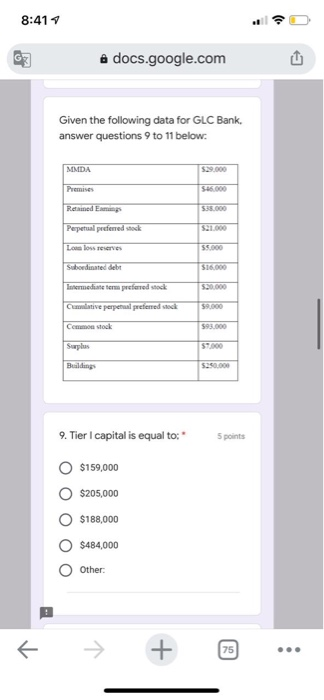

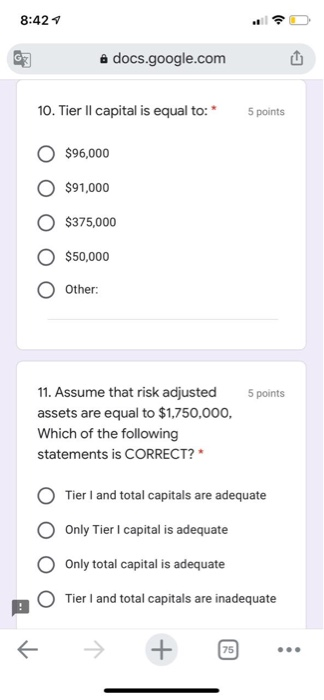

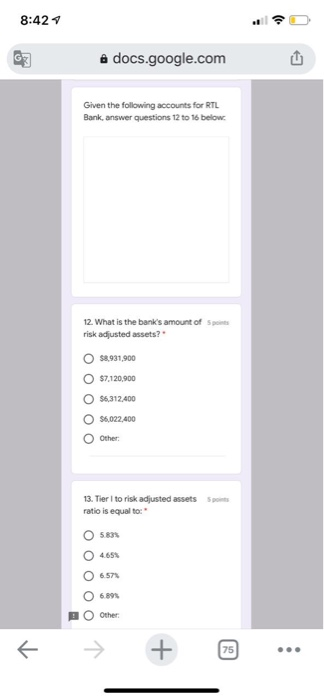

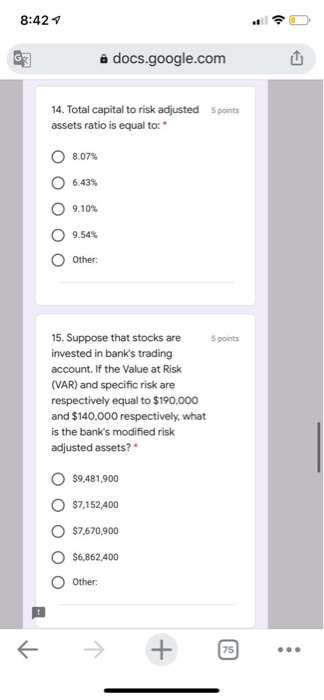

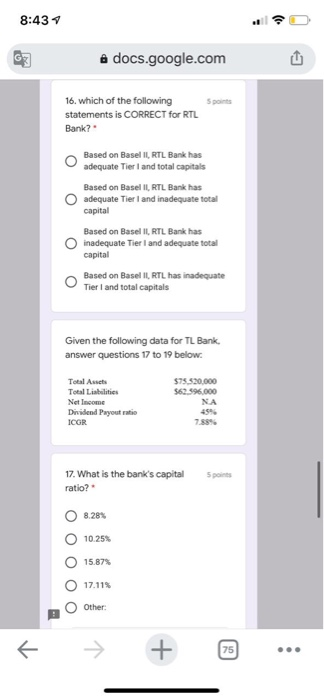

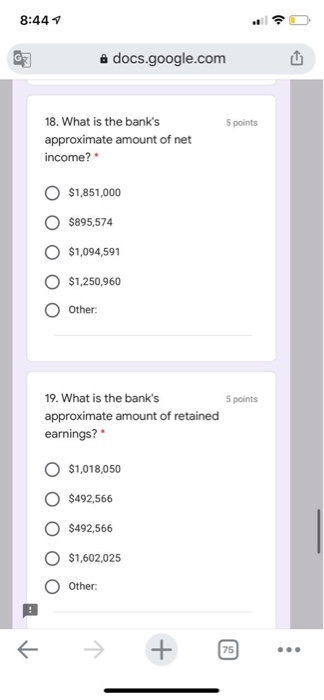

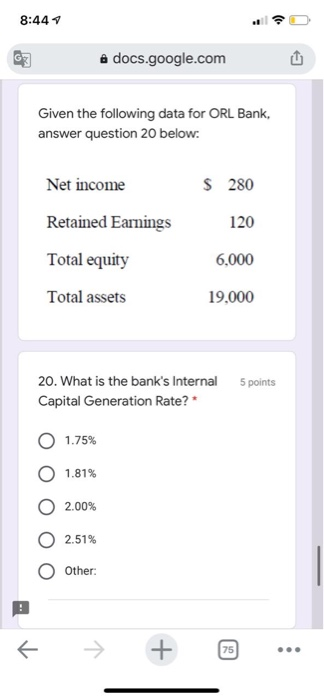

8:41 1 a docs.google.com Given the following data for GLC Bank, answer questions 9 to 11 below. MMDA $29.000 Premises Retnined Emp 53000 Perpetual preferred stock Low losse SO Subordinated bt $16.000 Intermediate ter preferred rock Clative perpetual preferred rock Common stock $93.000 Suplus 57000 Buildings $250.000 9. Tier I capital is equal to: 5 points $159,000 $205,000 $188,000 $484,000 Other: + 75 8:42 a docs.google.com 1 10. Tier II capital is equal to: * 5 points $96,000 $91,000 $375,000 $50,000 Other: 5 points 11. Assume that risk adjusted assets are equal to $1,750,000, Which of the following statements is CORRECT? Tier I and total capitals are adequate Only Tier I capital is adequate Only total capital is adequate Tier I and total capitals are inadequate + 75 8:421 a docs.google.com Given the following accounts for RTL Bank, answer questions 12 to 16 below 12 What is the bank's amount of Sports risk adjusted assets? 33,931,900 $7,120, $6,312, 400 6,022A00 Other 13. Tier I to risk adjusted assets om ratio is equal to 5 4. 