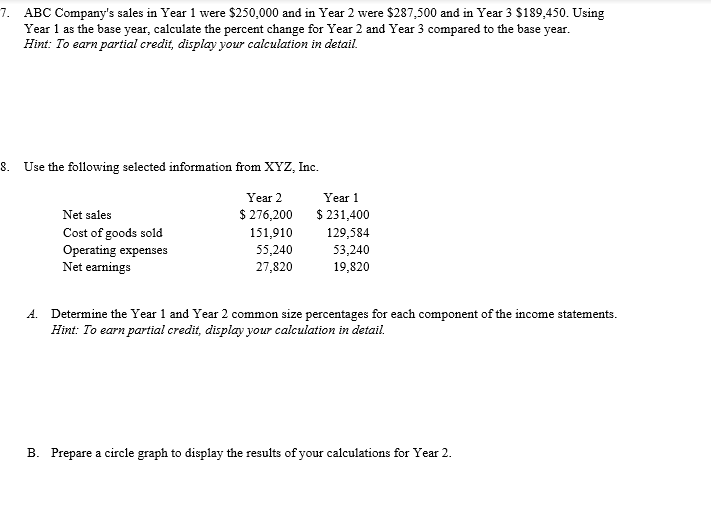

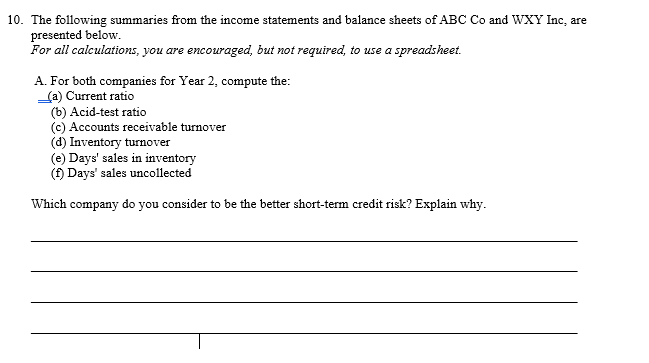

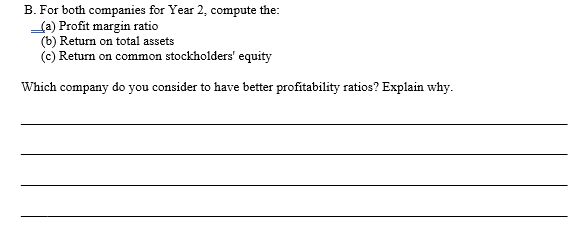

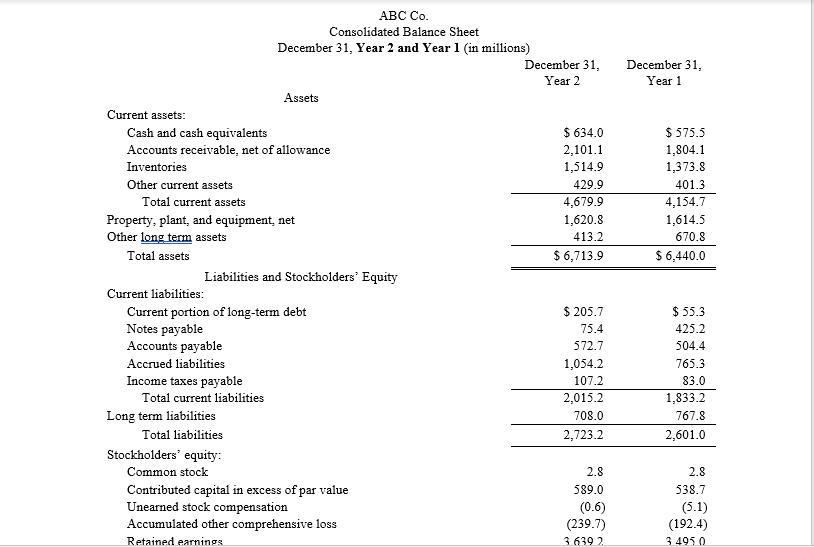

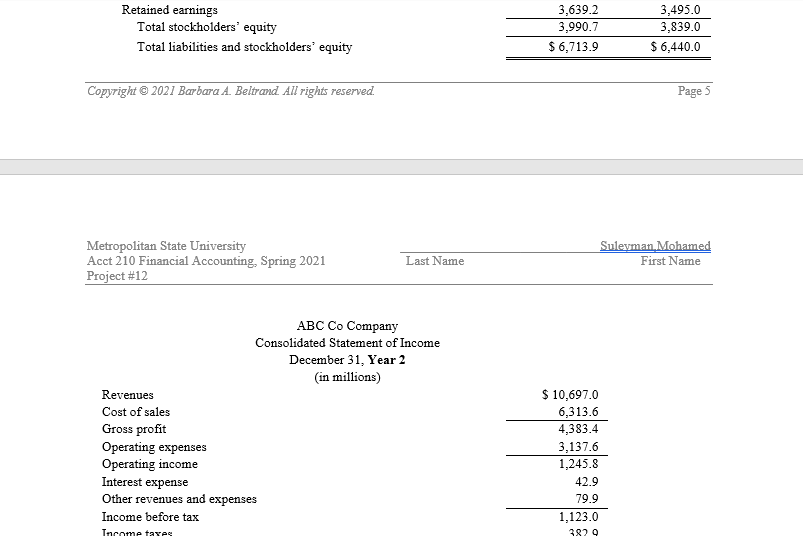

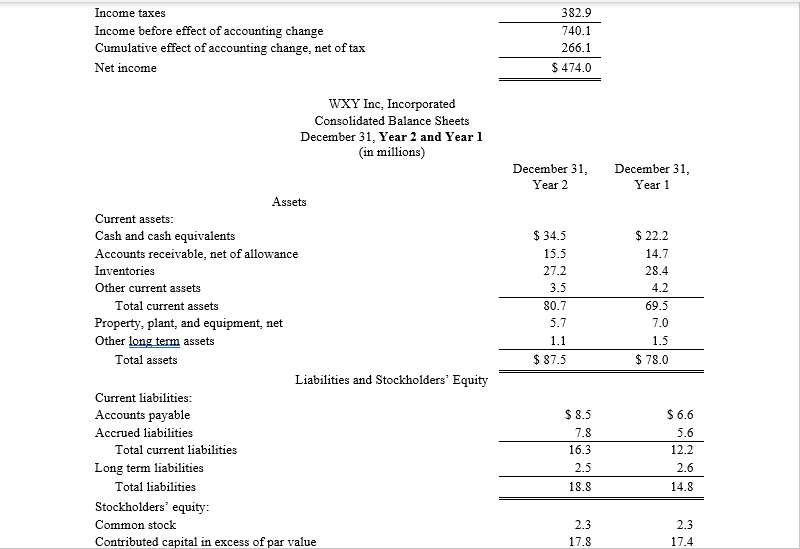

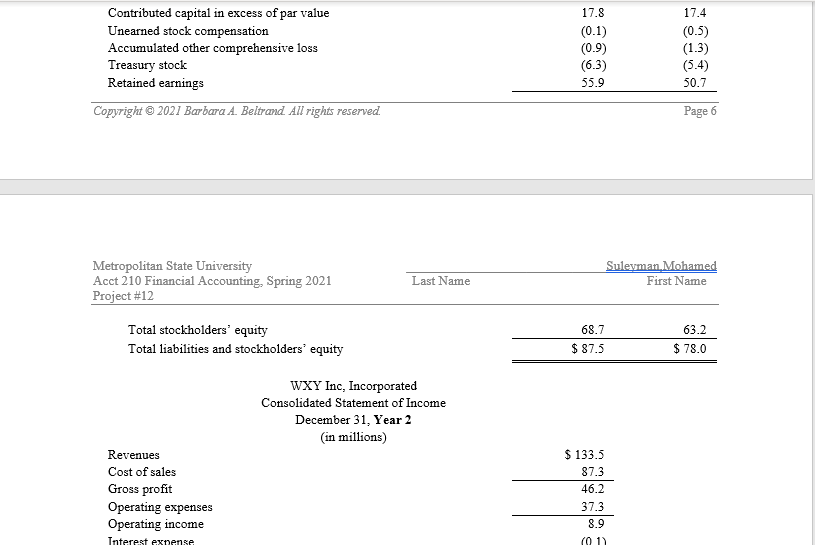

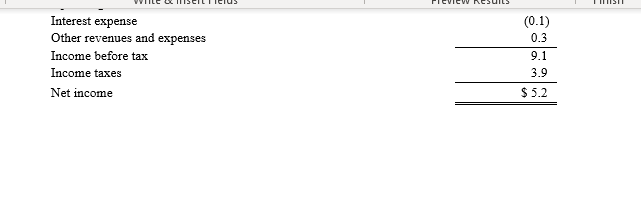

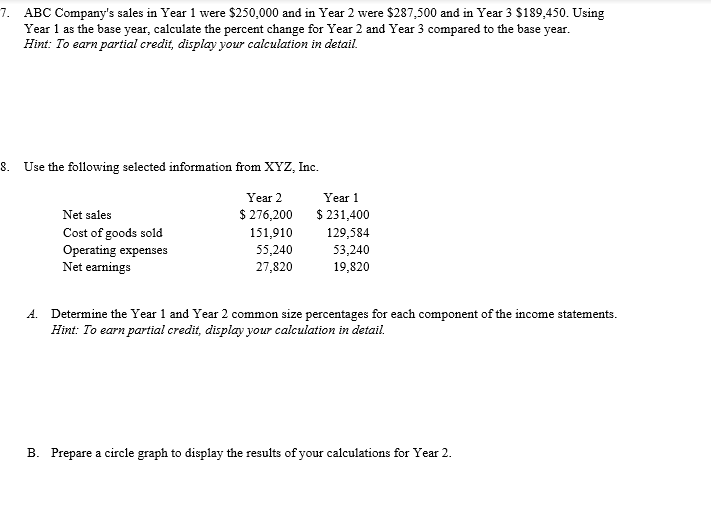

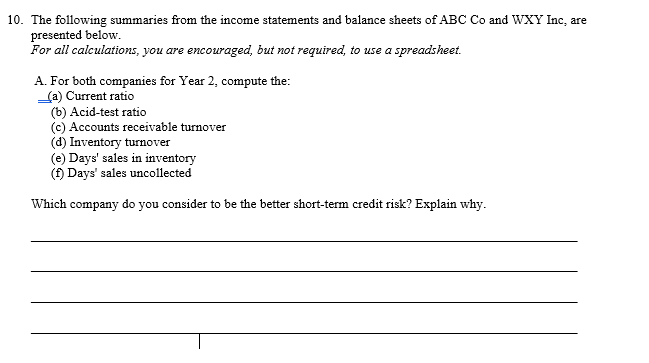

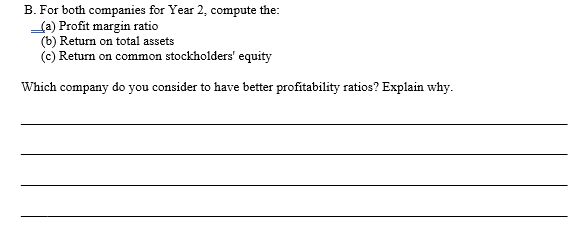

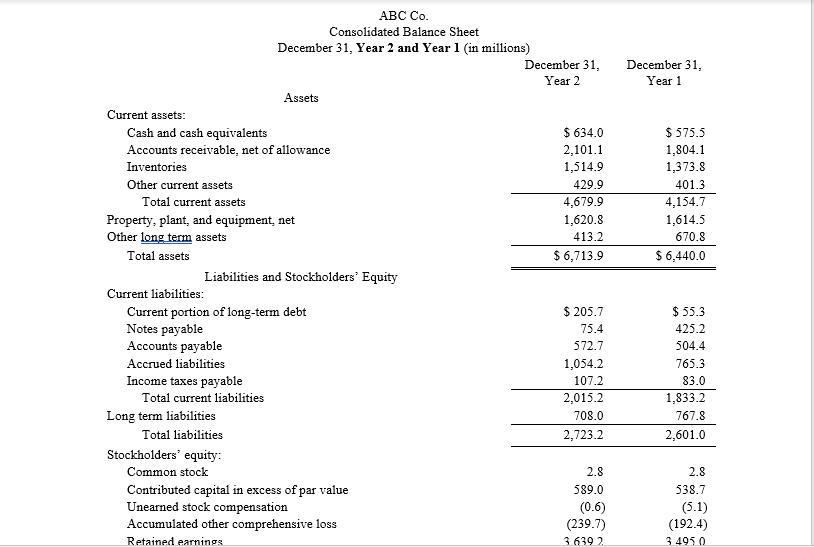

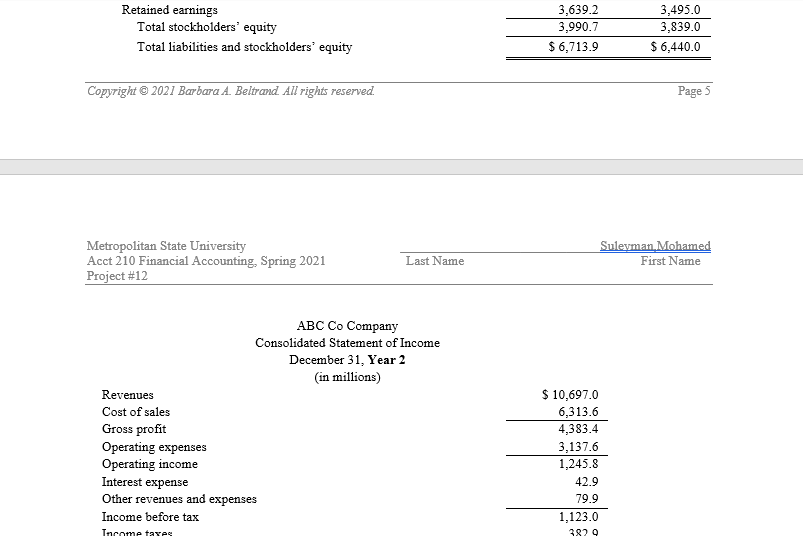

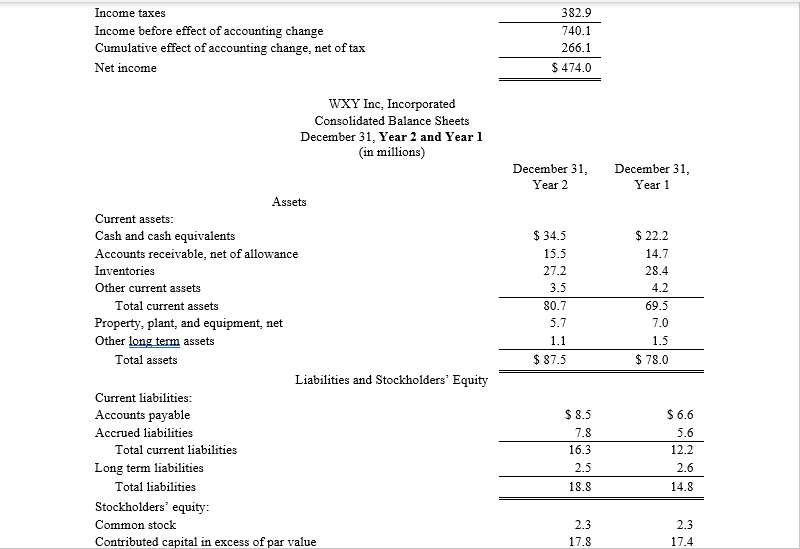

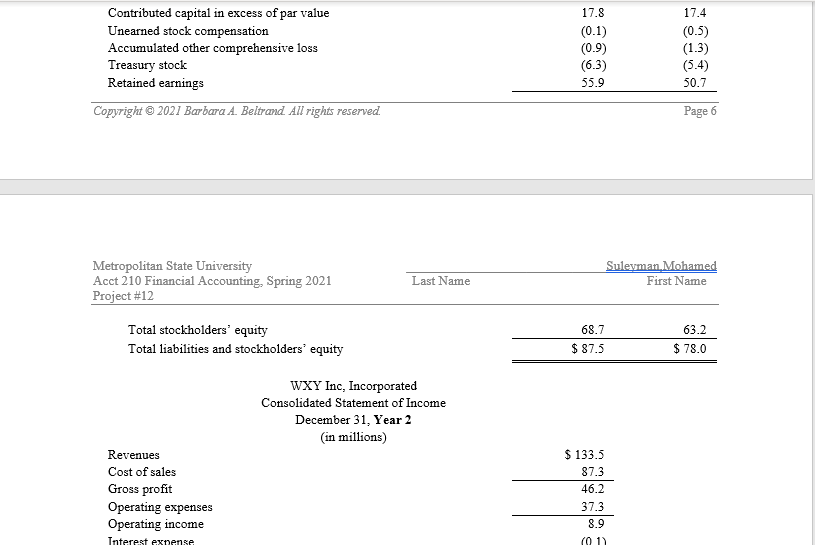

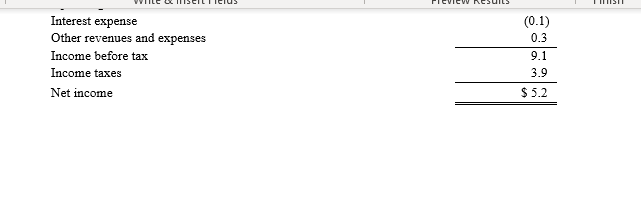

7. ABC Company's sales in Year 1 were $250,000 and in Year 2 were $287,500 and in Year 3 $189.450. Using Year 1 as the base year, calculate the percent change for Year 2 and Year 3 compared to the base year. Hint: To earn partial credit, display your calculation in detail. 8. Use the following selected information from XYZ, Inc. Net sales Cost of goods sold Operating expenses Net earnings Year 2 $ 276,200 151,910 55,240 27,820 Year 1 $ 231,400 129,584 53,240 19,820 A. Determine the Year 1 and Year 2 common size percentages for each component of the income statements. Hint: To earn partial credit, display your calculation in detail. B. Prepare a circle graph to display the results of your calculations for Year 2. 