Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. (2 points) Prepare AJEs that should be made on 12-31-21, the end of the accounting year, for each of the following situations. If no

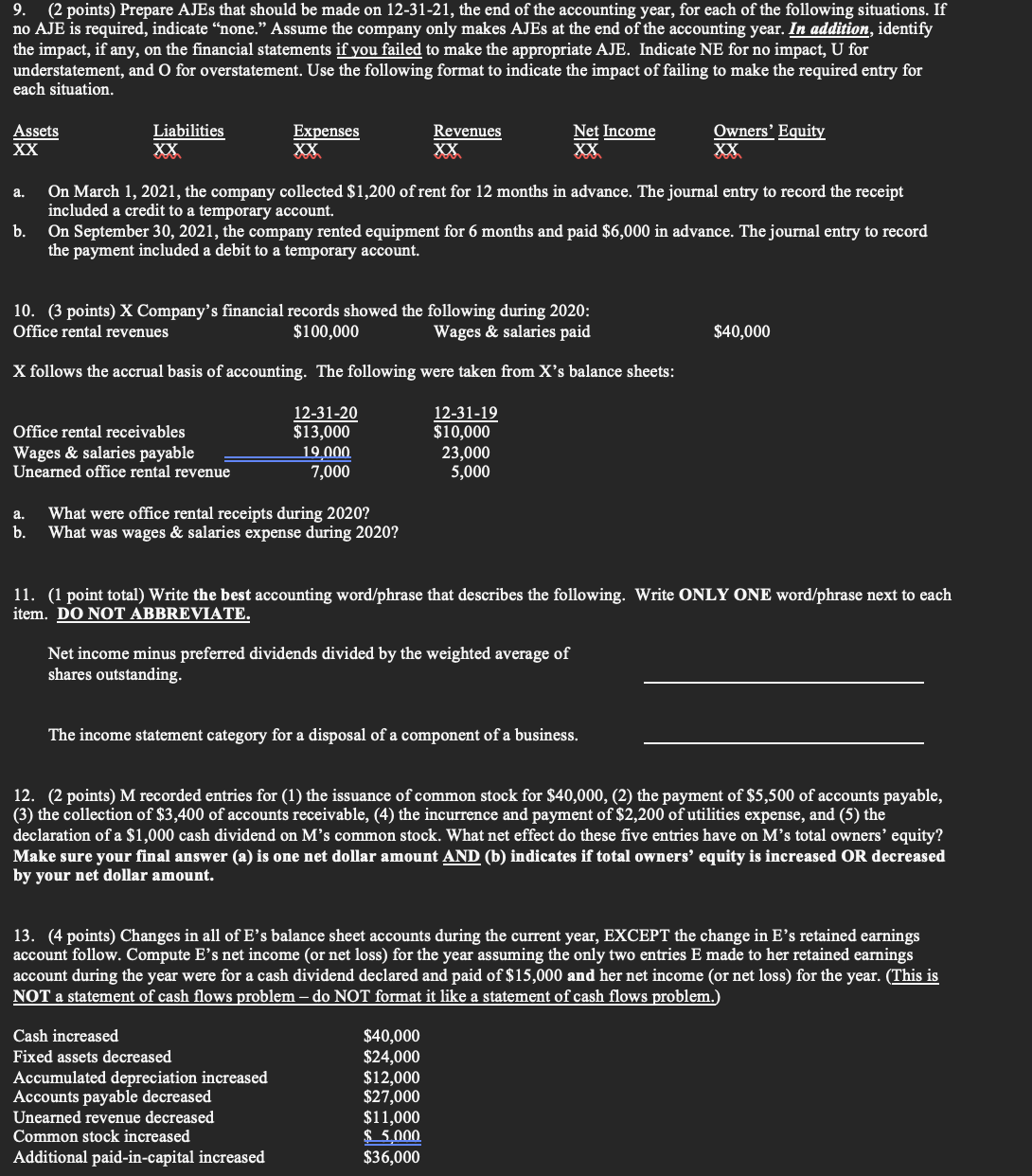

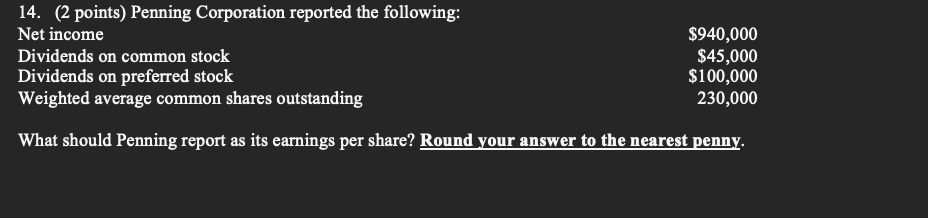

9. (2 points) Prepare AJEs that should be made on 12-31-21, the end of the accounting year, for each of the following situations. If no AJE is required, indicate "none." Assume the company only makes AJEs at the end of the accounting year. In addition, identify the impact, if any, on the financial statements if you failed to make the appropriate AJE. Indicate NE for no impact, U for understatement, and O for overstatement. Use the following format to indicate the impact of failing to make the required entry for each situation. Assets Liabilities Expenses Revenues Net Income Owners' Equity XX XX XX XX a. On March 1, 2021, the company collected $1,200 of rent for 12 months in advance. The journal entry to record the receipt included a credit to a temporary account. b. On September 30, 2021, the company rented equipment for 6 months and paid $6,000 in advance. The journal entry to record the payment included a debit to a temporary account. 10. (3 points) X Company's financial records showed the following during 2020: Office rental revenues $100,000 Wages \& salaries paid $40,000 X follows the accrual basis of accounting. The following were taken from X's balance sheets: a. What were office rental receipts during 2020 ? b. What was wages & salaries expense during 2020 ? 11. (1 point total) Write the best accounting word/phrase that describes the following. Write ONLY ONE word/phrase next to each item. DO NOT ABBREVIATE. Net income minus preferred dividends divided by the weighted average of shares outstanding. The income statement category for a disposal of a component of a business. 12. (2 points) M recorded entries for (1) the issuance of common stock for $40,000, (2) the payment of $5,500 of accounts payable, (3) the collection of $3,400 of accounts receivable, (4) the incurrence and payment of $2,200 of utilities expense, and (5) the declaration of a $1,000 cash dividend on M 's common stock. What net effect do these five entries have on M's total owners' equity? Make sure your final answer (a) is one net dollar amount AND (b) indicates if total owners' equity is increased OR decreased by your net dollar amount. 13. (4 points) Changes in all of E's balance sheet accounts during the current year, EXCEPT the change in E's retained earnings account follow. Compute E's net income (or net loss) for the year assuming the only two entries E made to her retained earnings account during the year were for a cash dividend declared and paid of $15,000 and her net income (or net loss) for the year. (This is NOT a statement of cash flows problem - do NOT format it like a statement of cash flows problem.) 14. ( 2 points) Penning Corporation reported the following: Net income Dividends on common stock Dividends on preferred stock $940,000 Weighted average common shares outstanding $45,000 $100,000 230,000 What should Penning report as its earnings per share? Round your answer to the nearest penny. 9. (2 points) Prepare AJEs that should be made on 12-31-21, the end of the accounting year, for each of the following situations. If no AJE is required, indicate "none." Assume the company only makes AJEs at the end of the accounting year. In addition, identify the impact, if any, on the financial statements if you failed to make the appropriate AJE. Indicate NE for no impact, U for understatement, and O for overstatement. Use the following format to indicate the impact of failing to make the required entry for each situation. Assets Liabilities Expenses Revenues Net Income Owners' Equity XX XX XX XX a. On March 1, 2021, the company collected $1,200 of rent for 12 months in advance. The journal entry to record the receipt included a credit to a temporary account. b. On September 30, 2021, the company rented equipment for 6 months and paid $6,000 in advance. The journal entry to record the payment included a debit to a temporary account. 