Answered step by step

Verified Expert Solution

Question

1 Approved Answer

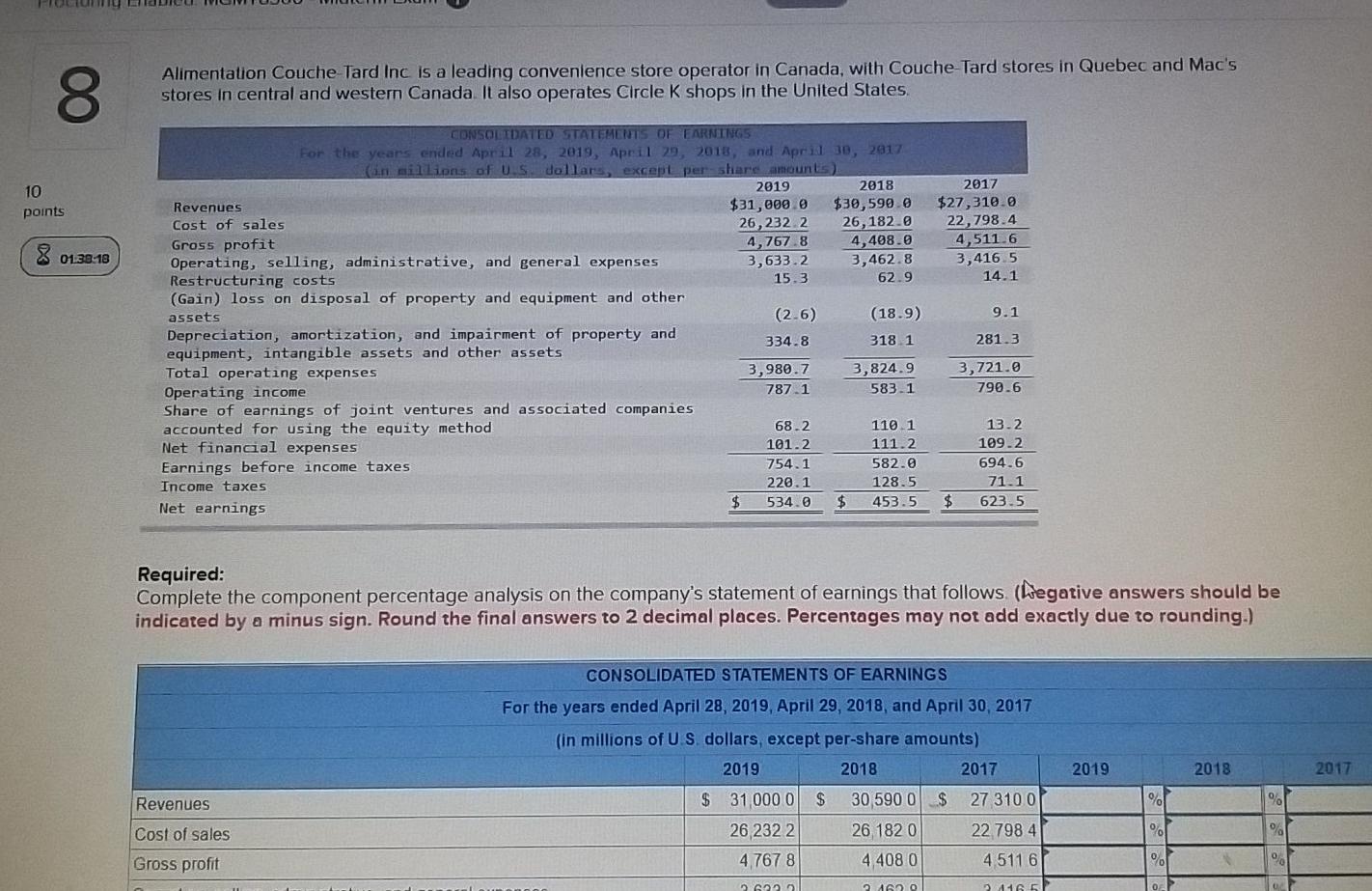

8 Alimentation Couche-Tard Inc is a leading convenience store operator in Canada, with Couche-Tard stores in Quebec and Mac's stores in central and western Canada.

