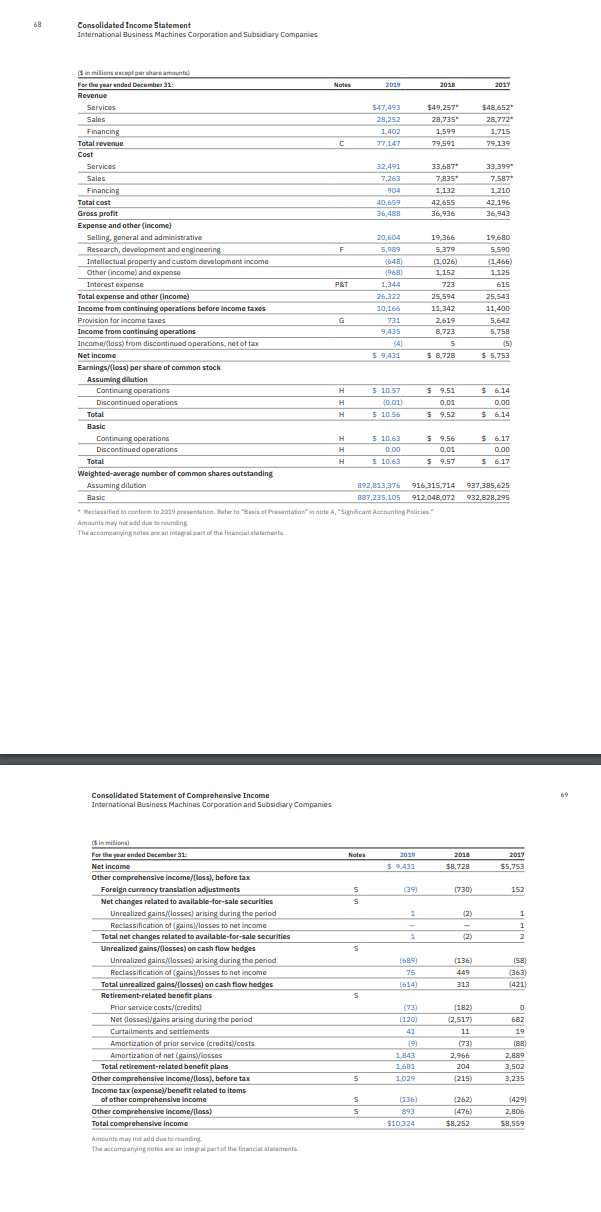

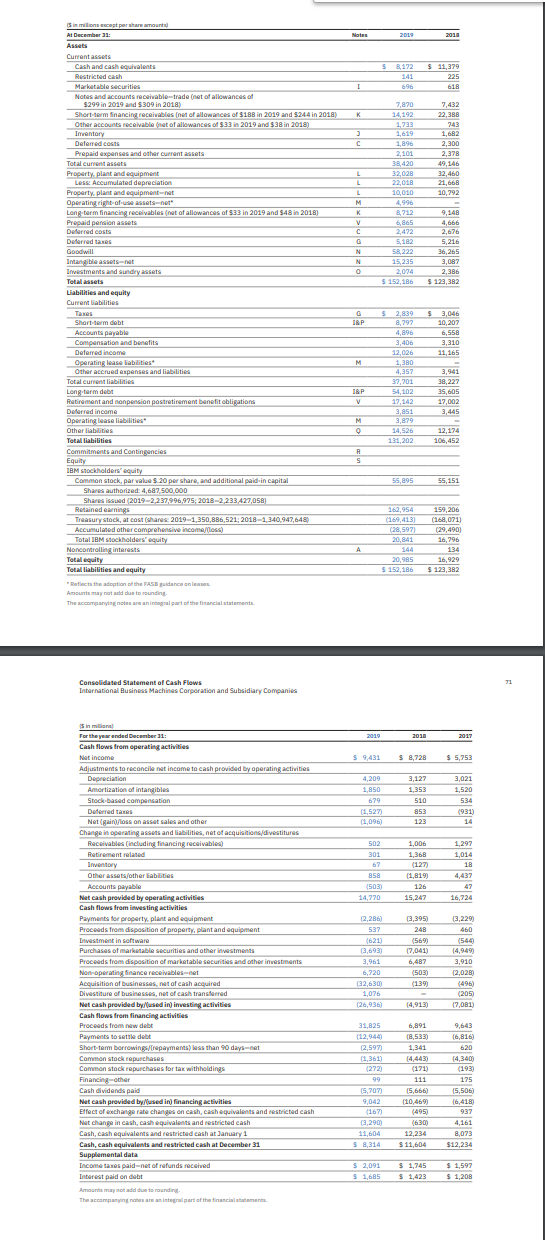

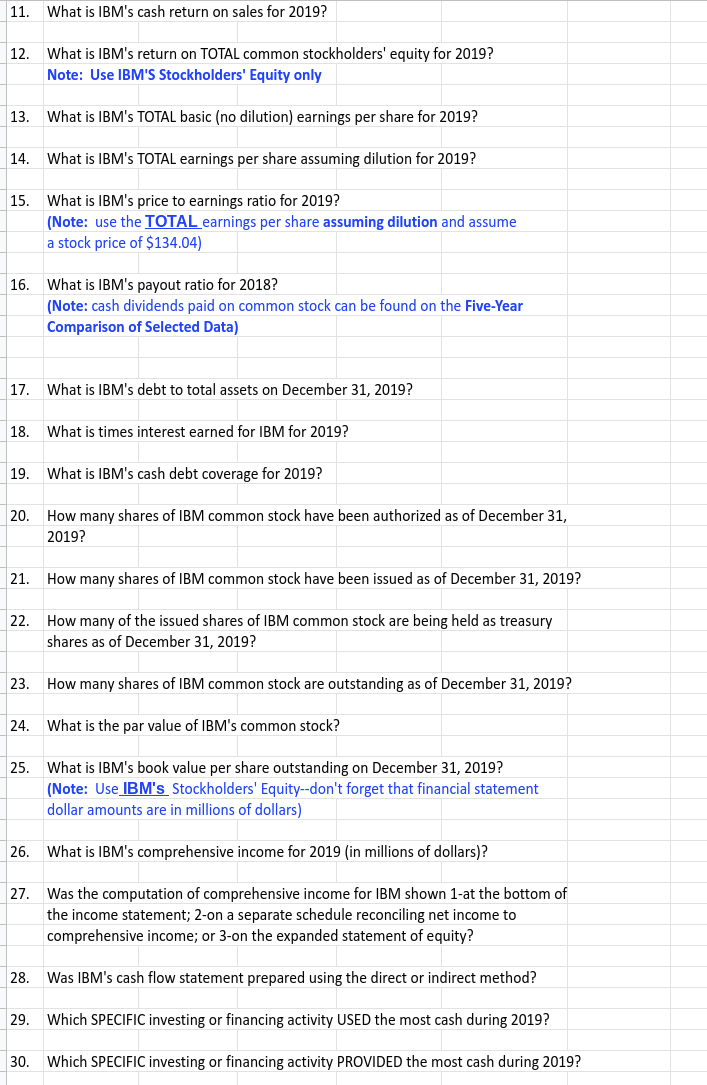

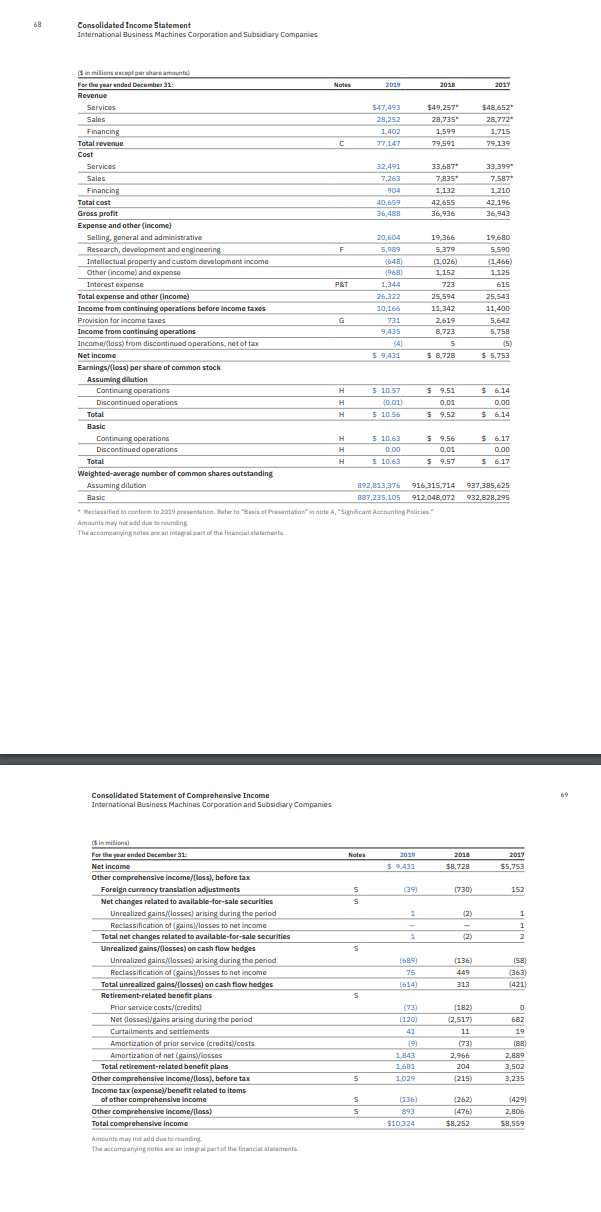

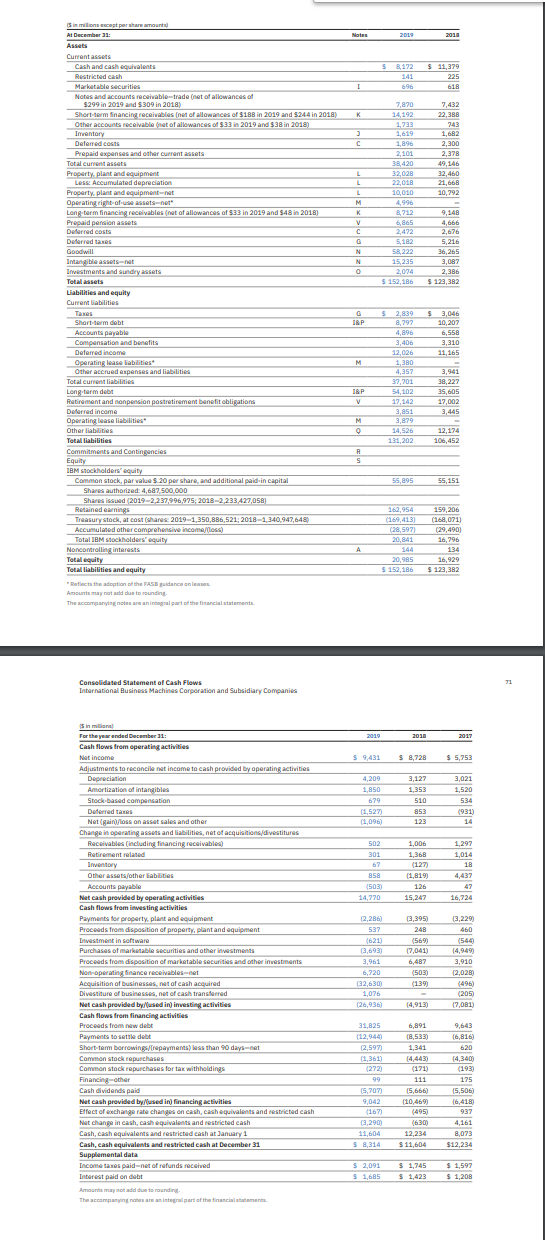

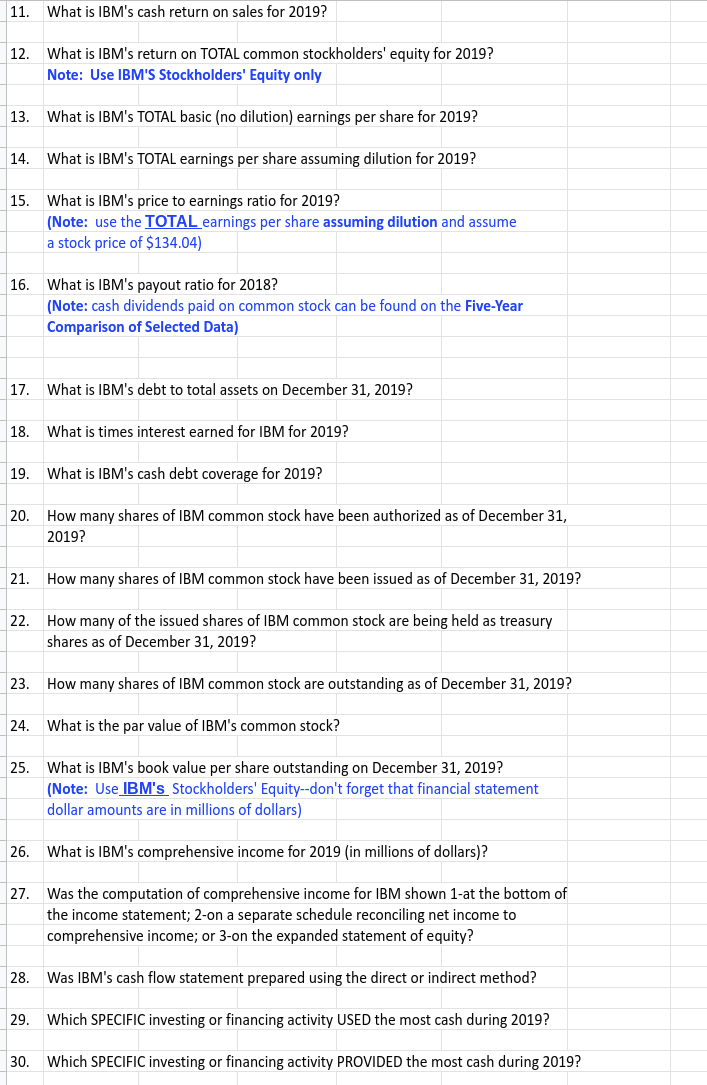

68 Consolidated Income Statement International Business Machines Corporation and Subsidiary Companies in millions oncept per she amounts) For the year ended December 31 2019 2015 2017 Revenue Services $47,493 $49,257 $48,652 Sales 28,252 28,735 28,772 Financing 1,402 1,599 1.715 Total revenue c 77,147 79,591 79,139 Cost Services 32,491 33,607 33 399 Sales 7.26 7,835 7.587 Financing 904 1,132 1.210 Total cost 40,659 42,655 42 196 Gross profit 36,488 36,936 36,943 Expense and other (Income) Selling, general and administrative 20,604 19,366 19,680 Research, development and engineering F 5,989 5.379 5.590 Intellectual property and custom development income (648 (1.026) (1.466) Other (income) and expense 1968) 1152 1125 Interest expense POT 1,344 723 615 Total expense and other (income) 26,322 25,594 25,543 Income from continuing operations