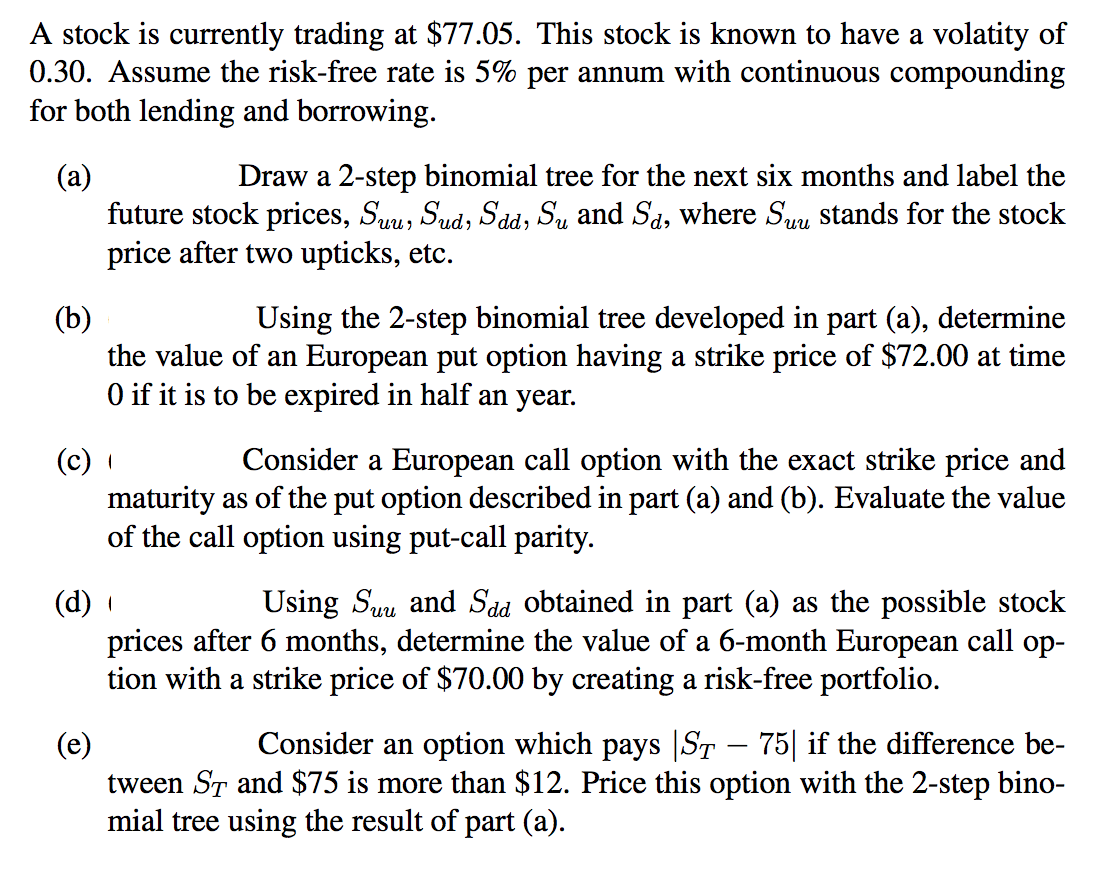

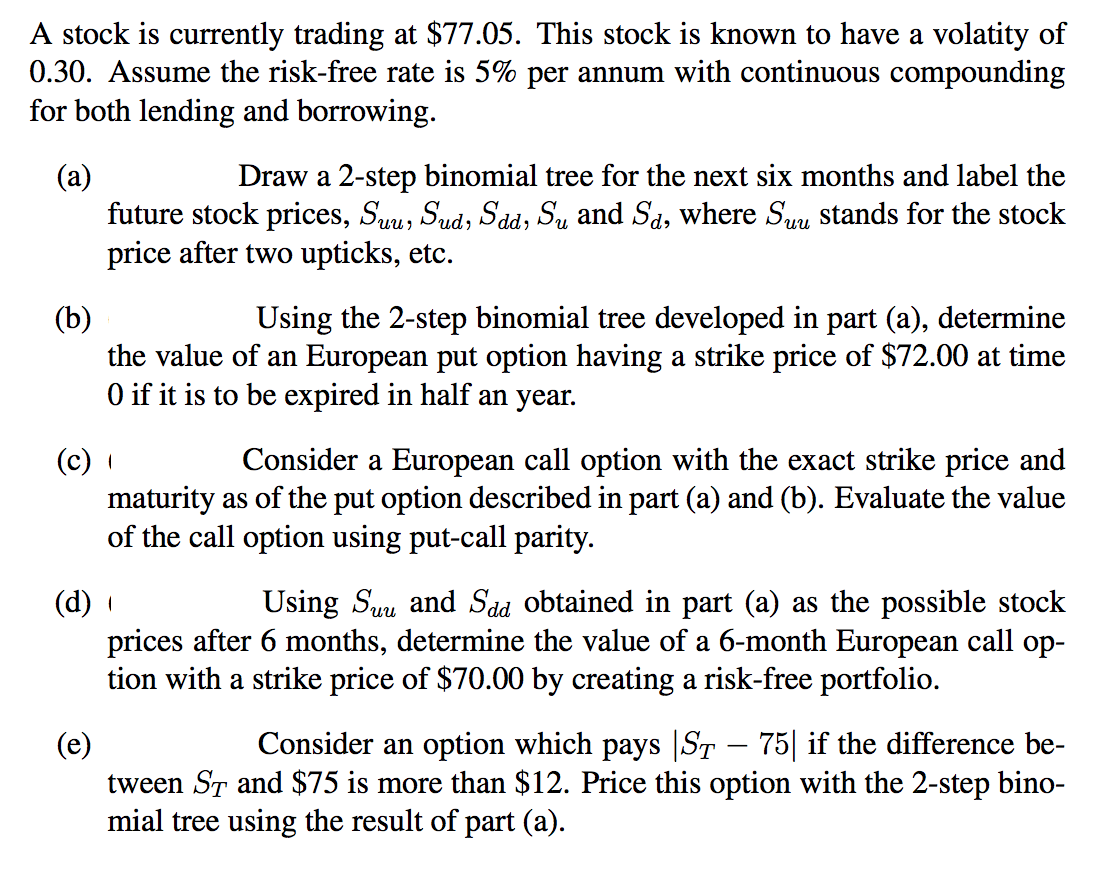

A stock is currently trading at $77.05. This stock is known to have a volatity of 0.30. Assume the risk-free rate is 5% per annum with continuous compounding for both lending and borrowing. Draw a 2-step binomial tree for the next six months and label the future stock prices, Suu, Sud, Sad, Su and Sd, where Suu stands for the stock price after two upticks, etc. (b) Using the 2-step binomial tree developed in part (a), determine the value of an European put option having a strike price of $72.00 at time O if it is to be expired in half an year. (c) Consider a European call option with the exact strike price and maturity as of the put option described in part (a) and (b). Evaluate the value of the call option using put-call parity. (d) Using Sur and Sad obtained in part (a) as the possible stock prices after 6 months, determine the value of a 6-month European call op- tion with a strike price of $70.00 by creating a risk-free portfolio. (e) Consider an option which pays ST 75| if the difference be- tween St and $75 is more than $12. Price this option with the 2-step bino- mial tree using the result of part (a). A stock is currently trading at $77.05. This stock is known to have a volatity of 0.30. Assume the risk-free rate is 5% per annum with continuous compounding for both lending and borrowing. Draw a 2-step binomial tree for the next six months and label the future stock prices, Suu, Sud, Sad, Su and Sd, where Suu stands for the stock price after two upticks, etc. (b) Using the 2-step binomial tree developed in part (a), determine the value of an European put option having a strike price of $72.00 at time O if it is to be expired in half an year. (c) Consider a European call option with the exact strike price and maturity as of the put option described in part (a) and (b). Evaluate the value of the call option using put-call parity. (d) Using Sur and Sad obtained in part (a) as the possible stock prices after 6 months, determine the value of a 6-month European call op- tion with a strike price of $70.00 by creating a risk-free portfolio. (e) Consider an option which pays ST 75| if the difference be- tween St and $75 is more than $12. Price this option with the 2-step bino- mial tree using the result of part (a)