657 Other + 75) 8:42 a docs.google.com 14. Total capital to risk adjusted Spoints assets ratio is equal to: 8.07% 6.43% 9.10% 9.54% Other: 15. Suppose that stocks are Spoints invested in bank's trading account. If the Value at Risk (VAR) and specific risk are respectively equal to $190,000 and $140,000 respectively, what is the bank's modified risk adjusted assets? $9,481,900 $7,152,400 $7,670,900 $6,862,400 Other: 1 + 75 8:431 docs.google.com 1 Spoints 16. which of the following statements is CORRECT for RTL Bank? Based on Basel II, RTL Bank has adequate Tier I and total capitals Based on Basel II, RTL Bank has adequate Tier I and inadequate total capital Based on Basel II, RTL Bank has inadequate Tier I and adequate total capital Based on Basel II RTL has inadequate Tier I and total capitals Given the following data for TL Bank, answer questions 17 to 19 below. Total Assets Total Liabilities Net Income Dividend Payout ratio ICGR $75.520.000 562 596.000 NA 7.88% 5 points 17. What is the bank's capital ratio? 8.28% 10.25% 15.87% OOO 17.11% Other: f + 75 8:44 1 a docs.google.com 5 points 18. What is the bank's approximate amount of net income? $1,851,000 $895,574 $1,094,591 $1,250,960 Other: 5 points 19. What is the bank's approximate amount of retained earnings? $1,018,050 $492,566 $492,566 $1,602,025 Other: 1 + 75 8:44 1 a docs.google.com Given the following data for ORL Bank, answer question 20 below: Net income $ 280 Retained Earnings 120 Total equity 6,000 Total assets 19,000 5 points 20. What is the bank's Internal Capital Generation Rate? * 0 1.75% 1.81% 2.00% 2.51% Other: 1 + 75