10. The following summaries from the income statements and balance sheets of ABC Co and WXY Inc, are presented below. For all calculations, you are encouraged, but not required, to use a spreadsheet. A. For both companies for Year 2, compute the: _(a) Current ratio (b) Acid-test ratio (c) Accounts receivable turnover (d) Inventory turnover (e) Days' sales in inventory (1) Days' sales uncollected Which company do you consider to be the better short-term credit risk? Explain why. B. For both companies for Year 2, compute the: _(a) Profit margin ratio (6) Return on total assets Return on common stockholders' equity Which company do you consider to have better profitability ratios? Explain why. December 31, Year 1 $575.5 1,804.1 1,373.8 401.3 4,154.7 1,614.5 670.8 $6,440.0 ABC Co. Consolidated Balance Sheet December 31, Year 2 and Year 1 (in millions) December 31, Year 2 Assets Current assets: Cash and cash equivalents $ 634.0 Accounts receivable, net of allowance 2,101.1 Inventories 1,514.9 Other current assets 429.9 Total current assets 4,679.9 Property, plant, and equipment, net 1,620.8 Other long term assets 413.2 Total assets $ 6,713.9 Liabilities and Stockholders' Equity Current liabilities: Current portion of long-term debt $ 205.7 Notes payable 75.4 Accounts payable 572.7 Accrued liabilities 