Answered step by step

Verified Expert Solution

Question

1 Approved Answer

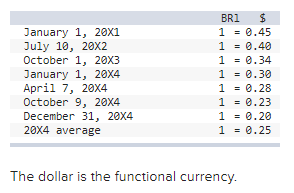

8.12b a. Prepare a schedule remeasuring Silva Company's December 31,20X4, trial balance from reals to dollars. (If no adjustment is needed, select 'No entry necessary'.)

8.12b

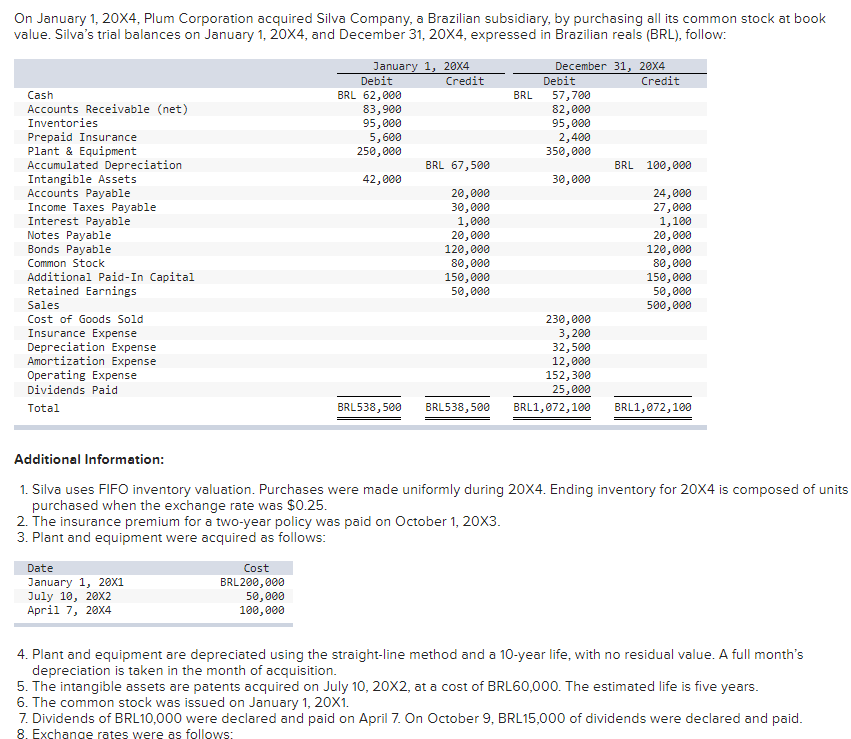

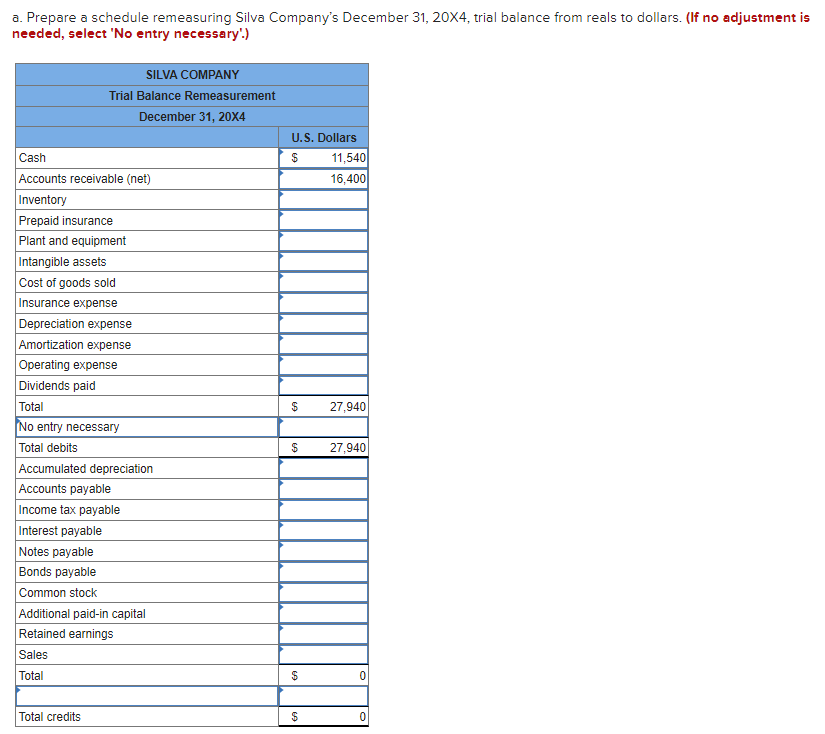

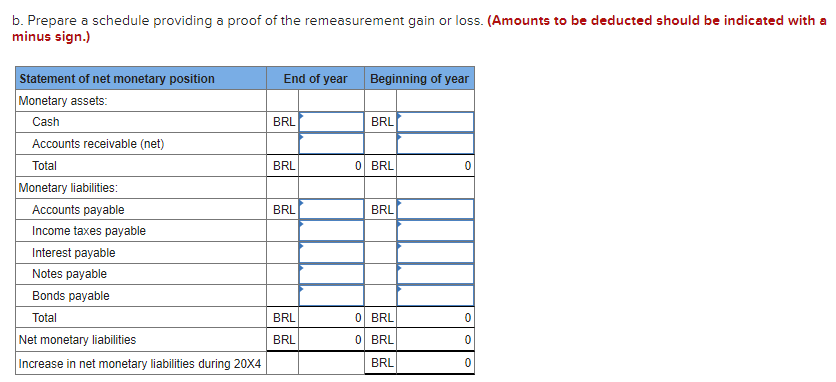

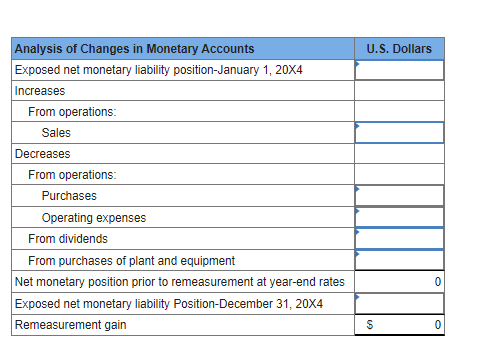

a. Prepare a schedule remeasuring Silva Company's December 31,20X4, trial balance from reals to dollars. (If no adjustment is needed, select 'No entry necessary'.) On January 1, 20X4, Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. Silva's trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (BRL), follow: Additional Information: 1. Silva uses FIFO inventory valuation. Purchases were made uniformly during 204. Ending inventory for 204 is composed of units purchased when the exchange rate was $0.25. 2. The insurance premium for a two-year policy was paid on October 1, 203. 3. Plant and equipment were acquired as follows: 4. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full month's depreciation is taken in the month of acquisition. 5. The intangible assets are patents acquired on July 10,20X2, at a cost of BRL60,000. The estimated life is five years. 6. The common stock was issued on January 1,201. 7. Dividends of BRL10,000 were declared and paid on April 7. On October 9, BRL15,000 of dividends were declared and paid. 8. Exchange rates were as follows: \begin{tabular}{|l|l|} \hline Analysis of Changes in Monetary Accounts & U.S. Dollars \\ \hline Exposed net monetary liability position-January 1, 20X4 & \\ \hline Increases & \\ \hline From operations: & \\ \hline Sales & \\ \hline Decreases & \\ \hline From operations: & \\ \hline Purchases & \\ \hline \multicolumn{1}{|c|}{ Operating expenses } & \\ \hline From dividends & \\ \hline From purchases of plant and equipment & \\ \hline Net monetary position prior to remeasurement at year-end rates & \\ \hline Exposed net monetary liability Position-December 31,204 & \\ \hline Remeasurement gain & \\ \hline \end{tabular} The dollar is the functional currency. b. Prepare a schedule providing a proof of the remeasurement gain or loss. (Amounts to be deducted should be indicated with a minus sign.) a. Prepare a schedule remeasuring Silva Company's December 31,20X4, trial balance from reals to dollars. (If no adjustment is needed, select 'No entry necessary'.) On January 1, 20X4, Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. Silva's trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (BRL), follow: Additional Information: 1. Silva uses FIFO inventory valuation. Purchases were made uniformly during 204. Ending inventory for 204 is composed of units purchased when the exchange rate was $0.25. 2. The insurance premium for a two-year policy was paid on October 1, 203. 3. Plant and equipment were acquired as follows: 4. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full month's depreciation is taken in the month of acquisition. 5. The intangible assets are patents acquired on July 10,20X2, at a cost of BRL60,000. The estimated life is five years. 6. The common stock was issued on January 1,201. 7. Dividends of BRL10,000 were declared and paid on April 7. On October 9, BRL15,000 of dividends were declared and paid. 8. Exchange rates were as follows: \begin{tabular}{|l|l|} \hline Analysis of Changes in Monetary Accounts & U.S. Dollars \\ \hline Exposed net monetary liability position-January 1, 20X4 & \\ \hline Increases & \\ \hline From operations: & \\ \hline Sales & \\ \hline Decreases & \\ \hline From operations: & \\ \hline Purchases & \\ \hline \multicolumn{1}{|c|}{ Operating expenses } & \\ \hline From dividends & \\ \hline From purchases of plant and equipment & \\ \hline Net monetary position prior to remeasurement at year-end rates & \\ \hline Exposed net monetary liability Position-December 31,204 & \\ \hline Remeasurement gain & \\ \hline \end{tabular} The dollar is the functional currency. b. Prepare a schedule providing a proof of the remeasurement gain or loss. (Amounts to be deducted should be indicated with a minus sign.)

