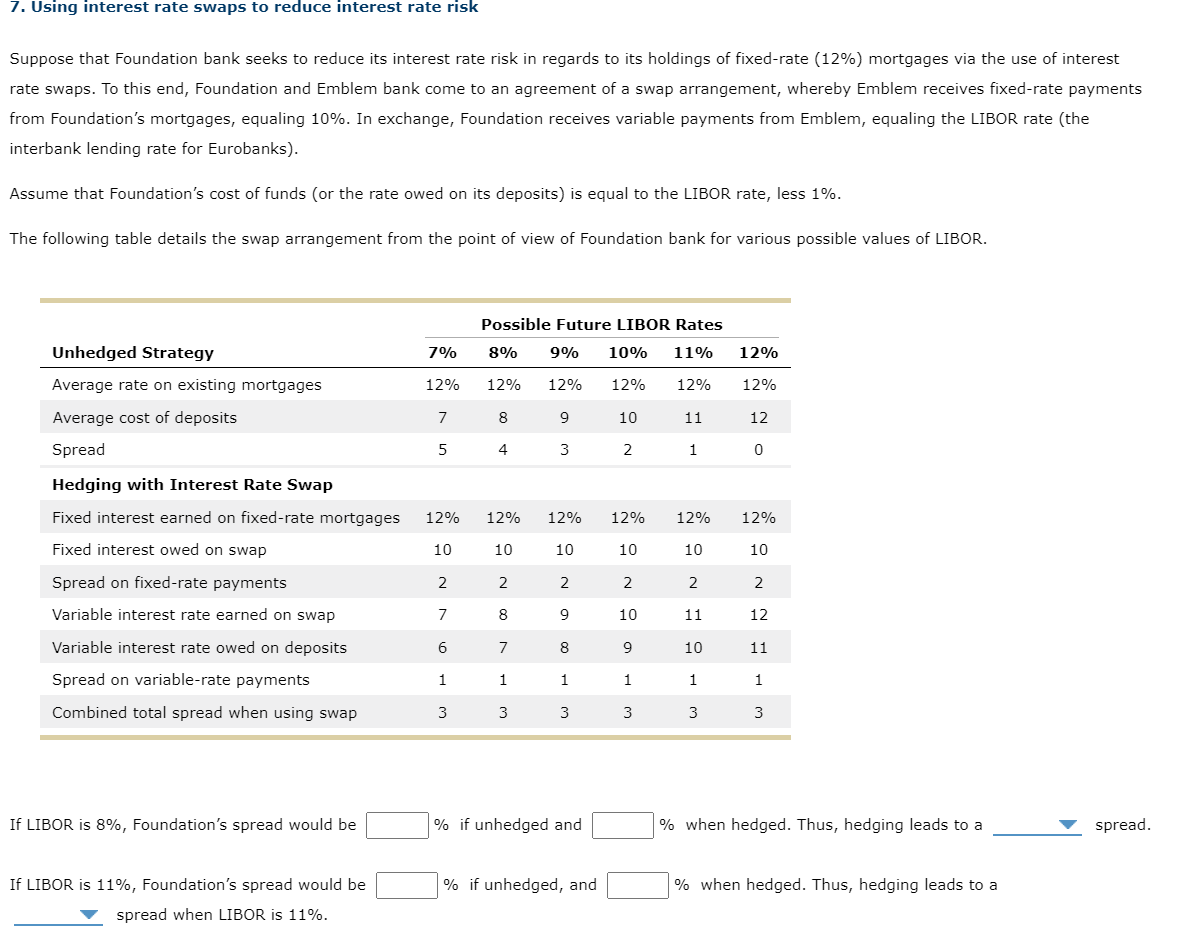

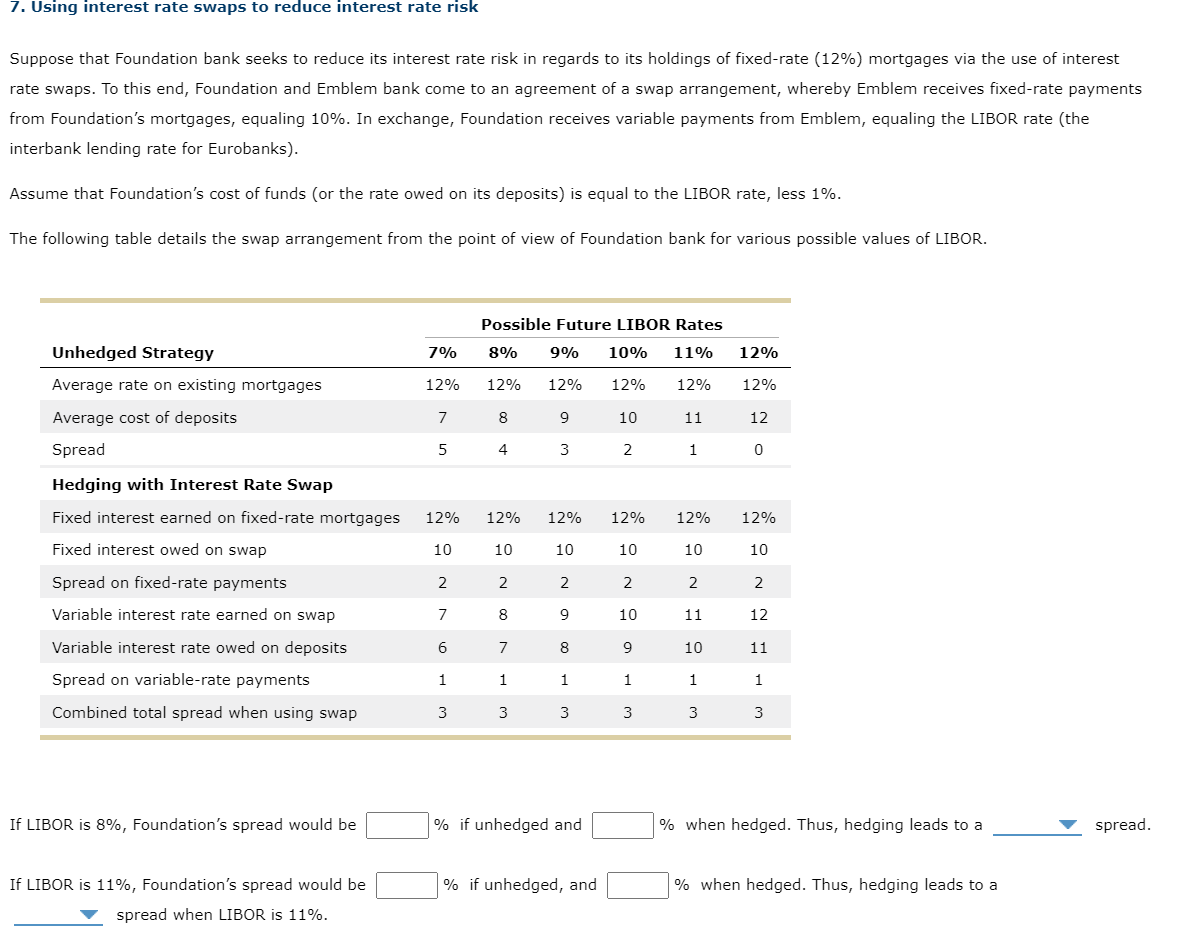

7. Using interest rate swaps to reduce interest rate risk Suppose that Foundation bank seeks to reduce its interest rate risk in regards to its holdings of fixed-rate (12%) mortgages via the use of interest rate swaps. To this end, Foundation and Emblem bank come to an agreement of a swap arrangement, whereby Emblem receives fixed-rate payments from Foundation's mortgages, equaling 10%. In exchange, Foundation receives variable payments from Emblem, equaling the LIBOR rate (the interbank lending rate for Eurobanks). Assume that Foundation's cost of funds (or the rate owed on its deposits) is equal to the LIBOR rate, less 1%. The following table details the swap arrangement from the point of view of Foundation bank for various possible values of LIBOR. Possible Future LIBOR Rates 8% 9% 10% 11% 7% 12% 12% 12% 12% 12% 12% 12% Unhedged Strategy Average rate on existing mortgages Average cost of deposits Spread 7 8 9 10 11 12 5 4 3 2 1 0 Hedging with Interest Rate Swap Fixed interest earned on fixed-rate mortgages 12% 12% 12% 12% 12% 12% Fixed interest owed on swap 10 10 10 10 10 10 Spread on fixed-rate payments 2 2 2 2 2 2 Variable interest rate earned on swap 7 8 9 10 11 12 Variable interest rate owed on deposits 6 7 8 9 10 11 Spread on variable-rate payments 1 1 1 1 1 1 Combined total spread when using swap 3 3 3 3 3 3 If LIBOR is 8%, Foundation's spread would be % if unhedged and % when hedged. Thus, hedging leads to a spread. % if unhedged, and % when hedged. Thus, hedging leads to a If LIBOR is 11%, Foundation's spread would be spread when LIBOR is 11%. If LIBOR is 8%, Foundation's spread would be % if unhedged and % when hedged. Thus, hedging leads to a spread. higher % if unhedged, and % when hedged. Thus, hedging leads to If LIBOR is 11%, Foundation's spread