1,054.2 Income taxes payable 107.2 Total current liabilities 2,015.2 Long term liabilities 708.0 Total liabilities 2,723.2 Stockholders' equity: Common stock 2.8 Contributed capital in excess of par value 589.0 Unearned stock compensation (0.6) Accumulated other comprehensive loss (239.7) Retained earnings 3.6392 $ 55.3 425.2 504.4 765.3 83.0 1,833.2 767.8 2,601.0 2.8 538.7 (5.1) (192.4) 3.495 0 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 3,639.2 3,990.7 $ 6,713.9 3,495.0 3,839.0 $6,440.0 Copyright 2021 Barbara A. Beltrand All rights reserved. Page 5 Metropolitan State University Acct 210 Financial Accounting, Spring 2021 Project #12 Last Name Suleyman Mohamed First Name ABC Co Company Consolidated Statement of Income December 31, Year 2 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes $ 10,697.0 6,313.6 4,383.4 3,137.6 1,245.8 42.9 79.9 1,123.0 3829 Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income 382.9 740.1 266.1 $ 474.0 WXY Inc, Incorporated Consolidated Balance Sheets December 31, Year 2 and Year 1 (in millions) December 31, Year 2 December 31, Year 1 $ 34.5 15.5 27.2 3.5 80.7 5.7 1.1 $ 87.5 $ 22.2 14.7 28.4 4.2 69.5 7.0 1.5 $ 78.0 Assets Current assets: Cash and cash equivalents Accounts receivable, net of allowance Inventories Other current assets Total current assets Property, plant, and equipment, net