a. Prepare a schedule remeasuring Silva Company's December 31,20X4, trial balance from reals to dollars. (If no adjustment is needed, select 'No entry necessary'.) On January 1, 20X4, Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. Silva's trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (BRL), follow: Additional Information: 1. Silva uses FIFO inventory valuation. Purchases were made uniformly during 204. Ending inventory for 204 is composed of units purchased when the exchange rate was $0.25. 2. The insurance premium for a two-year policy was paid on October 1, 203. 3. Plant and equipment were acquired as follows: 4. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full month's depreciation is taken in the month of acquisition. 5. The intangible assets are patents acquired on July 10,20X2, at a cost of BRL60,000. The estimated life is five years. 6. The common stock was issued on January 1,201. 7. Dividends of BRL10,000 were declared and paid on April 7. On October 9, BRL15,000 of dividends were declared and paid. 8. Exchange rates were as follows: \begin{tabular}{|l|l|} \hline Analysis of Changes in Monetary Accounts & U.S. Dollars \\ \hline Exposed net monetary liability position-January 1, 20X4 & \\ \hline Increases & \\ \hline From operations: & \\ \hline Sales & \\ \hline Decreases & \\ \hline From operations: & \\ \hline Purchases & \\ \hline \multicolumn{1}{|c|}{ Operating expenses } & \\ \hline From dividends & \\ \hline From purchases of plant and equipment & \\ \hline Net monetary position prior to remeasurement at year-end rates & \\ \hline Exposed net monetary liability Position-December 31,204 & \\ \hline Remeasurement gain & \\ \hline \end{tabular} The dollar is the functional currency. b. Prepare a schedule providing a proof of the remeasurement gain or loss. (Amounts to be deducted should be indicated with a minus sign.) a. Prepare a schedule remeasuring Silva Company's December 31,20X4, trial balance from reals to dollars. (If no adjustment is needed, select 'No entry necessary'.) On January 1, 20X4, Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. Silva's trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (BRL), follow: Additional Information: 1. Silva uses FIFO inventory valuation. Purchases were made uniformly during 204. Ending inventory for 204 is composed of units purchased when the exchange rate was $0.25. 2. The insurance premium for a two-year policy was paid on October 1, 203. 3. Plant and equipment were acquired as follows: 4. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full month's depreciation is taken in the month of acquisition. 5. The intangible assets are patents acquired on July 10,20X2, at a cost of BRL60,000. The estimated life is five years. 6. The common stock was issued on January 1,201. 7. Dividends of BRL10,000 were declared and paid on April 7. On October 9, BRL15,000 of dividends were declared and paid. 8. Exchange rates were as follows: \begin{tabular}{|l|l|} \hline Analysis of Changes in Monetary Accounts & U.S. Dollars \\ \hline Exposed net monetary liability position-January 1, 20X4 & \\ \hline Increases & \\ \hline From operations: & \\ \hline Sales & \\ \hline Decreases & \\ \hline From operations: & \\ \hline Purchases & \\ \hline \multicolumn{1}{|c|}{ Operating expenses } & \\ \hline From dividends & \\ \hline From purchases of plant and equipment & \\ \hline Net monetary position prior to remeasurement at year-end rates & \\ \hline Exposed net monetary liability Position-December 31,204 & \\ \hline Remeasurement gain & \\ \hline \end{tabular} The dollar is the functional currency. b. Prepare a schedule providing a proof of the remeasurement gain or loss. (Amounts to be deducted should be indicated with a minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started