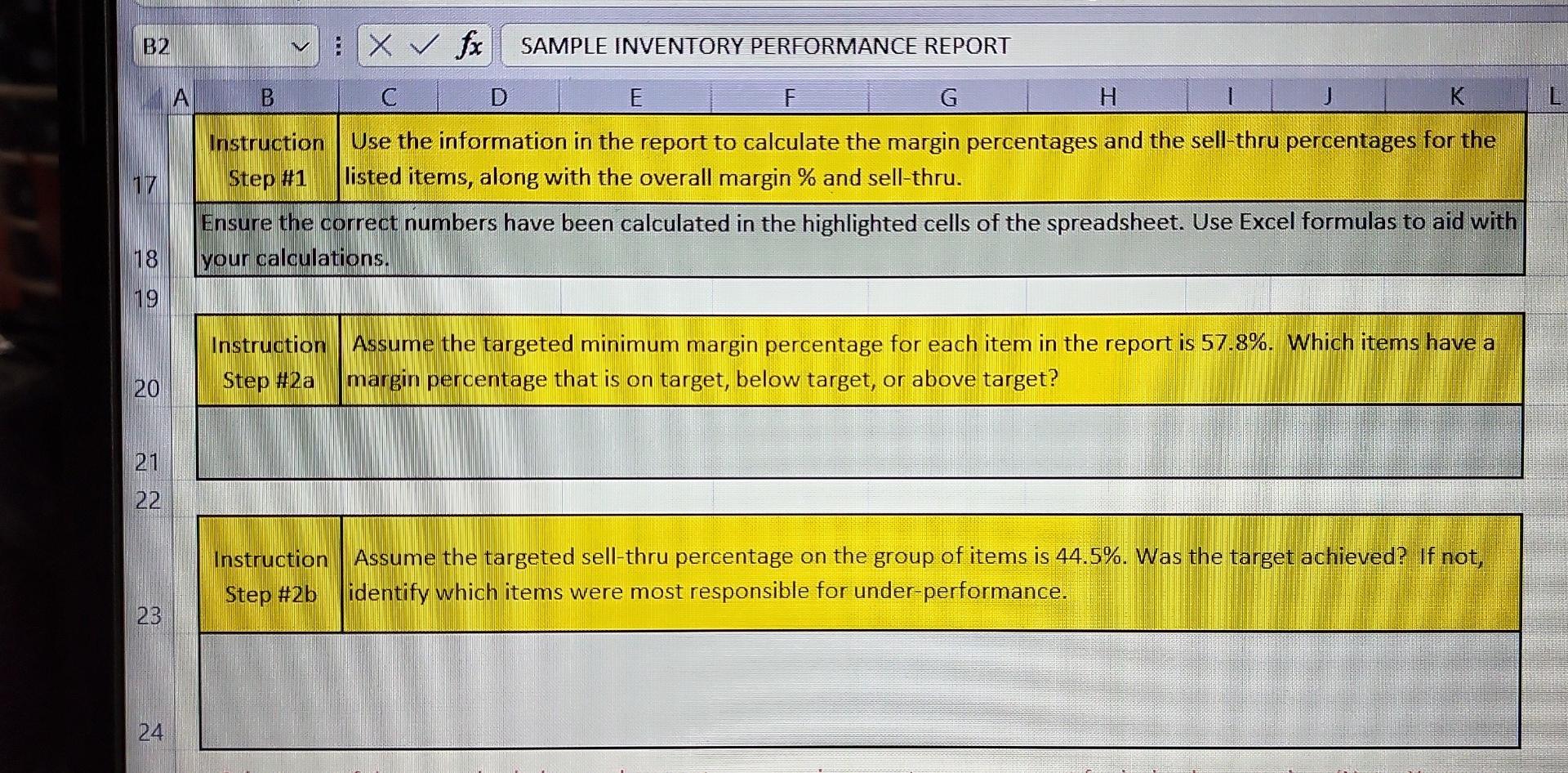

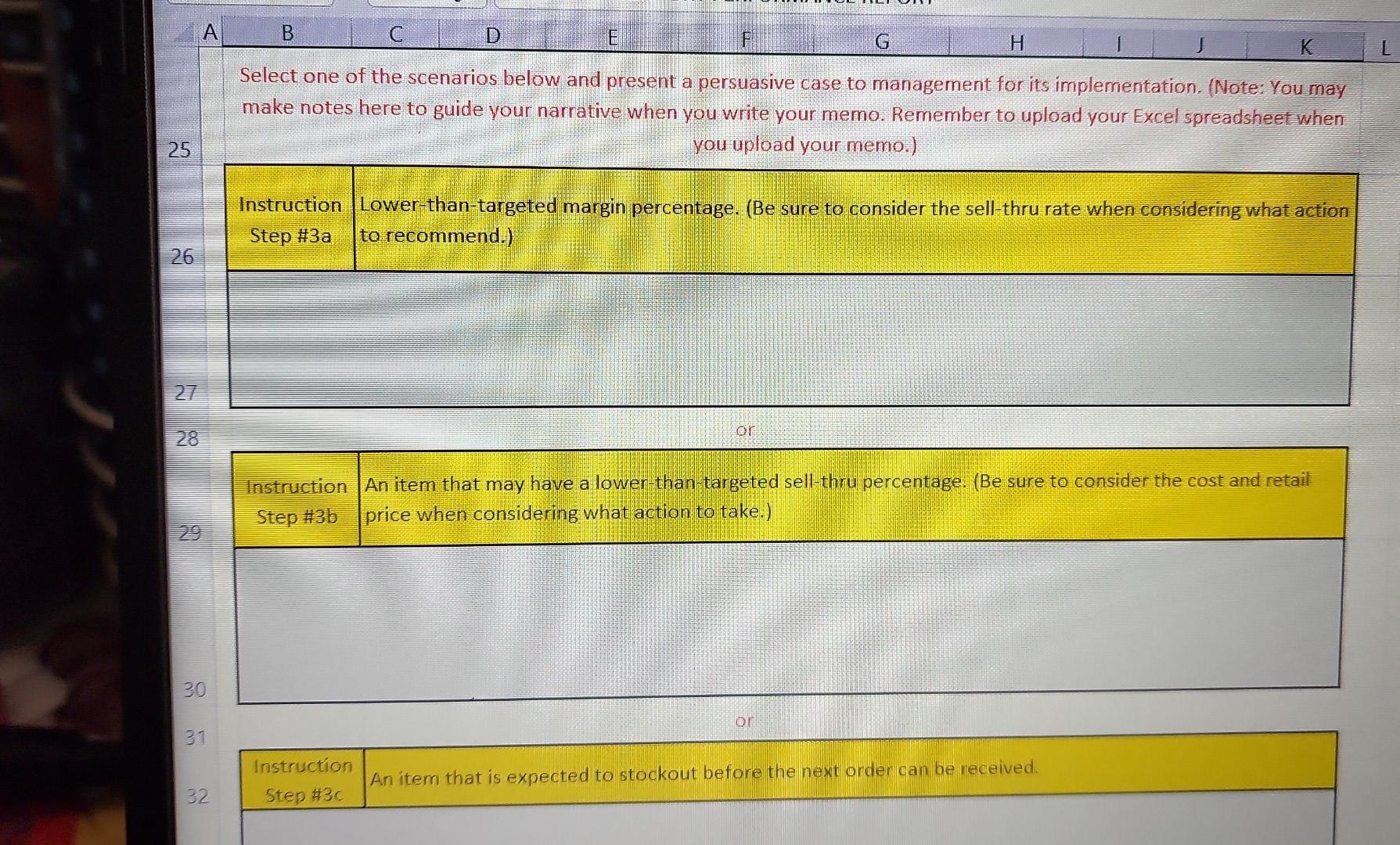

6 7 10 2 15 SKU# 1234567 1234568 1234569 1234570 1234571 1234572 Total Pertinent Information and Results After 1 Month of Sales Initial Buy at Initial Buy at Margin % Initial Unit Buy Cost Retail 58.12% 1,000 $1,780 $4,250 1,200 $2,268 $5,280 1,200 $2,544 $5,580 500 $1,125 $2,400 750 $2,595 $6,938 750 $4,163 $14,100 5,400 14,475 38,548 Cost Retail $ 1.78 $ 4.25 $ 1.89 $ 4.40 $ 2.12 $ 4.65 $ 2.25 $ 4.80 $ 3.46 $ 9.25 $5.55 $ 18.80 Overall Margin % Unit Dollar Sales Sales 725 $3,081 280 $1,232 530 $2,465 352 $1,690 199 $1,841 210 $3,948 2,296 14,256 Overall Sell Thru % = Sell-thru % 72.50% 28.00% X fx SAMPLE INVENTORY PERFORMANCE REPORT B C D E F G H 1 J K Instruction Use the information in the report to calculate the margin percentages and the sell-thru percentages for the Step #1 listed items, along with the overall margin % and sell-thru. Ensure the correct numbers have been calculated in the highlighted cells of the spreadsheet. Use Excel formulas to aid with your calculations. 18 19 Instruction Assume the targeted minimum margin percentage for each item in the report is 57.8%. Which items have a margin percentage that is on target, below target, or above target? 