Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Assume the normal PDF is a good model for stock returns. Your firm has created a fund (a portfolio of stocks) with an

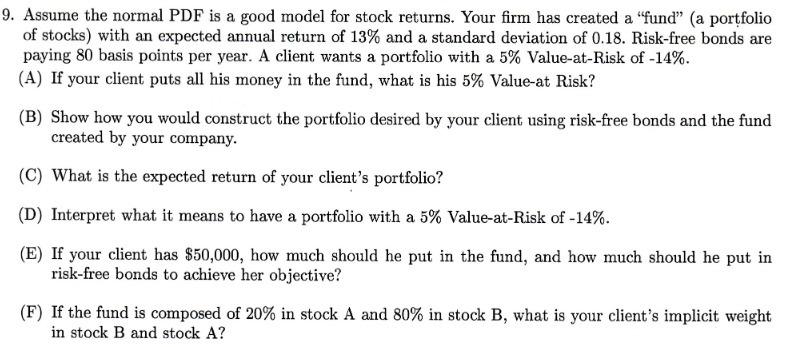

9. Assume the normal PDF is a good model for stock returns. Your firm has created a "fund" (a portfolio of stocks) with an expected annual return of 13% and a standard deviation of 0.18. Risk-free bonds are paying 80 basis points per year. A client wants a portfolio with a 5% Value-at-Risk of -14%. (A) If your client puts all his money in the fund, what is his 5% Value-at Risk? (B) Show how you would construct the portfolio desired by your client using risk-free bonds and the fund created by your company. (C) What is the expected return of your client's portfolio? (D) Interpret what it means to have a portfolio with a 5% Value-at-Risk of -14%. (E) If your client has $50,000, how much should he put in the fund, and how much should he put in risk-free bonds to achieve her objective? (F) If the fund is composed of 20% in stock A and 80% in stock B, what is your client's implicit weight in stock B and stock A?

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer A To calculate the ValueatRisk VaR for the clients portfolio we need to find the zscore corresponding to a 5 probability The formula for VaR is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642c142d1e86_974516.pdf

180 KBs PDF File

6642c142d1e86_974516.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started