Answered step by step

Verified Expert Solution

Question

1 Approved Answer

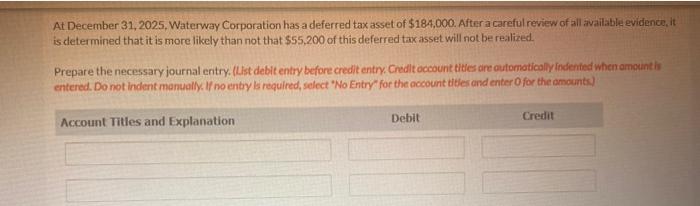

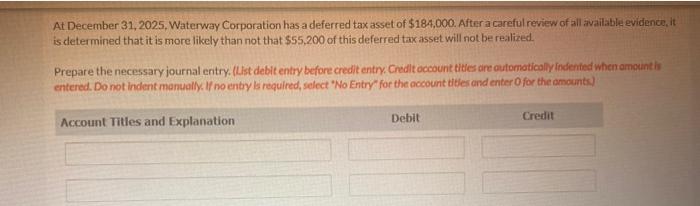

7 At December 31, 2025, Waterway Corporation has a deferred tax asset of $184,000. After a careful review of all available evidence, it is determined

7

At December 31, 2025, Waterway Corporation has a deferred tax asset of $184,000. After a careful review of all available evidence, it is determined that it is more likely than not that $55,200 of this deferred tax asset will not be realized. Prepare the necessary journal entry. (List debit entry before credit entry. Credl occount tittes dre outomaticoliy indentied when amountis entered. Do not indent manually. If no entry ls required, select 'No Entry" for the occount titles and enter 0 for the onounts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started