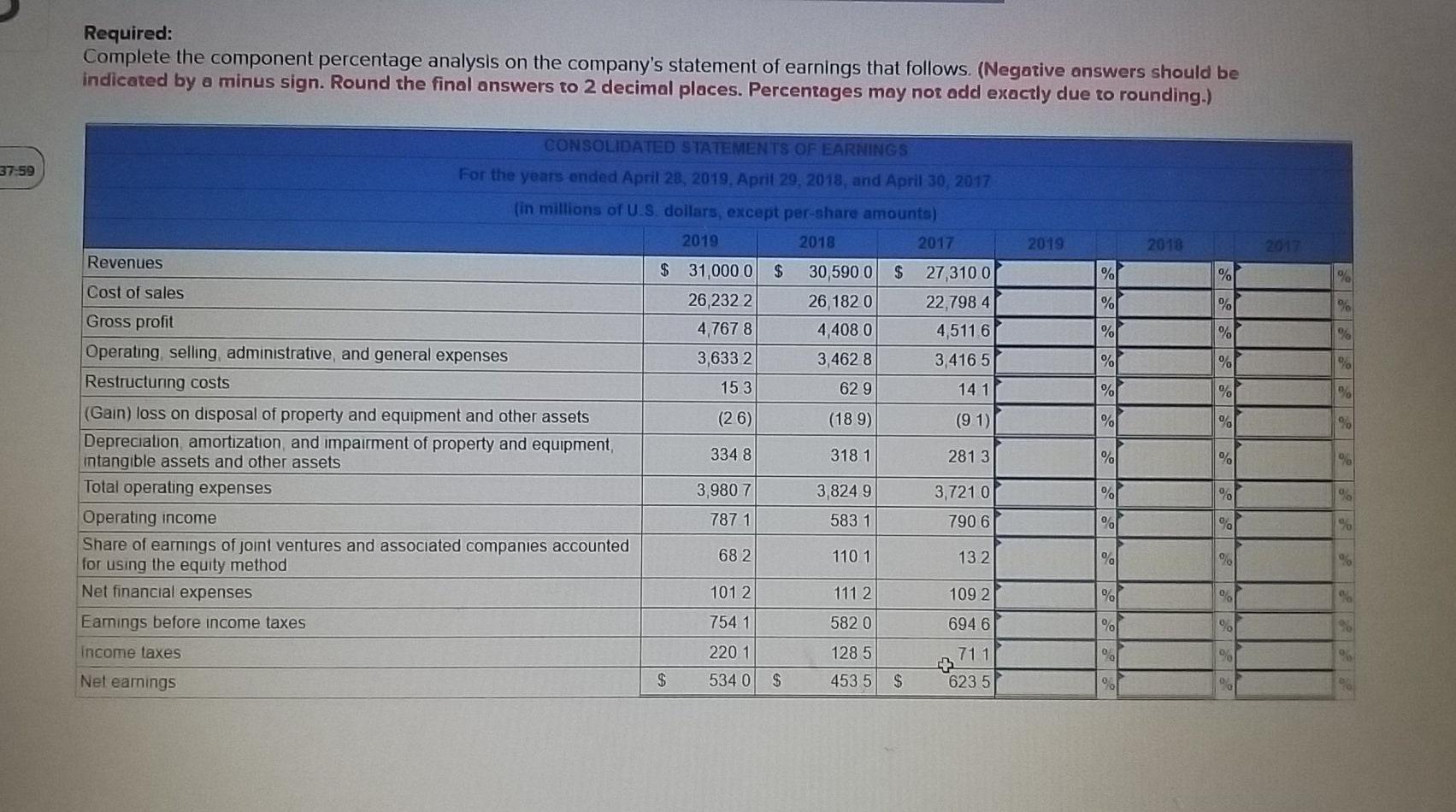

8 Alimentation Couche-Tard Inc is a leading convenience store operator in Canada, with Couche-Tard stores in Quebec and Mac's stores in central and western Canada. It also operates Circle K shops in the United States. 2018 10 points 2017 $27,310.0 22,798.4 4,511.6 3,416.5 14.1 8 01.30-18 9.1 CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019, April 29, 2018, and April 30, 2017 (en millions of US dollars, except per share amounts) 2019 Revenues $31,000 $30,590.0 Cost of sales 26,232 2 26,182.0 Gross profit 4,767.8 4,408.0 Operating, selling, administrative, and general expenses 3,633.2 3,462.8 Restructuring costs 15.3 62.9 (Gain) loss on disposal of property and equipment and other assets (2.6) (18.9) Depreciation, amortization, and impairment of property and 334.8 318 1 equipment, intangible assets and other assets Total operating expenses 3,980.7 3,824.9 Operating income 787.1 583.1 Share of earnings of joint ventures and associated companies accounted for using the equity method 68.2. 110.1 Net finanaal expenses 101.2 1112 Earnings before income taxes 754.1 582.0 Income taxes 220.1 128.5 Net earnings $ 534.0 $ 453.5 281.3 3,721.0 790.6 13.2 109.2 694.6 71.1 623.5 $ Required: Complete the component percentage analysis on the company's statement of earnings that follows (legative answers should be indicated by a minus sign. Round the final answers to 2 decimal places. Percentages may not add exactly due to rounding.) CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019. April 29, 2018, and April 30, 2017 (in millions of US dollars, except per-share amounts) 2019 2018 2017 $ 31 000 0 $ 30 590 0 $ 27 3100 26 2322 26 1820 22.798 4 4,767 8 4.408 0 4511 6 2019 2018 2017 Revenues % Cost of sales Gross profit % GO 416 Required: Complete the component percentage analysis on the company's statement of earnings that follows. (Negative answers should be indicated by a minus sign. Round the final answers to 2 decimal places. Percentages may not add exactly due to rounding.) 37-59 CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019. April 29, 2018, and April 30, 2017 fin millions of U.S. dollars, except per-share amounts) 2019 2018 2017 2019 2018 2017 Revenues $ 27 3100 % % 9% 22,798 4 % % % $ 31,0000 $ 26,2322 4,767 8 3,6332 153 30,590 0 26 1820 4,408 0 3,4628 % % 4,5116 3.416 5 % 629 141 % % (26) (189) (91) % % % Cost of sales Gross profit Operating selling administrative and general expenses Restructuring costs (Gain) loss on disposal of property and equipment and other assets Depreciation amortization and impairment of property and equipment, intangible assets and other assets Total operating expenses Operating income Share of earnings of joint ventures and associated companies accounted for using the equity method Net financial expenses Earnings before income taxes 334 8 3181 2813 % % % 3,9807 3,8249 3,7210 % % % 787 1 583 1 790 6 % % % 682 1101 132 % % 90 1012 1112 109 2 % 754 1 5820 6946 % Income taxes 220 1 711 % % 1285 4535 Net earnings $ 5340 $ $ 623 5 06 90 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started