Other long term assets Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long term liabilities Total liabilities Stockholders' equity: Common stock Contributed capital in excess of par value $ 8.5 7.8 16.3 2.5 $ 6.6 5.6 12.2 2.6 18.8 14.8 2.3 17.8 2.3 17.4 Contributed capital in excess of par value Unearned stock compensation Accumulated other comprehensive loss Treasury stock Retained earnings Copyright 2021 Barbara A. Beltrand All rights reserved. 17.8 (0.1) (0.9) (6-3) 55.9 17.4 (0.5) (1.3) (5.4) 50.7 Page 6 Metropolitan State University Acct 210 Financial Accounting, Spring 2021 Project #12 Suleyman Mohamed First Name Last Name Total stockholders' equity Total liabilities and stockholders' equity 68.7 $ 87.5 63.2 $ 78.0 WXY Inc, Incorporated Consolidated Statement of Income December 31, Year 2 in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense $ 133.5 87.3 46.2 37.3 8.9 (01) Interest expense Other revenues and expenses Income before tax Income taxes Net income (0.1) 0.3 9.1 3.9 $5.2 7. ABC Company's sales in Year 1 were $250,000 and in Year 2 were $287,500 and in Year 3 $189.450. Using Year 1 as the base year, calculate the percent change for Year 2 and Year 3 compared to the base year. Hint: To earn partial credit, display your calculation in detail. 