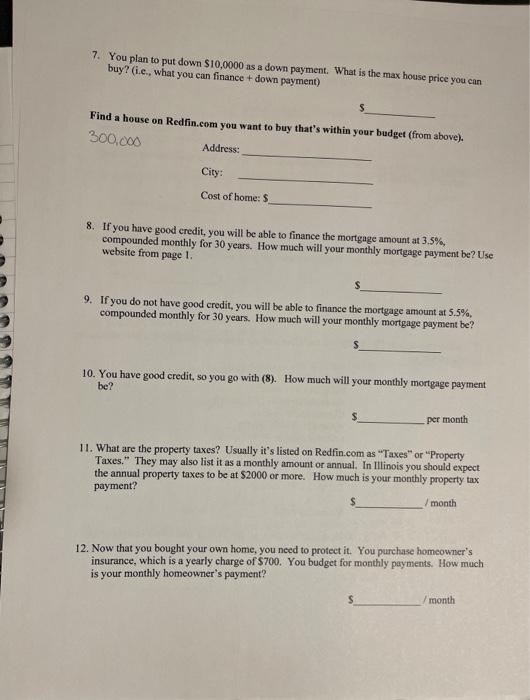

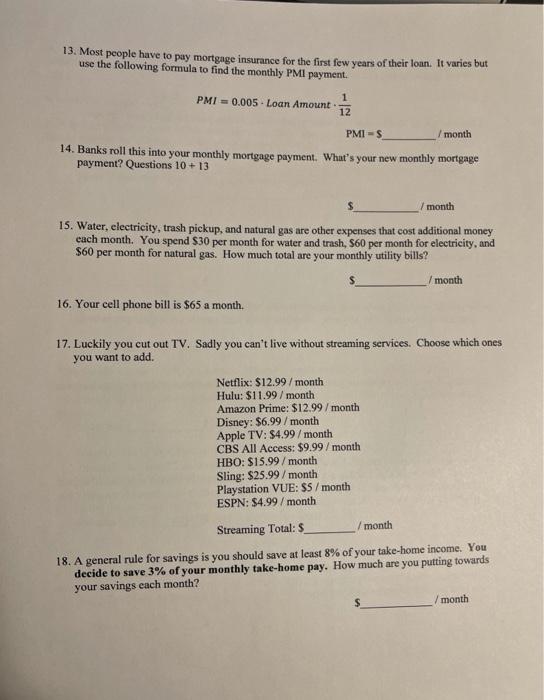

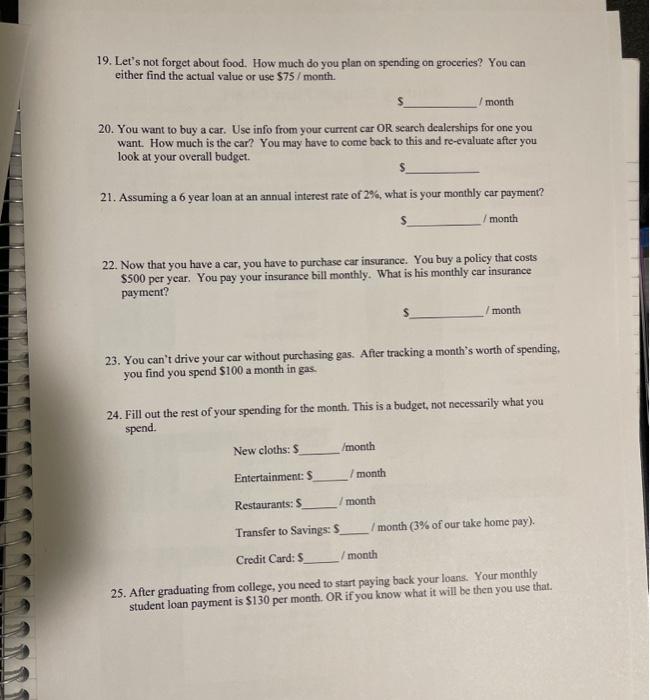

7. You plan to put down $10,0000 as a down payment. What is the max house price you can buy? (i.e., what you can finance + down payment) Find a house on Redfin.com you want to buy that's within your budget (from above). 300.000 Address: City: Cost of home: S 8. If you have good credit, you will be able to finance the mortgage amount at 3.5%, compounded monthly for 30 years. How much will your monthly mortgage payment be? Use website from page 1 S 9. If you do not have good credit, you will be able to finance the mortgage amount at 5.5%, compounded monthly for 30 years. How much will your monthly mortgage payment be? 10. You have good credit, so you go with (8). How much will your monthly mortgage payment be? per month 11. What are the property taxes? Usually it's listed on Redfin.com as "Taxes" or "Property Taxes." They may also list it as a monthly amount or annual. In Illinois you should expect the annual property taxes to be at $2000 or more. How much is your monthly property tax payment? _/month 12. Now that you bought your own home, you need to protect it. You purchase homeowner's insurance, which is a yearly charge of $700. You budget for monthly payments. How much is your monthly homeowner's payment? month 13. Most people have to pay mortgage insurance for the first few years of their loan. It varies but use the following formula to find the monthly PMI payment. PMI = 0.005. Loan Amount 1 12 PMIS / month 14. Banks roll this into your monthly mortgage payment. What's your new monthly mortgage payment? Questions 10+ 13 /month 15. Water, electricity, trash pickup, and natural gas are other expenses that cost additional money each month. You spend $30 per month for water and trash, S60 per month for electricity, and $60 per month for natural gas. How much total are your monthly utility bills? month 16. Your cell phone bill is $65 a month. 17. Luckily you cut out TV. Sadly you can't live without streaming services. Choose which ones you want to add Netflix: $12.99/month Hulu: $11.99 / month Amazon Prime: $12.99 / month Disney: $6.99/month Apple TV: $4.99/month CBS All Access: $9.99/month HBO: $15.99 / month Sling: $25.99/month Playstation VUE: $5 /month ESPN: $4.99 / month Streaming Total: $ / month 18. A general rule for savings is you should save at least 8% of your take-home income. You decide to save 3% of your monthly take-home pay. How much are you putting towards your savings each month? $ /month 19. Let's not forget about food. How much do you plan on spending on groceries? You can either find the actual value or use $75 /month. /month 20. You want to buy a car. Use info from your current car OR search dealerships for one you want. How much is the car? You may have to come back to this and re-evaluate after you look at your overall budget. 21. Assuming a 6 year loan at an annual interest rate of 2%, what is your monthly car payment? /month 22. Now that you have a car, you have to purchase car insurance. You buy a policy that costs $500 per year. You pay your insurance bill monthly. What is his monthly car insurance payment? month 23. You can't drive your car without purchasing gas. After tracking a month's worth of spending, you find you spend $100 a month in gas. 24. Fill out the rest of your spending for the month. This is a budget, not necessarily what you spend. New cloths: $ month Entertainment: $ 7 month Restaurants: month Transfer to Savings: 5 / month (3% of our take home pay). Credit Card: S /month 25. After graduating from college, you need to start paying back your loans. Your monthly student loan payment is $130 per month. OR if you know what it will be then you use that