would be spread when LIBOR is 11%. lower 7. Using interest rate swaps to reduce interest rate risk Suppose that Foundation bank seeks to reduce its interest rate risk in regards to its holdings of fixed-rate (12%) mortgages via the use of interest rate swaps. To this end, Foundation and Emblem bank come to an agreement of a swap arrangement, whereby Emblem receives fixed-rate payments from Foundation's mortgages, equaling 10%. In exchange, Foundation receives variable payments from Emblem, equaling the LIBOR rate (the interbank lending rate for Eurobanks). Assume that Foundation's cost of funds (or the rate owed on its deposits) is equal to the LIBOR rate, less 1%. The following table details the swap arrangement from the point of view of Foundation bank for various possible values of LIBOR. Possible Future LIBOR Rates 8% 9% 10% 11% 7% 12% 12% 12% 12% 12% 12% 12% Unhedged Strategy Average rate on existing mortgages Average cost of deposits Spread 7 8 9 10 11 12 5 4 3 2 1 0 Hedging with Interest Rate Swap Fixed interest earned on fixed-rate mortgages 12% 12% 12% 12% 12% 12% Fixed interest owed on swap 10 10 10 10 10 10 Spread on fixed-rate payments 2 2 2 2 2 2 Variable interest rate earned on swap 7 8 9 10 11 12 Variable interest rate owed on deposits 6 7 8 9 10 11 Spread on variable-rate payments 1 1 1 1 1 1 Combined total spread when using swap 3 3 3 3 3 3 If LIBOR is 8%, Foundation's spread would be % if unhedged and % when hedged. Thus, hedging leads to a spread. % if unhedged, and % when hedged. Thus, hedging leads to a If LIBOR is 11%, Foundation's spread would be spread when LIBOR is 11%. If LIBOR is 8%, Foundation's spread would be % if unhedged and % when hedged. Thus, hedging leads to a spread. higher % if unhedged, and % when hedged. Thus, hedging leads to If LIBOR is 11%, Foundation's spread would be spread when LIBOR is 11%. lower