10. (3 points) X Company's financial records showed the following during 2020: Office rental revenues $100,000 Wages \& salaries paid $40,000 X follows the accrual basis of accounting. The following were taken from X's balance sheets: a. What were office rental receipts during 2020 ? b. What was wages & salaries expense during 2020 ? 11. (1 point total) Write the best accounting word/phrase that describes the following. Write ONLY ONE word/phrase next to each item. DO NOT ABBREVIATE. Net income minus preferred dividends divided by the weighted average of shares outstanding. The income statement category for a disposal of a component of a business. 12. (2 points) M recorded entries for (1) the issuance of common stock for $40,000, (2) the payment of $5,500 of accounts payable, (3) the collection of $3,400 of accounts receivable, (4) the incurrence and payment of $2,200 of utilities expense, and (5) the declaration of a $1,000 cash dividend on M 's common stock. What net effect do these five entries have on M's total owners' equity? Make sure your final answer (a) is one net dollar amount AND (b) indicates if total owners' equity is increased OR decreased by your net dollar amount. 13. (4 points) Changes in all of E's balance sheet accounts during the current year, EXCEPT the change in E's retained earnings account follow. Compute E's net income (or net loss) for the year assuming the only two entries E made to her retained earnings account during the year were for a cash dividend declared and paid of $15,000 and her net income (or net loss) for the year. (This is NOT a statement of cash flows problem - do NOT format it like a statement of cash flows problem.) 14. ( 2 points) Penning Corporation reported the following: Net income Dividends on common stock Dividends on preferred stock $940,000 Weighted average common shares outstanding $45,000 $100,000 230,000 What should Penning report as its earnings per share? Round your answer to the nearest penny

9. (2 points) Prepare AJEs that should be made on 12-31-21, the end of the accounting year, for each of the following situations. If no AJE is required, indicate "none." Assume the company only makes AJEs at the end of the accounting year. In addition, identify the impact, if any, on the financial statements if you failed to make the appropriate AJE. Indicate NE for no impact, U for understatement, and O for overstatement. Use the following format to indicate the impact of failing to make the required entry for each situation. Assets Liabilities Expenses Revenues Net Income Owners' Equity XX XX XX XX a. On March 1, 2021, the company collected $1,200 of rent for 12 months in advance. The journal entry to record the receipt included a credit to a temporary account. b. On September 30, 2021, the company rented equipment for 6 months and paid $6,000 in advance. The journal entry to record the payment included a debit to a temporary account. 10. (3 points) X Company's financial records showed the following during 2020: Office rental revenues $100,000 Wages \& salaries paid $40,000 X follows the accrual basis of accounting. The following were taken from X's balance sheets: a. What were office rental receipts during 2020 ? b. What was wages & salaries expense during 2020 ? 11. (1 point total) Write the best accounting word/phrase that describes the following. Write ONLY ONE word/phrase next to each item. DO NOT ABBREVIATE. Net income minus preferred dividends divided by the weighted average of shares outstanding. The income statement category for a disposal of a component of a business. 12. (2 points) M recorded entries for (1) the issuance of common stock for $40,000, (2) the payment of $5,500 of accounts payable, (3) the collection of $3,400 of accounts receivable, (4) the incurrence and payment of $2,200 of utilities expense, and (5) the declaration of a $1,000 cash dividend on M 's common stock. What net effect do these five entries have on M's total owners' equity? Make sure your final answer (a) is one net dollar amount AND (b) indicates if total owners' equity is increased OR decreased by your net dollar amount. 