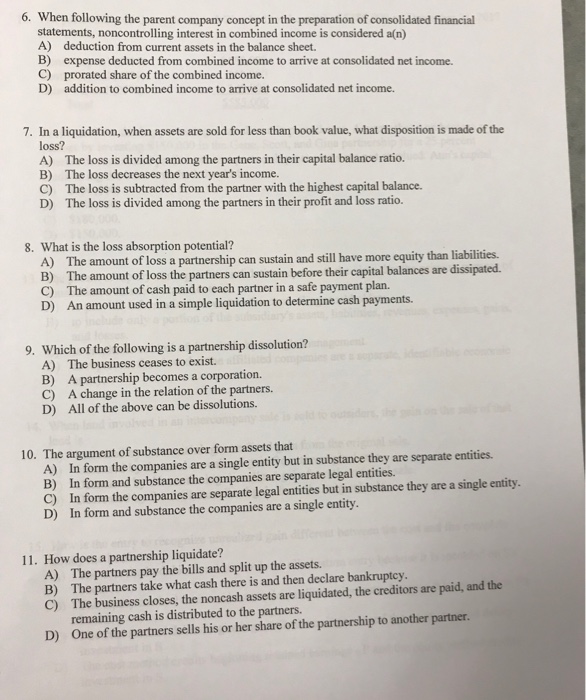

6. When following the parent company concept in the preparation of consolidated financial statements, noncontrolling interest in combined income is considered a(n) A) deduction from current assets in the balance sheet B) expense deducted from combined income to arrive at consolidated net income. C) prorated share of the combined income. D) addition to combined income to arrive at consolidated net income. 7. In a liquidation, when assets are sold for less than book value, what disposition is made of the loss? A) The loss is divided among the partners in their capital balance ratio. B) The loss decreases the next year's income. C) The loss is subtracted from the partner with the highest capital balance. D) The loss is divided among the partners in their profit and loss ratio. 8. What is the loss absorption potential? A) The amount of loss a partnership can sustain and still have more equity than liabilities. The amount of loss the partners can sustain before their capital balances are dissipated. B) C) The amount of cash paid to each partner in a safe payment plan. D) An amount used in a simple liquidation to determine cash payments. Which of the following is a partnership dissolution? A) B) C) D) 9. The business ceases to exist. A partnership becomes a corporation. A change in the relation of the partners. All of the above can be dissolutions. 10. The argument of substance over form assets that A) In form the companies are a single entity but in substance they are separate entities. B) In form and substance the companies are separate legal entities. C) In form the companies are separate legal entities but in substance they are a single entity. D) In form and substance the companies are a single entity. How does a partnership liquidate? A) The partners pay the bills and split up the assets. B) The partners take what cash there is and then declare bankruptcy C) The business closes, the noncash assets are liquidated, the creditors are paid, and the 11. remaining cash is distributed to the partners. D) One of the partners sells his or her share of the partnership to another partner