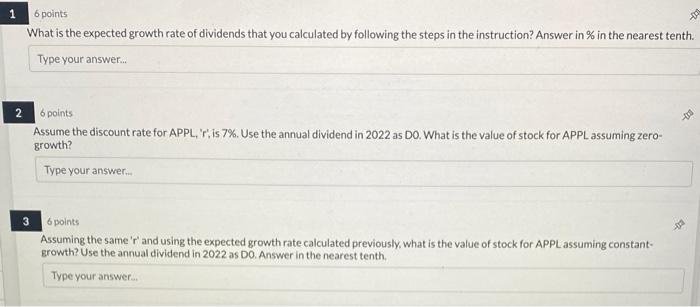

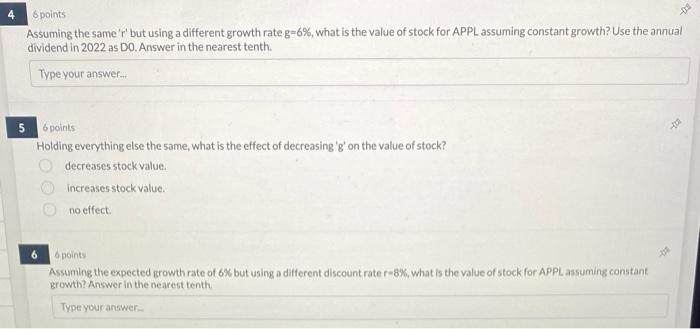

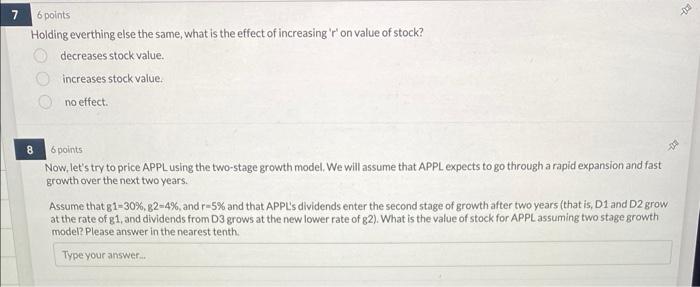

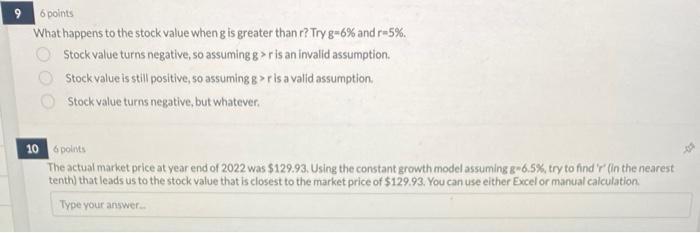

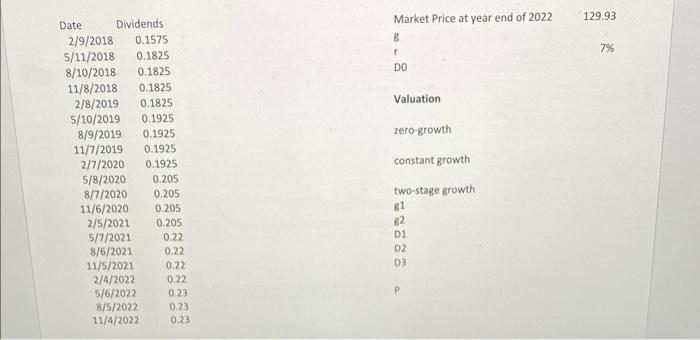

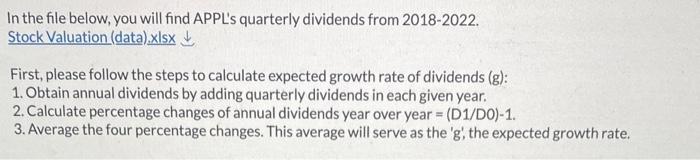

6 points What is the expected growth rate of dividends that you calculated by following the steps in the instruction? Answer in % in the nearest tenth Type your answer... 6 points Assume the discount rate for APPL, 'r', is 7\%. Use the annual dividend in 2022 as DO. What is the value of stock for APPL assuming zerogrowth? 6 points Assuming the same 'r' and using the expected growth rate calculated previously, what is the value of stock for APPL assuming constantgrowth? Use the annual dividend in 2022 as DO. Answer in the nearest tenth. o poincs Assuming the same ' r ' but using a different growth rate g=6%, what is the value of stock for APPL assuming constant growth? Use the annual dividend in 2022 as D0. Answer in the nearest tenth. Type your answer.- 6 points Holding everything else the same, what is the effect of decreasing ' g ' on the value of stock? decreases stock value. increases stock value. no effect. 6 opoints Assuming the expected growth rate of 6% but using a different discount rate r=8%, what is the value of stock for APPL assuming constant growth? Answer in the nearest tenth Type your answer- Holding everthing else the same, what is the effect of increasing ' r ' on value of stock? decreases stock value. increases stock value. no effect. 8 points Now, let's try to price APPL using the two-stage growth model. We will assume that APPL expects to go through a rapid expansion and fast growth over the next two years. Assume that 81=30%,82=4%, and r=5% and that APPL's dividends enter the second stage of growthafter two years (that is, D1 and D2 grow at the rate of g1, and dividends from D3 grows at the new lower rate of g2). What is the value of stock for APPL assuming two stage growth model? Please answer in the nearest tenth. 6 points What happens to the stock value when g is greater than r ? Try g=6% and r=5%. Stock value turns negative, so assuming g>r is an invalid assumption. Stock value is still positive, so assuming g>r is a valid assumption. Stock value turns negative, but whatever. 6 bolints The actual market price at year end of 2022 was $129.93. Using the constant growth model assuming g* 6.5%, try to find ' r ' (in the nearest tenth) that leads us to the stock value that is closest to the market price of $129.93. You can use either Excel or manual calculation Type your answer.- \begin{tabular}{rr} \multicolumn{1}{c}{ Date Dividends } \\ 2/9/2018 & 0.1575 \\ 5/11/2018 & 0.1825 \\ 8/10/2018 & 0.1825 \\ 11/8/2018 & 0.1825 \\ 2/8/2019 & 0.1825 \\ 5/10/2019 & 0.1925 \\ 8/9/2019 & 0.1925 \\ 11/7/2019 & 0.1925 \\ 2/7/2020 & 0.1925 \\ 5/8/2020 & 0.205 \\ 8/7/2020 & 0.205 \\ 11/6/2020 & 0.205 \\ 2/5/2021 & 0.205 \\ 5/7/2021 & 0.22 \\ 8/6/2021 & 0.22 \\ 11/5/2021 & 0.22 \\ 2/4/2022 & 0.22 \\ 5/6/2022 & 0.23 \\ 8/5/2022 & 0.23 \\ 11/4/2022 & 0.23 \end{tabular} Market Price at year end of 2022129.93 7% Valuation zero-growth constant growth two-stage growth g1 g2 D1 D2 In the file below, you will find APPL's quarterly dividends from 2018-2022. Stock Valuation (data) .xIsx First, please follow the steps to calculate expected growth rate of dividends (g): 1. Obtain annual dividends by adding quarterly dividends in each given year. 2. Calculate percentage changes of annual dividends year over year = (D1/D0)-1. 