Answered step by step

Verified Expert Solution

Question

1 Approved Answer

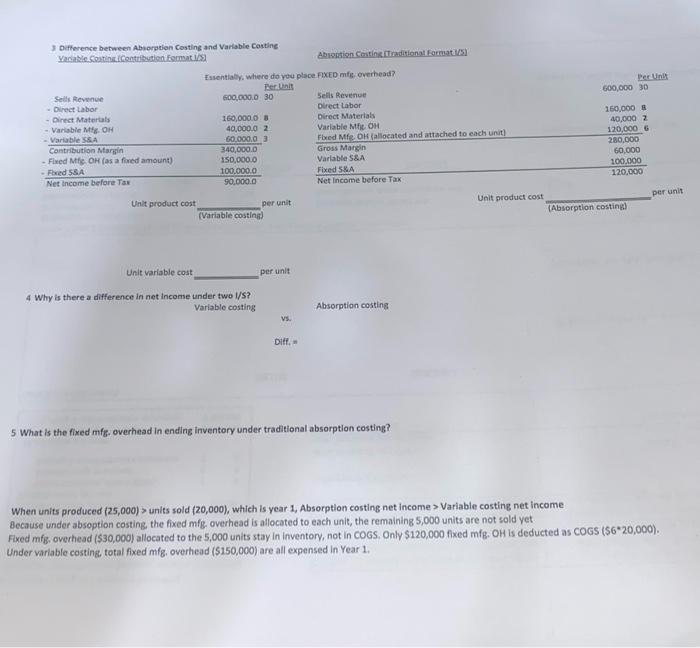

600,000.0 30 160,000.0 8 3 Difference between Absorption Costing and Variable Costing Vadable Coating (Contribution Format 1/5) Sells Revenue -Direct Labor Direct Materials Absoption

600,000.0 30 160,000.0 8 3 Difference between Absorption Costing and Variable Costing Vadable Coating (Contribution Format 1/5) Sells Revenue -Direct Labor Direct Materials Absoption Costing (Traditional Format 1/5) Essentially, where do you place FIXED mfg overhead? Per Unit Sells Revenue Direct Labor Per Unit 600,000 30 Direct Materials 160,000 8 -Variable Mfg. OH 40,000.0 2 Variable Mfg. OH 40,000 2 - Variable S&A 60,000.0 3 Fixed Mfg, OH (allocated and attached to each unit) 120,000 6 Contribution Margin 340,000.0 Gross Margin 280,000 -Fixed Mfg. OH (as a fixed amount) 150,000.0 Variable S&A 60,000 -Fixed S&A 100,000.0 Fixed S&A 100,000 Net Income before Tax 90,000.0 Net Income before Tax 120,000 Unit product cost per unit Unit product cost per unit (Variable costing) (Absorption costing) Unit variable cost per unit 4 Why is there a difference in net income under two I/S? Variable costing Diff. Absorption costing 5 What is the fixed mfg. overhead in ending inventory under traditional absorption costing? When units produced (25,000) > units sold (20,000), which is year 1, Absorption costing net income > Variable costing net income Because under absoption costing, the fixed mfg. overhead is allocated to each unit, the remaining 5,000 units are not sold yet Fixed mfg. overhead ($30,000) allocated to the 5,000 units stay in inventory, not in COGS. Only $120,000 fixed mfg. OH is deducted as COGS ($6*20,000). Under variable costing, total fixed mfg, overhead ($150,000) are all expensed in Year 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started