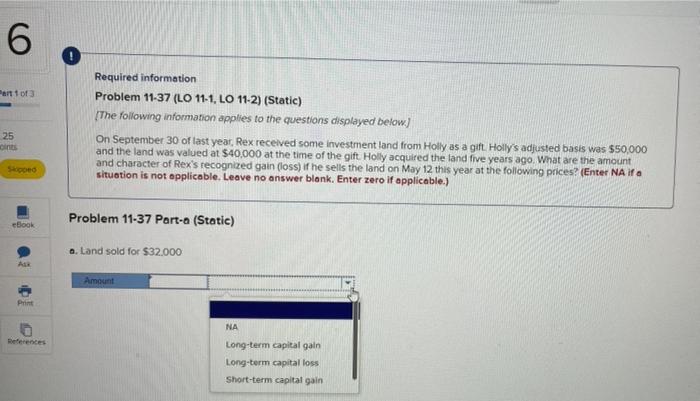

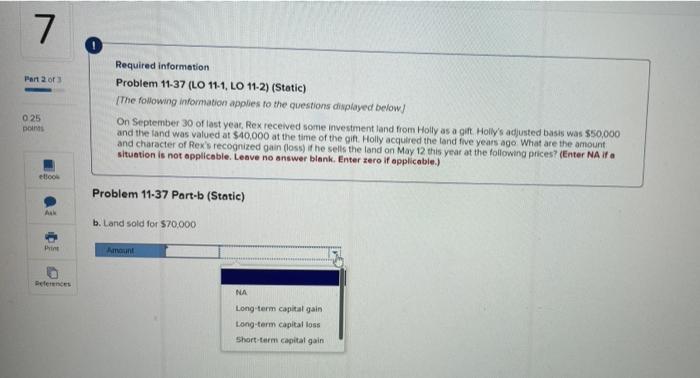

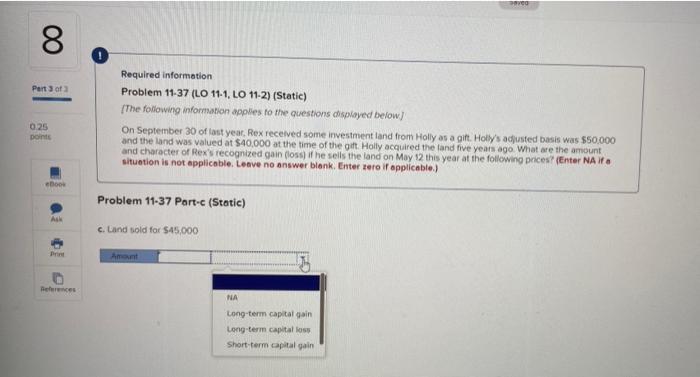

6 Part 1 of 3 Required information Problem 11-37 (LO 11-1, LO 11-2) (Static) The following information applies to the questions displayed below) On September 30 of last year, Rex received some investment land from Holly as a gift Holly's adjusted basis was $50,000 and the land was valued at $40,000 at the time of the gift Holly acquired the land five years ago What are the amount and character of Rex's recognized gain (loss) if he sells the land on May 12 this year at the following prices? (Enter NA if a situation is not applicable. Leave no answer blank. Enter zero if applicable.) 25 ins Problem 11-37 Part-a (Static) eBook a. Land sold for $32.000 Amount Print NA lo Long-term capital gain Long-term capital loss Short-term capital gain 7 Part 2 or Required information Problem 11-37 (LO 11-1, LO 11-2) (Static) The following information applies to the questions displayed below! On September 30 of last year, Rex received some investment and from Holly as a gift. Holly's adjusted basis was $50,000 and the land was valued at $40,000 at the time of the gift Holly acquired the land five years ago What are the amount and character of Rex's recognized gain (los) if he sells the land on May 12 this year at the following prices? (Enter NA ita situation is not applicable. Leave no answer blank. Enter zero if applicable) 025 pois Problem 11-37 Part-b (Static) b. Land sold for $70,000 Print References NA Long-term capital gain Long term capital loss Short-term capital gain 0 Part 3 of 3 Required information Problem 11-37 (LO 11-1, LO 11-2) (Static) [The following information applies to the questions prayed below) On September 30 of last year, Rex received some investment and from Holly as a gift. Holy's adjusted basis was $50,000 and the land was valued at $40,000 at the time of the gift. Holly acquired the land five years ago What are the amount and character of Rex's recognized gain (loss) if he sells the land on May 12 this year at the following prices? (Enter NA situation is not applicable. Leave no answer blank. Enter vero if applicable) 0.25 points . Problem 11-37 Part-c (Static) Ask c. Land sold for $45,000 10 Print Anant rences NA Long-term capital gain Long-term capital loss Short-term capital gain