8. Use the following selected information from XYZ, Inc. Net sales Cost of goods sold Operating expenses Net earnings Year 2 $ 276,200 151,910 55,240 27,820 Year 1 $ 231,400 129,584 53,240 19,820 A. Determine the Year 1 and Year 2 common size percentages for each component of the income statements. Hint: To earn partial credit, display your calculation in detail. B. Prepare a circle graph to display the results of your calculations for Year 2. 10. The following summaries from the income statements and balance sheets of ABC Co and WXY Inc, are presented below. For all calculations, you are encouraged, but not required, to use a spreadsheet. A. For both companies for Year 2, compute the: _(a) Current ratio (b) Acid-test ratio (c) Accounts receivable turnover (d) Inventory turnover (e) Days' sales in inventory (1) Days' sales uncollected Which company do you consider to be the better short-term credit risk? Explain why. B. For both companies for Year 2, compute the: _(a) Profit margin ratio (6) Return on total assets Return on common stockholders' equity Which company do you consider to have better profitability ratios? Explain why. December 31, Year 1 $575.5 1,804.1 1,373.8 401.3 4,154.7 1,614.5 670.8 $6,440.0 ABC Co. Consolidated Balance Sheet December 31, Year 2 and Year 1 (in millions) December 31, Year 2 Assets Current assets: Cash and cash equivalents $ 634.0 Accounts receivable, net of allowance 