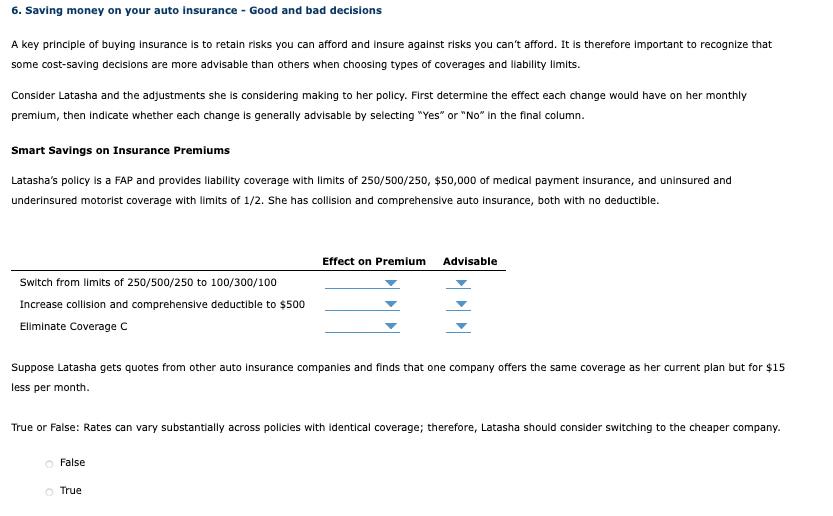

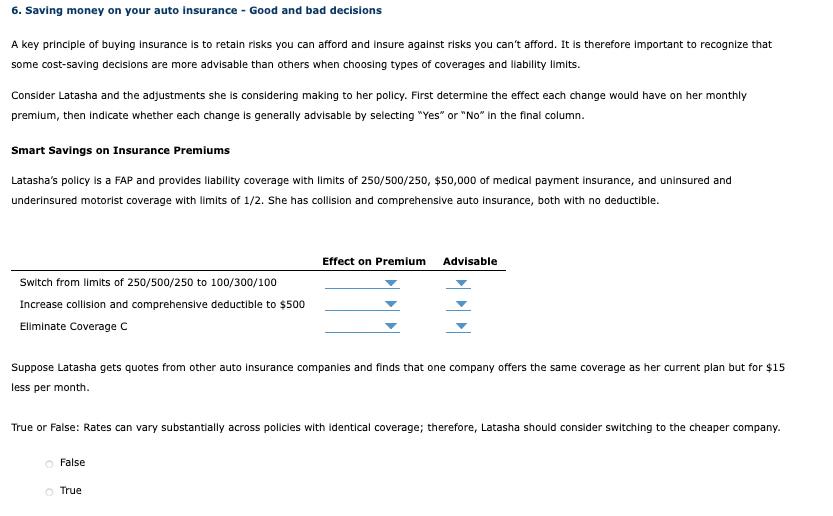

6. Saving money on your auto insurance - Good and bad decisions A key principle of buying Insurance is to retain risks you can afford and insure against risks you can't afford. It is therefore important to recognize that some cost-saving decisions are more advisable than others when choosing types of coverages and liability limits. Consider Latasha and the adjustments she is considering making to her policy. First determine the effect each change would have on her monthly premium, then indicate whether each change is generally advisable by selecting "Yes" or "No" in the final column. Smart Savings on Insurance Premiums Latasha's policy is a FAP and provides liability coverage with limits of 250/500/250, $50,000 of medical payment insurance, and uninsured and underinsured motorist coverage with limits of 1/2. She has collision and comprehensive auto Insurance, both with no deductible. Effect on Premium Advisable Switch from limits of 250/500/250 to 100/300/100 Increase collision and comprehensive deductible to $500 Eliminate Coverage Suppose Latasha gets quotes from other auto Insurance companies and finds that one company offers the same coverage as her current plan but for $15 less per month. True or False: Rates can vary substantially across policies with identical coverage; therefore, Latasha should consider switching to the cheaper company. False True 6. Saving money on your auto insurance - Good and bad decisions A key principle of buying Insurance is to retain risks you can afford and insure against risks you can't afford. It is therefore important to recognize that some cost-saving decisions are more advisable than others when choosing types of coverages and liability limits. Consider Latasha and the adjustments she is considering making to her policy. First determine the effect each change would have on her monthly premium, then indicate whether each change is generally advisable by selecting "Yes" or "No" in the final column. Smart Savings on Insurance Premiums Latasha's policy is a FAP and provides liability coverage with limits of 250/500/250, $50,000 of medical payment insurance, and uninsured and underinsured motorist coverage with limits of 1/2. She has collision and comprehensive auto Insurance, both with no deductible. Effect on Premium Advisable Switch from limits of 250/500/250 to 100/300/100 Increase collision and comprehensive deductible to $500 Eliminate Coverage Suppose Latasha gets quotes from other auto Insurance companies and finds that one company offers the same coverage as her current plan but for $15 less per month. True or False: Rates can vary substantially across policies with identical coverage; therefore, Latasha should consider switching to the cheaper company. False True