Answered step by step

Verified Expert Solution

Question

1 Approved Answer

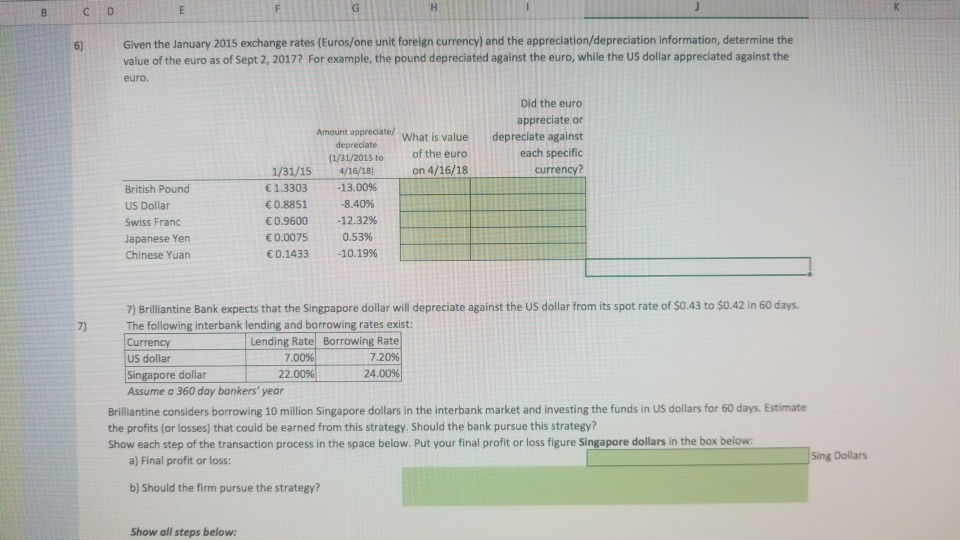

6) Given the January 2015 exchange rates (Euros/one unit foreign currency) and the appreciation/depreciation information, determine the value of the euro as of Sept 2,

6) Given the January 2015 exchange rates (Euros/one unit foreign currency) and the appreciation/depreciation information, determine the value of the euro as of Sept 2, 2017? For example, the pound depreciated against the euro, while the US dollar appreciated against the euro. Did the euro appreciate or depreciate against each specific Amount appreciate/ What is value depreciate of the euro on 4/16/18 (1/31/2015 to British Pound US Dollar Swiss Franc Japanese Yen Chinese Yuan 1/31/15 4/16/18) 1.3303-13.00% 0.8851-8.40% 0.9600-12.32% 0.0075 0.53% 0.1433-10.19% 7) Brilliantine Bank expects that the Singpapore dollar will depreciate against the US dollar from its spot rate of $0.43 to $0.42 in 60 days The following interbank lending and borrowing rates exist Currency US dollar Singapore dollar Assume a 360 day bankers' year 7) Lending Rate Borrowing Rate 7,20% 24 00% 7.00% Brilliantine considers borrowing 10 million Singapore dollars in the interbank market and investing the funds in US dollars for 60 days. Estimate the profits (or losses) that could be earned from this strategy. Should the bank pursue this strategy? Show each step of the transaction process in the space below. Put your final profit or loss figure Singapore dollars in the box below a) Final profit or loss: Sing Dollars b) Should the firm pursue the strategy? Show all steps below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started