Question

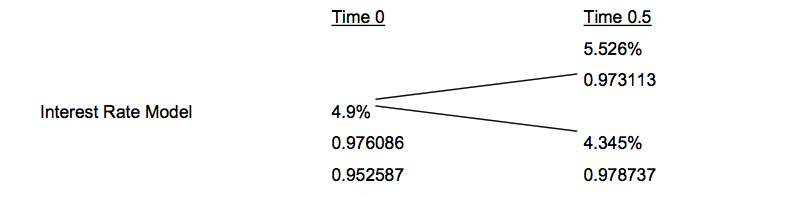

6) Assume all rates are annualized with semi-annual compounding. Use the interest rate tree below. The first number at each node is the 0.5-year rate

6) Assume all rates are annualized with semi-annual compounding.

Use the interest rate tree below. The first number at each node is the 0.5-year rate at that node. The next number is the price of $1 par of a 0.5-year zero at that node. The next number, at the time 0 node, is the price of $1 par of a 1-year zero.

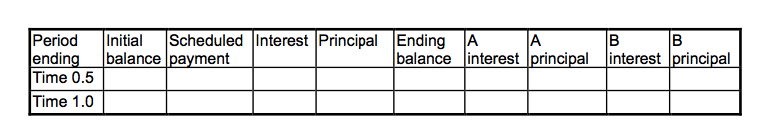

Consider a 1-year semi-annual pay mortgage with a semi-annual mortgage rate of 5% and initial principal balance of $10,000. The mortgage is divided into two sequential pay tranches. Tranche A receives the first $5000 of principal, tranche B receives the next $5000 of principal, and both tranches receive interest on their outstanding principal each period.

a) Fill in the amortization schedule for the mortgage in the table below, assuming no prepayment.

b) Assuming that there are no prepayments, what is the value of

(i) the whole mortgage?

(ii) tranche A?

(iii) tranche B?

c) Suppose the mortgagor can pay off the mortgage on any payment date by paying the remaining principal balance. Assuming the mortgagor follows a prepayment policy that minimizes the value of the mortgage, determine the value of the whole mortgage

d)

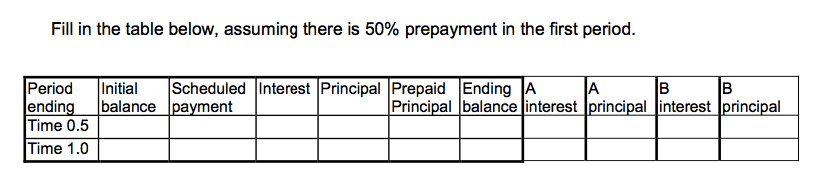

Suppose the mortgage above is in fact a pool of mortgages, and it is known that at time 0.5, exactly half of mortgages will prepay in full, regardless of the level of interest rates. In other words, suppose there is a 50% prepayment rate in the first period with certainty. Again, the pool is divided into two sequential pay tranches. Tranche A receives the first $5000 of principal, tranche B receives the next $5000 of principal, and both tranches receive interest on their outstanding principal each period.

Fill in the table below, assuming there is 50% prepayment in the first period.

What is the time 0 value of (i) the whole mortgage? (ii) tranche A? (iii) tranche B?

Fill in the table below, assuming there is 50% prepayment in the first period. Fill in the table below, assuming there is 50% prepayment in the first period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started