20 Step #2a 21 22 Instruction Assume the targeted sell-thru percentage on the group of items is 44.5%. Was the target achieved? If not, identify which items were most responsible for under-performance. Step #2b 23 B2 24 A A B C D E G H K L Select one of the scenarios below and present a persuasive case to management for its implementation. (Note: You may make notes here to guide your narrative when you write your memo. Remember to upload your Excel spreadsheet when you upload your memo.) 25 Instruction Step #3a Lower-than-targeted margin percentage. (Be sure to consider the sell-thru rate when considering what action to recommend.) Instruction Step #3b An item that may have a lower-than-targeted sell-thru percentage. (Be sure to consider the cost and retail price when considering what action to take.) or Instruction An item that is expected to stockout before the next order can be received. Step #3c 28 29 30 31 32 6 7 10 2 15 SKU# 1234567 1234568 1234569 1234570 1234571 1234572 Total Pertinent Information and Results After 1 Month of Sales Initial Buy at Initial Buy at Margin % Initial Unit Buy Cost Retail 58.12% 1,000 $1,780 $4,250 1,200 $2,268 $5,280 1,200 $2,544 $5,580 500 $1,125 $2,400 750 $2,595 $6,938 750 $4,163 $14,100 5,400 14,475 38,548 Cost Retail $ 1.78 $ 4.25 $ 1.89 $ 4.40 $ 2.12 $ 4.65 $ 2.25 $ 4.80 $ 3.46 $ 9.25 $5.55 $ 18.80 Overall Margin % Unit Dollar Sales Sales 725 $3,081 280 $1,232 530 $2,465 352 $1,690 199 $1,841 210 $3,948 2,296 14,256 Overall Sell Thru % = Sell-thru % 72.50% 28.00% X fx SAMPLE INVENTORY PERFORMANCE REPORT B C D E F G H 1 J K Instruction Use the information in the report to calculate the margin percentages and the sell-thru percentages for the Step #1 listed items, along with the overall margin % and sell-thru. Ensure the correct numbers have been calculated in the highlighted cells of the spreadsheet. Use Excel formulas to aid with your calculations. 18 19 Instruction Assume the targeted minimum margin percentage for each item in the report is 57.8%. Which items have a margin percentage that is on target, below target, or above target? 20 Step #2a 21 22 Instruction Assume the targeted sell-thru percentage on the group of items is 44.5%. Was the target achieved? If not, identify which items were most responsible for under-performance. Step #2b 23 B2 24 A A B C D E G H K L Select one of the scenarios below and present a persuasive case to management for its implementation. (Note: You may make notes here to guide your narrative when you write your memo. Remember to upload your Excel spreadsheet when you upload your memo.) 25 Instruction Step #3a Lower-than-targeted margin percentage. (Be sure to consider the sell-thru rate when considering what action to recommend.) Instruction Step #3b An item that may have a lower-than-targeted sell-thru percentage. (Be sure to consider the cost and retail price when considering what action to take.) or Instruction An item that is expected to stockout before the next order can be received. Step #3c 28 29 30 31 32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started