Answered step by step

Verified Expert Solution

Question

1 Approved Answer

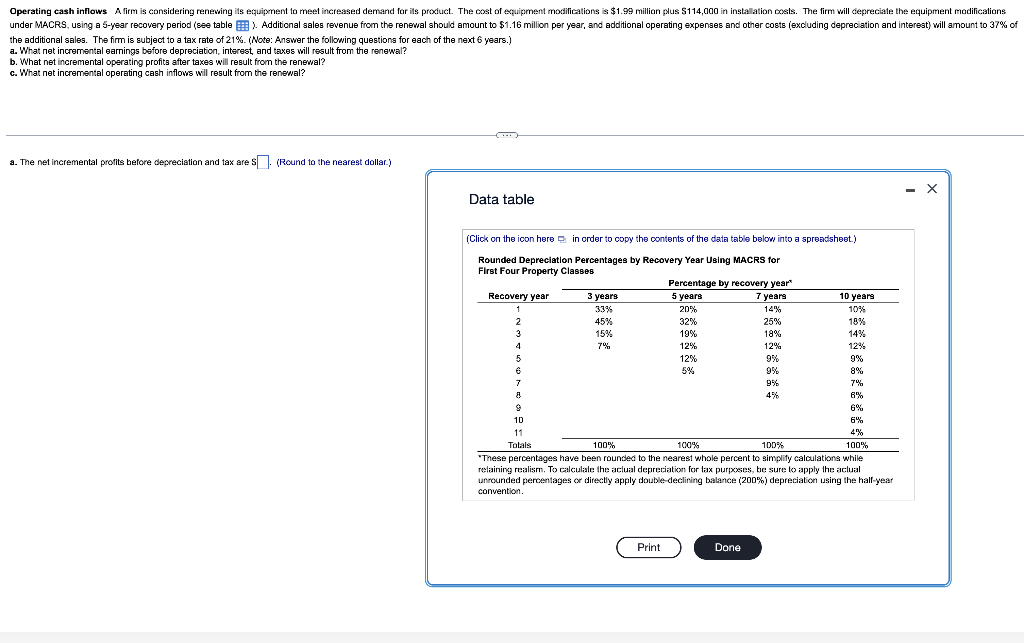

7. the additional sales. The firm is subject to a tax rate of 21%. (Nate: Answer the following questions for each of the next 6

7.

the additional sales. The firm is subject to a tax rate of 21%. (Nate: Answer the following questions for each of the next 6 years.) a. What net incremental earnings before depreciation, interest, and taxes will result from the renewal? b. What net incremental operating profits after taxes, will result from the renewal? c. What net incremental operating cash inflows will result from the renewal? a. The net incremental proits before depreciation and tax are s (Round to the nearest dollar.) Data table (Click on the icon here Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Provertv Classes "These percentages have been rounded to the nearest whole percent to simplify calculations while relaining reaalism. To calculaale the aclual depreciation for lax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200\%) depreciation using the half-year conventionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started