Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#8. A private equity firm is trying to figure out how to structure a deal so that the top managers of the firm they

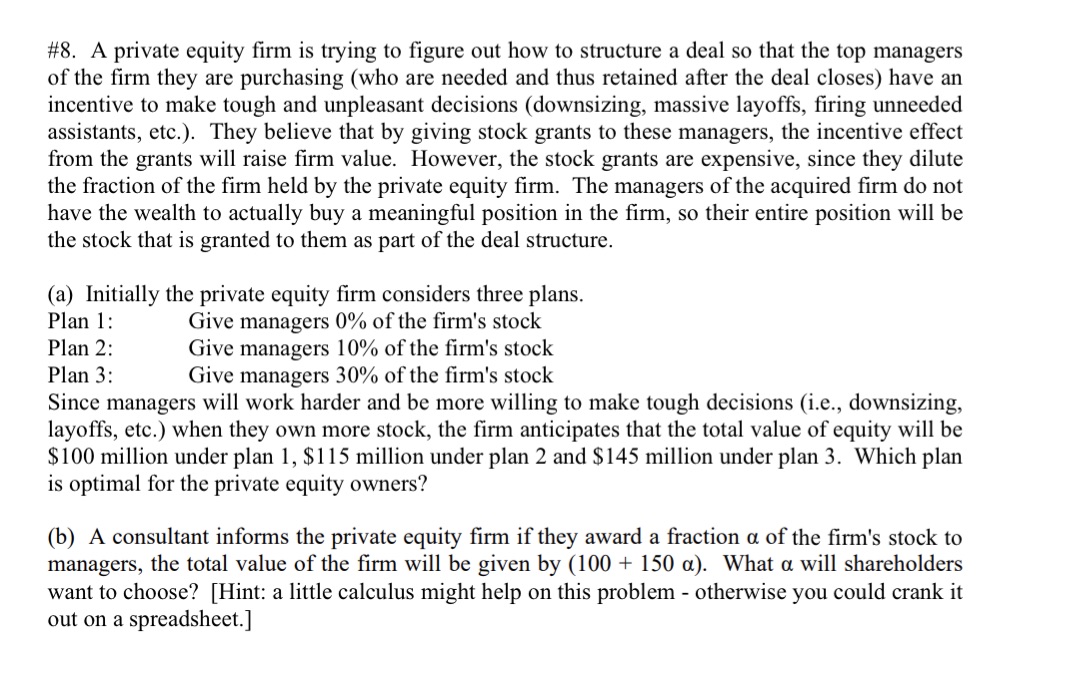

#8. A private equity firm is trying to figure out how to structure a deal so that the top managers of the firm they are purchasing (who are needed and thus retained after the deal closes) have an incentive to make tough and unpleasant decisions (downsizing, massive layoffs, firing unneeded assistants, etc.). They believe that by giving stock grants to these managers, the incentive effect from the grants will raise firm value. However, the stock grants are expensive, since they dilute the fraction of the firm held by the private equity firm. The managers of the acquired firm do not have the wealth to actually buy a meaningful position in the firm, so their entire position will be the stock that is granted to them as part of the deal structure. (a) Initially the private equity firm considers three plans. Give managers 0% of the firm's stock Give managers 10% of the firm's stock Plan 1: Plan 2: Plan 3: Give managers 30% of the firm's stock Since managers will work harder and be more willing to make tough decisions (i.e., downsizing, layoffs, etc.) when they own more stock, the firm anticipates that the total value of equity will be $100 million under plan 1, $115 million under plan 2 and $145 million under plan 3. Which plan is optimal for the private equity owners? (b) A consultant informs the private equity firm if they award a fraction a of the firm's stock to managers, the total value of the firm will be given by (100 + 150 a). What a will shareholders want to choose? [Hint: a little calculus might help on this problem - otherwise you could crank it out on a spreadsheet.]

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the optimal plan for the private equity owners we need to consider the tradeoff betwe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started