2,101.1 Inventories 1,514.9 Other current assets 429.9 Total current assets 4,679.9 Property, plant, and equipment, net 1,620.8 Other long term assets 413.2 Total assets $ 6,713.9 Liabilities and Stockholders' Equity Current liabilities: Current portion of long-term debt $ 205.7 Notes payable 75.4 Accounts payable 572.7 Accrued liabilities 1,054.2 Income taxes payable 107.2 Total current liabilities 2,015.2 Long term liabilities 708.0 Total liabilities 2,723.2 Stockholders' equity: Common stock 2.8 Contributed capital in excess of par value 589.0 Unearned stock compensation (0.6) Accumulated other comprehensive loss (239.7) Retained earnings 3.6392 $ 55.3 425.2 504.4 765.3 83.0 1,833.2 767.8 2,601.0 2.8 538.7 (5.1) (192.4) 3.495 0 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 3,639.2 3,990.7 $ 6,713.9 3,495.0 3,839.0 $6,440.0 Copyright 2021 Barbara A. Beltrand All rights reserved. Page 5 Metropolitan State University Acct 210 Financial Accounting, Spring 2021 Project #12 Last Name Suleyman Mohamed First Name ABC Co Company Consolidated Statement of Income December 31, Year 2 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes $ 10,697.0 6,313.6 4,383.4 3,137.6 1,245.8 42.9 79.9 1,123.0 3829 Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income 382.9 740.1 266.1 $ 474.0 WXY Inc, Incorporated Consolidated Balance Sheets