before income taxes 10,166 11 342 11,400 Provision for income taxes G 731 2.619 Income from continuing operations 9,435 8,723 5,758 Income/loss) from discontinued operations, net of tax 4 5 (5) Net Income $ 9,431 $ 8,728 $ 5,753 Earnings/loss) per share of common stock Assuming dilution Continuing operations $ 10.57 $ 9.51 $ 614 Discontinued operations H (0.01) 0.01 0.00 Total $ 10.56 $ 9.52 $6.14 Basic Continuing operations $ 10.63 $ 9.56 $ 6.17 Discontinued operations 0.00 0.01 0.00 Total $ 10.63 $ 9.57 $ 6.17 Weighted-average number of common shares outstanding Assuming dilution 892,813,376 916,315,714 937,385,625 Basic 887,235,105 912,048,072 932,828,295 * Reclassified to conform to 2019 presentation. Refer to "Basis of Presentation in note A, "Significant Accounting Policies." Amounts may not add due to rounding The accompanying notes an integral part of the financial statements 69 Consolidated Statement of Comprehensive Income International Business Machines Corporation and Subsidiary Companies in milion Notes 2019 $ 9,431 2018 $8,728 2017 $5,753 s (39) (730) 152 S 1 1 1 1 1 2 s (136) (689) 75 (614) (58) (363 (421) 313 S For the year ended December 3 Net Income Other comprehensive income/Closs), before tax Foreign currency translation adjustments Net changes related to available for sale securities Unrealized gains/losses) arising during the period Reclassification of gains losses to net income Total net changes related to available-for-sale securities Unrealized gains/losses) on cash flow hedges Unrealized gains/losses) arising during the period Reclassification of (gains\/losses to net income Total unrealized gains/(losses) on cash flow hedges Retirement-related benefit plans Prior service costs/credits) Net (losses gains arising during the period Curtailments and settlements Amortization of prior service (credits/costs Amortization of net (gains/losses Total retirement-related benefit plans Other comprehensive income/(loss), before tax Income tax (expense/benefit related to items of other comprehensive income Other comprehensive Income/loss) Total comprehensive Income Amount may not add due to rounding The accompanying notes an integral