Question

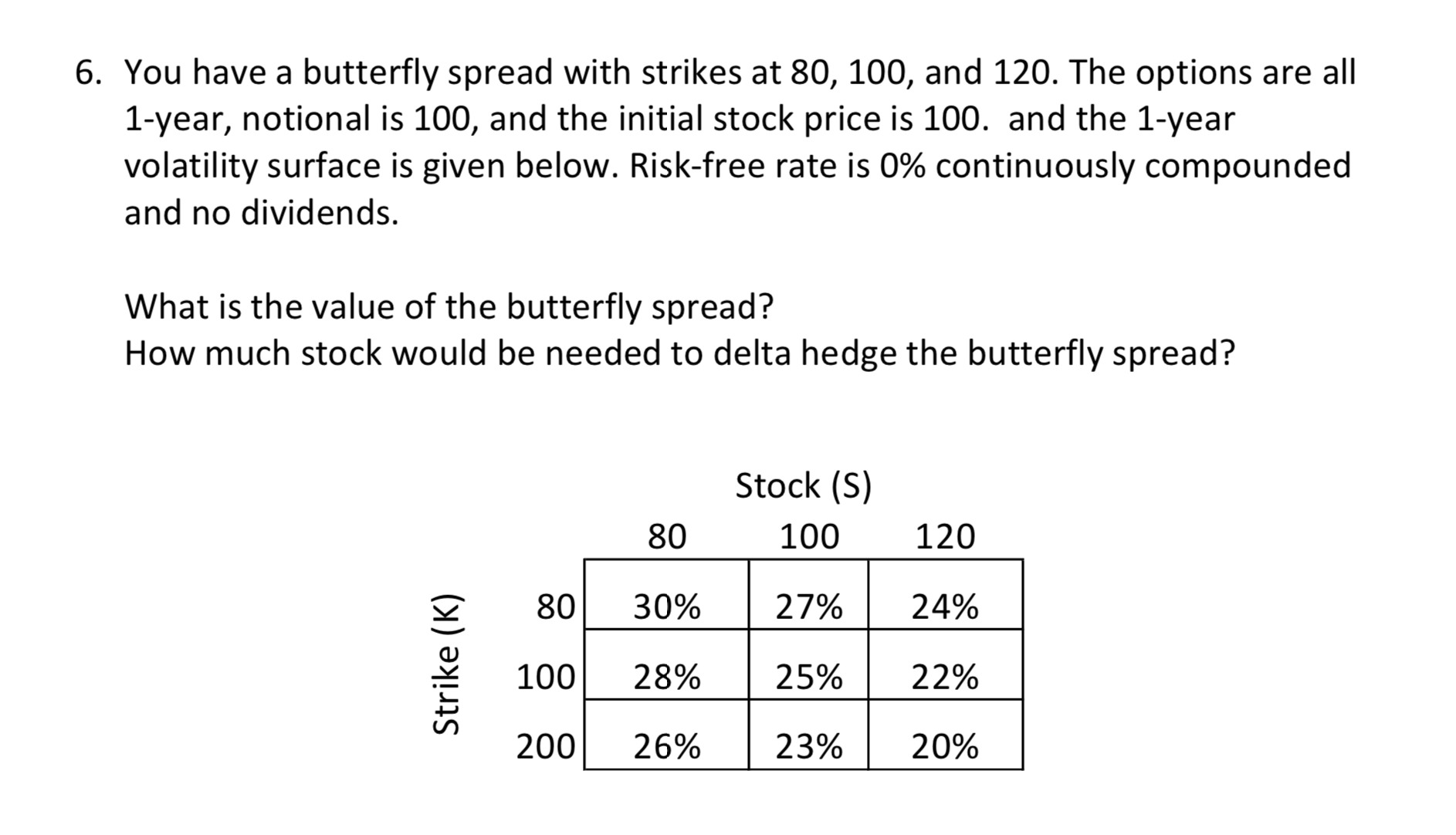

6. You have a butterfly spread with strikes at 80, 100, and 120. The options are all 1-year, notional is 100, and the initial

6. You have a butterfly spread with strikes at 80, 100, and 120. The options are all 1-year, notional is 100, and the initial stock price is 100. and the 1-year volatility surface is given below. Risk-free rate is 0% continuously compounded and no dividends. What is the value of the butterfly spread? How much stock would be needed to delta hedge the butterfly spread? Strike (K) 80 100 200 80 30% 28% 26% Stock (S) 100 120 27% 24% 25% 22% 23% 20%

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the butterfly spread we need to determine the prices of the individual options at each strike price and apply the appropriate weights The butterfly spread consists of buying ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Market Practice In Financial Modelling

Authors: Tan Chia Chiang

1st Edition

9814366544, 978-9814366540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App