December 31, Year 2 and Year 1 (in millions) December 31, Year 2 December 31, Year 1 $ 34.5 15.5 27.2 3.5 80.7 5.7 1.1 $ 87.5 $ 22.2 14.7 28.4 4.2 69.5 7.0 1.5 $ 78.0 Assets Current assets: Cash and cash equivalents Accounts receivable, net of allowance Inventories Other current assets Total current assets Property, plant, and equipment, net Other long term assets Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long term liabilities Total liabilities Stockholders' equity: Common stock Contributed capital in excess of par value $ 8.5 7.8 16.3 2.5 $ 6.6 5.6 12.2 2.6 18.8 14.8 2.3 17.8 2.3 17.4 Contributed capital in excess of par value Unearned stock compensation Accumulated other comprehensive loss Treasury stock Retained earnings Copyright 2021 Barbara A. Beltrand All rights reserved. 17.8 (0.1) (0.9) (6-3) 55.9 17.4 (0.5) (1.3) (5.4) 50.7 Page 6 Metropolitan State University Acct 210 Financial Accounting, Spring 2021 Project #12 Suleyman Mohamed First Name Last Name Total stockholders' equity Total liabilities and stockholders' equity 68.7 $ 87.5 63.2 $ 78.0 WXY Inc, Incorporated Consolidated Statement of Income December 31, Year 2 in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense $ 133.5 87.3 46.2 37.3 8.9 (01) Interest expense Other revenues and expenses Income before tax Income taxes Net income (0.1) 0.3 9.1 3.9 $5.2