Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 MCQ'S only answers needed An aging of a company's accounts receivable indicates that $4,200 is estimated to be uncollectible. If Allowance for Doubtful Accounts

6 MCQ'S only answers needed

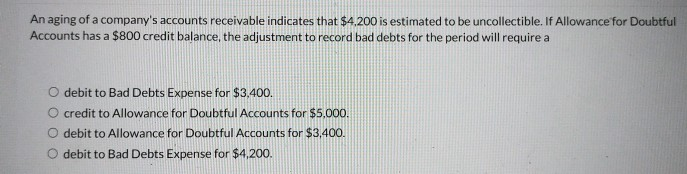

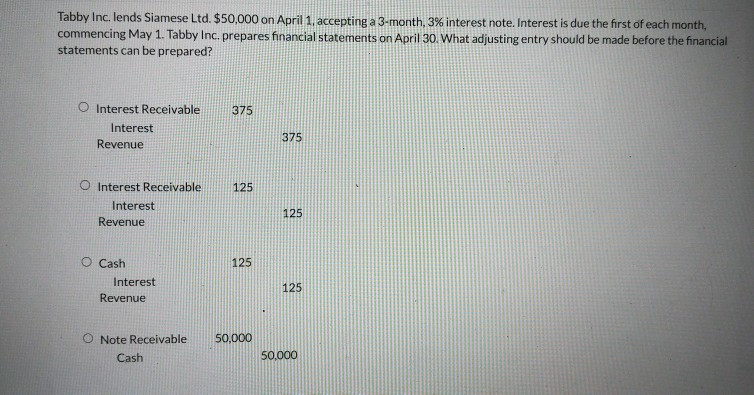

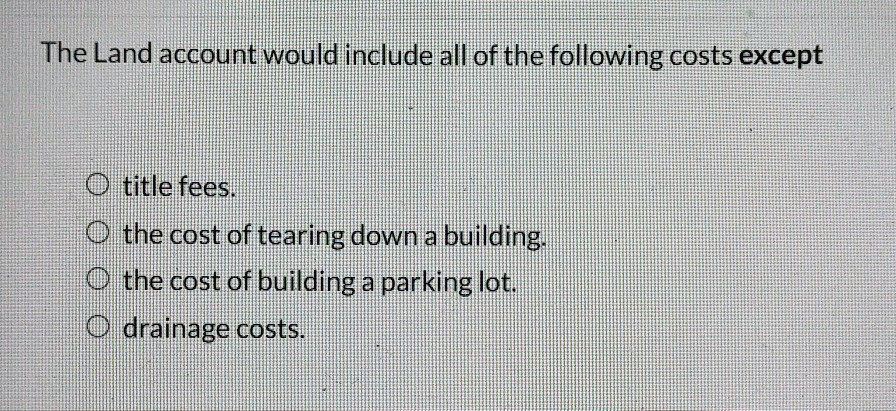

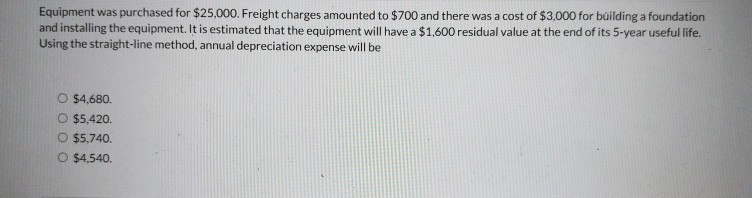

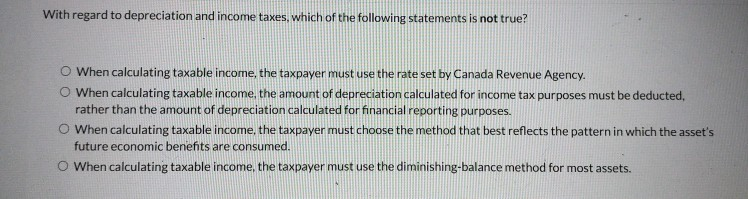

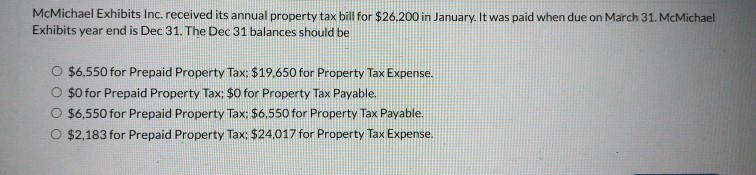

An aging of a company's accounts receivable indicates that $4,200 is estimated to be uncollectible. If Allowance for Doubtful Accounts has a $800 credit balance, the adjustment to record bad debts for the period will require a Odebit to Bad Debts Expense for $3,400. O credit to Allowance for Doubtful Accounts for $5,000. O debit to Allowance for Doubtful Accounts for $3,400. O debit to Bad Debts Expense for $4,200. Tabby Inc. lends Siamese Ltd. $50,000 on April 1, accepting a 3-month, 3% interest note. Interest is due the first of each month, commencing May 1. Tabby Inc. prepares financial statements on April 30. What adjusting entry should be made before the financial statements can be prepared? 375 O Interest Receivable Interest Revenue 375 125 Interest Receivable Interest Revenue 125 125 O Cash Interest Revenue 125 50,000 Note Receivable Cash 50,000 The Land account would include all of the following costs except O title fees. o the cost of tearing down a building, o the cost of building a parking lot. O drainage costs. Equipment was purchased for $25,000. Freight charges amounted to $700 and there was a cost of $3,000 for building a foundation and installing the equipment. It is estimated that the equipment will have a $1,600 residual value at the end of its 5-year useful life. Using the straight-line method, annual depreciation expense will be O $4.680 O $5,420. O $5,740 $4,540. With regard to depreciation and income taxes, which of the following statements is not true? O When calculating taxable income, the taxpayer must use the rate set by Canada Revenue Agency. O When calculating taxable income the amount of depreciation calculated for income tax purposes must be deducted, rather than the amount of depreciation calculated for financial reporting purposes. O When calculating taxable income, the taxpayer must choose the method that best reflects the pattern in which the asset's future economic benefits are consumed. When calculating taxable income, the taxpayer must use the diminishing-balance method for most assets. McMichael Exhibits Inc. received its annual property tax bill for $26,200 in January. It was paid when due on March 31. McMichael Exhibits year end is Dec 31. The Dec 31 balances should be O $6,550 for Prepaid Property Tax: $19.650 for Property Tax Expense. $0 for Prepaid Property Tax: $0 for Property Tax Payable. O $6,550 for Prepaid Property Tax: $6,550 for Property Tax Payable. O $2,183 for Prepaid Property Tax: $24.017 for Property Tax ExpenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started