part of the financial statements (73) (120) 41 41 (9) 1.843 1,681 1,029 (182) (2,517) 11 173) 2,966 204 682 19 (88) 2,889 3,502 3,235 s (215) S S (136) 893 $10.324 (262) (476) $8,252 (429) 2,806 $8,559 BOSNN of 533 in 2010 and $48 in 2018 a mama RUSS XO B Nanding and et of refunds received 11. What is IBM's cash return on sales for 2019? 12. What is IBM's return on TOTAL common stockholders' equity for 2019? Note: Use IBM'S Stockholders' Equity only 13. What is IBM's TOTAL basic (no dilution) earnings per share for 2019? 14. What is IBM's TOTAL earnings per share assuming dilution for 2019? 15. What is IBM's price to earnings ratio for 2019? (Note: use the TOTAL earnings per share assuming dilution and assume a stock price of $134.04) 16. What is IBM's payout ratio for 2018? (Note: cash dividends paid on common stock can be found on the Five-Year Comparison of Selected Data) 17. What is IBM's debt to total assets on December 31, 2019? 18. What is times interest earned for IBM for 2019? 19. What is IBM's cash debt coverage for 2019? 20. How many shares of IBM common stock have been authorized as of December 31, 2019? 21. How many shares of IBM common stock have been issued as of December 31, 2019? 22. How many of the issued shares of IBM common stock are being held as treasury shares as of December 31, 2019? 23. How many shares of IBM common stock are outstanding as of December 31, 2019? 24. What is the par value of IBM's common stock? 25. What is IBM's book value per share outstanding on December 31, 2019? (Note: Use IBM's Stockholders' Equity--don't forget that financial statement dollar amounts are in millions of dollars) 26. What is IBM's comprehensive income for 2019 (in millions of dollars)? 27. Was the computation of comprehensive income for IBM shown 1-at the bottom of the income statement; 2-on a separate schedule reconciling net income to comprehensive income; or 3-on the expanded statement of equity? 28. Was IBM's cash flow statement prepared using the direct or indirect method? 29. Which SPECIFIC investing or financing activity USED the most cash during 2019? 30. Which SPECIFIC investing or financing activity PROVIDED the most cash during 2019