13. (4 points) Changes in all of E's balance sheet accounts during the current year, EXCEPT the change in E's retained earnings account follow. Compute E's net income (or net loss) for the year assuming the only two entries E made to her retained earnings account during the year were for a cash dividend declared and paid of $15,000 and her net income (or net loss) for the year. (This is NOT a statement of cash flows problem - do NOT format it like a statement of cash flows problem.) 14. ( 2 points) Penning Corporation reported the following: Net income Dividends on common stock Dividends on preferred stock $940,000 Weighted average common shares outstanding $45,000 $100,000 230,000 What should Penning report as its earnings per share? Round your answer to the nearest penny. 9. (2 points) Prepare AJEs that should be made on 12-31-21, the end of the accounting year, for each of the following situations. If no AJE is required, indicate "none." Assume the company only makes AJEs at the end of the accounting year. In addition, identify the impact, if any, on the financial statements if you failed to make the appropriate AJE. Indicate NE for no impact, U for understatement, and O for overstatement. Use the following format to indicate the impact of failing to make the required entry for each situation. Assets Liabilities Expenses Revenues Net Income Owners' Equity XX XX XX XX a. On March 1, 2021, the company collected $1,200 of rent for 12 months in advance. The journal entry to record the receipt included a credit to a temporary account. b. On September 30, 2021, the company rented equipment for 6 months and paid $6,000 in advance. The journal entry to record the payment included a debit to a temporary account. 10. (3 points) X Company's financial records showed the following during 2020: Office rental revenues $100,000 Wages \& salaries paid $40,000 X follows the accrual basis of accounting. The following were taken from X's balance sheets: a. What were office rental receipts during 2020 ? b. What was wages & salaries expense during 2020 ? 11. (1 point total) Write the best accounting word/phrase that describes the following. Write ONLY ONE word/phrase next to each item. DO NOT ABBREVIATE. Net income minus preferred dividends divided by the weighted average of shares outstanding. The income statement category for a disposal of a component of a business. 12. (2 points) M recorded entries for (1) the issuance of common stock for $40,000, (2) the payment of $5,500 of accounts payable, (3) the collection of $3,400 of accounts receivable, (4) the incurrence and payment of $2,200 of utilities expense, and (5) the declaration of a $1,000 cash dividend on M 's common stock. What net effect do these five entries have on M's total owners' equity? Make sure your final answer (a) is one net dollar amount AND (b) indicates if total owners' equity is increased OR decreased by your net dollar amount. 13. (4 points) Changes in all of E's balance sheet accounts during the current year, EXCEPT the change in E's retained earnings account follow. Compute E's net income (or net loss) for the year assuming the only two entries E made to her retained earnings account during the year were for a cash dividend declared and paid of $15,000 and her net income (or net loss) for the year. (This is NOT a statement of cash flows problem - do NOT format it like a statement of cash flows problem.) 14. ( 2 points) Penning Corporation reported the following: Net income Dividends on common stock Dividends on preferred stock $940,000 Weighted average common shares outstanding $45,000 $100,000 230,000 What should Penning report as its earnings per share? Round your answer to the nearest penny Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started