Question

7 Sparrow Ltd owns a building, currently carried in its accounting records at GHS 800,000. It has agreed to exchange this building for a

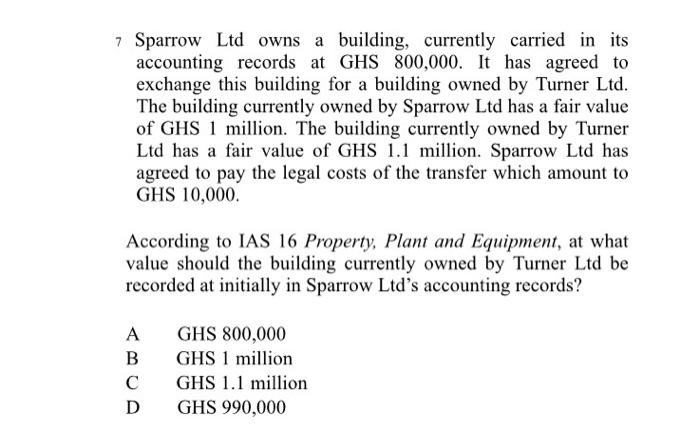

7 Sparrow Ltd owns a building, currently carried in its accounting records at GHS 800,000. It has agreed to exchange this building for a building owned by Turner Ltd. The building currently owned by Sparrow Ltd has a fair value of GHS 1 million. The building currently owned by Turner Ltd has a fair value of GHS 1.1 million. Sparrow Ltd has agreed to pay the legal costs of the transfer which amount to GHS 10,000. According to IAS 16 Property, Plant and Equipment, at what value should the building currently owned by Turner Ltd be recorded at initially in Sparrow Ltd's accounting records? A GHS 800,000 B GHS 1 million C GHS 1.1 million D GHS 990,000

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answers Answer When an item of PPE is acquired in exchange for a nonmonetary asset or a combina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and managerial accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

1st edition

111800423X, 9781118233443, 1118016114, 9781118004234, 1118233441, 978-1118016114

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App