3. Average the four percentage changes. This average will serve as the ' g ', the expected growth rate. 6 points What is the expected growth rate of dividends that you calculated by following the steps in the instruction? Answer in % in the nearest tenth Type your answer... 6 points Assume the discount rate for APPL, 'r', is 7\%. Use the annual dividend in 2022 as DO. What is the value of stock for APPL assuming zerogrowth? 6 points Assuming the same 'r' and using the expected growth rate calculated previously, what is the value of stock for APPL assuming constantgrowth? Use the annual dividend in 2022 as DO. Answer in the nearest tenth. o poincs Assuming the same ' r ' but using a different growth rate g=6%, what is the value of stock for APPL assuming constant growth? Use the annual dividend in 2022 as D0. Answer in the nearest tenth. Type your answer.- 6 points Holding everything else the same, what is the effect of decreasing ' g ' on the value of stock? decreases stock value. increases stock value. no effect. 6 opoints Assuming the expected growth rate of 6% but using a different discount rate r=8%, what is the value of stock for APPL assuming constant growth? Answer in the nearest tenth Type your answer- Holding everthing else the same, what is the effect of increasing ' r ' on value of stock? decreases stock value. increases stock value. no effect. 8 points Now, let's try to price APPL using the two-stage growth model. We will assume that APPL expects to go through a rapid expansion and fast growth over the next two years. Assume that 81=30%,82=4%, and r=5% and that APPL's dividends enter the second stage of growthafter two years (that is, D1 and D2 grow at the rate of g1, and dividends from D3 grows at the new lower rate of g2). What is the value of stock for APPL assuming two stage growth model? Please answer in the nearest tenth. 6 points What happens to the stock value when g is greater than r ? Try g=6% and r=5%. Stock value turns negative, so assuming g>r is an invalid assumption. Stock value is still positive, so assuming g>r is a valid assumption. Stock value turns negative, but whatever. 6 bolints The actual market price at year end of 2022 was $129.93. Using the constant growth model assuming g* 6.5%, try to find ' r ' (in the nearest tenth) that leads us to the stock value that is closest to the market price of $129.93. You can use either Excel or manual calculation Type your answer.- \begin{tabular}{rr} \multicolumn{1}{c}{ Date Dividends } \\ 2/9/2018 & 0.1575 \\ 5/11/2018 & 0.1825 \\ 8/10/2018 & 0.1825 \\ 11/8/2018 & 0.1825 \\ 2/8/2019 & 0.1825 \\ 5/10/2019 & 0.1925 \\ 8/9/2019 & 0.1925 \\ 11/7/2019 & 0.1925 \\ 2/7/2020 & 0.1925 \\ 5/8/2020 & 0.205 \\ 8/7/2020 & 0.205 \\ 11/6/2020 & 0.205 \\ 2/5/2021 & 0.205 \\ 5/7/2021 & 0.22 \\ 8/6/2021 & 0.22 \\ 11/5/2021 & 0.22 \\ 2/4/2022 & 0.22 \\ 5/6/2022 & 0.23 \\ 8/5/2022 & 0.23 \\ 11/4/2022 & 0.23 \end{tabular} Market Price at year end of 2022129.93 7% Valuation zero-growth constant growth two-stage growth g1 g2 D1 D2 In the file below, you will find APPL's quarterly dividends from 2018-2022. Stock Valuation (data) .xIsx First, please follow the steps to calculate expected growth rate of dividends (g): 1. Obtain annual dividends by adding quarterly dividends in each given year. 2. Calculate percentage changes of annual dividends year over year = (D1/D0)-1. 3. Average the four percentage changes. This average will serve as the ' g ', the expected growth rate